Martin dca and Hedg pyramid mode.!

Hello, I have a question on the Group, but no one can answer it yet? so I would like to ask on the forum, hope someone can answer me. I have spent the past week setting it up but failed.

I will tell you my idea: I will find an extreme point in a trend (up or down), then enter an order against the trend.

1. Entry: To find this extreme point I will combine 2 indicators: 1/ RSI (overbought oversold) and 2/ Closing price away from ema 10, a value of 50 pips (above ema 10: sell; below ema 10: buy).

Initial lot: 0.03

Take profit: 100 usd.

Trailing stop: 50 usd.

Trailing step: 20 usd.

2. Martin: If the price moves unfavorably, then the martin mode will be used with:

- Step: 20 pis.

- Mutilot: 1.3

If the price returns to the Target Profit as above (Take profit: 100 usd.; Trailing stop: 50 usd. Trailing step: 20 usd.), the order chain will be closed.

If after 4 Martin orders (or dawdown: -1%) the price does not return, there will be Hedg mode. Martin mode still works according to the original logic (Step: 20 pis; Mutilot: 1.3)

3.Hedg: After 4 martin orders (or dawdown: -1%), there will be Hedg for the first order.

Lot hedg: 0.03. If the price returns to the Target Profit as above (Take profit: 100 usd.; Trailing stop: 50 usd. Trailing step: 20 usd.), the order chain will be closed.

If the price continues to be unfavorable for Martin: at this time the Martin order chain will increase: 5,6,7,8....... then the hedg order will also correspond: 1,2,3,4..... until (Take profit: 100 usd.; Trailing stop: 50 usd. Trailing step: 20 usd.); with multilot for hedg order: 1.3.

I have read the documents and viewed the questions on the forum but still cannot set up the correct logic like that. Hope someone can help me. Thank you very much.

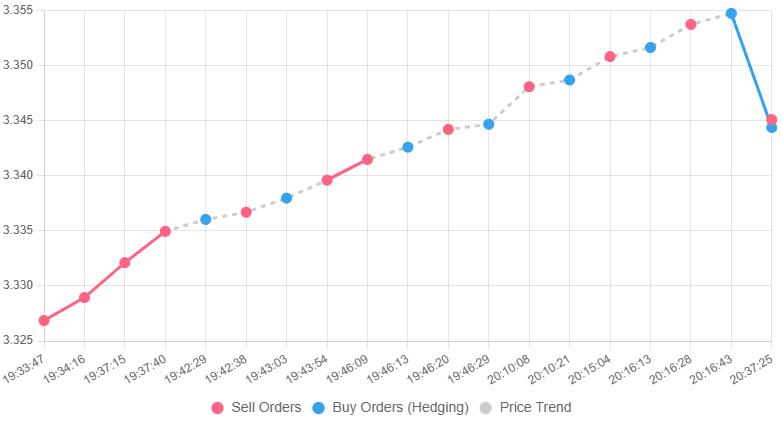

CommunityPower_v3.01_XAUUSD_HEGE-H1

| # | Lot Martin (×1.3) | # Hedge | Lot Hedge (×1.3) | Note |

|---|---|---|---|---|

| 1 | 0.0300 | 0 | – | Open first order |

| 2 | 0.0390 | 0 | – | … |

| 3 | 0.0507 | 0 | – | … |

| 4 | 0.0660 | 1 | 0.0300 | Open first hedge |

| 5 | 0.0858 | 2 | 0.0390 | Open hedge 2 |

| 6 | 0.1115 | 3 | 0.0507 | Open hedge 3 |

| 7 | 0.1450 | 4 | 0.0660 | Open hedge 4 |

| 8 | 0.1885 | 5 | 0.0858 | Open hedge 5 |

| 9 | 0.2450 | 6 | 0.1115 | Open hedge 6 |

| 10 | 0.3185 | 7 | 0.1450 | Open hedge 7 |

| 11 | 0.4140 | 8 | 0.1885 | Open hedge 8 |

| 12 | 0.5380 | 9 | 0.2450 | Open hedge 9 |

| 13 | 0.6990 | 10 | 0.3185 | Open hedge 10 |

| 14 | 0.9090 | 11 | 0.4140 | Open hedge 11 |

| 15 | 1.1810 | 12 | 0.5380 | Open hedge 12 |

Community Power EA can't do this for you

Hedging in CP is just a series in the opposite direction of the main series. You can start it when the main series reaches some number of orders or drawdown, but you can't synchronize these two series later.