Partial Close - close at least N largest postions

Hi,

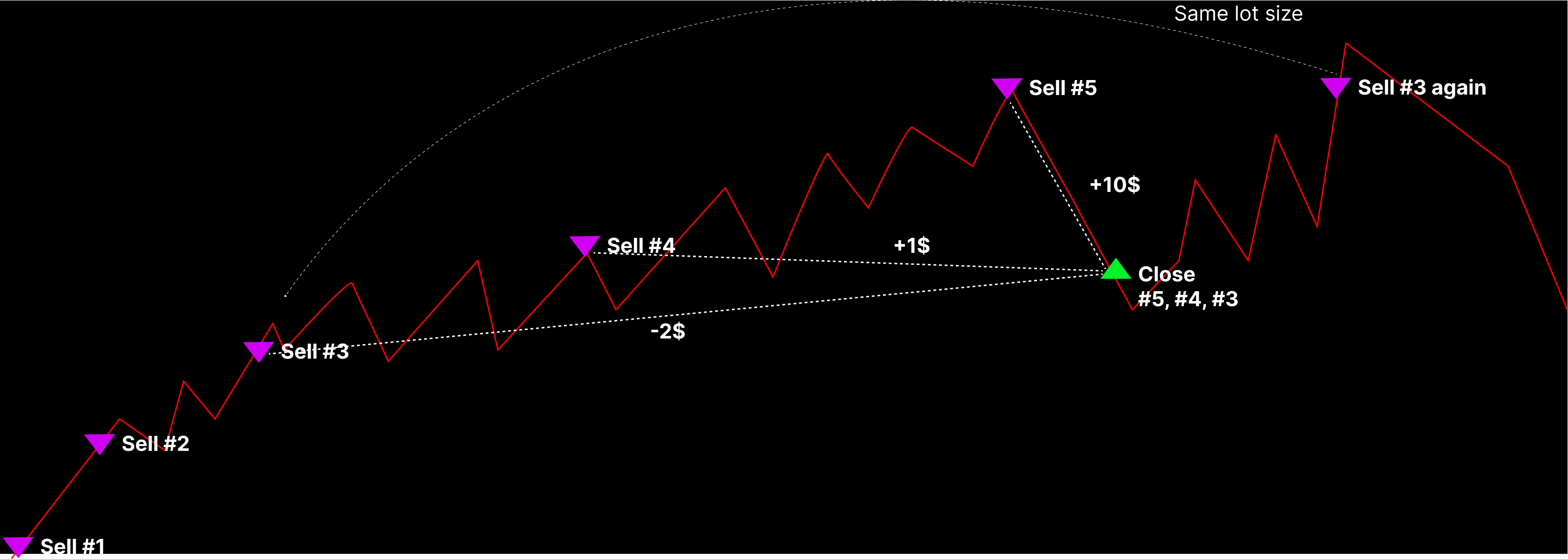

if it would be possible to set minimal amount of N largest position (same direction) to be closed, a very, very robust risk management would be possible.

So in short, I assume only two changes are needed:

1. set the minimal amount of positions to be closed (sort by size is already available as an option)

2. After the (e.g. #5 ) largest position is closed, continue with lot size same as the smallest position closed but at the location of the last largest position.

Here is an image, illustrating the concept.

Huge thanks for looking at this.

Hi, Hannes! Thanks for your idea!

To implement this technic, we need:

1) allow closing of most profitable trades in series without the largest loss, it is not hard,

2) and prevent #3 from reopening to the level of closed #5, it is a bit harder.

What I am afraid of is the increasing distance between orders. You may find yourself in a situation where you have a series open and the market swings between orders for a very long time.

All distance calculations for next orders should also be corrected.Do you think it is worth it?