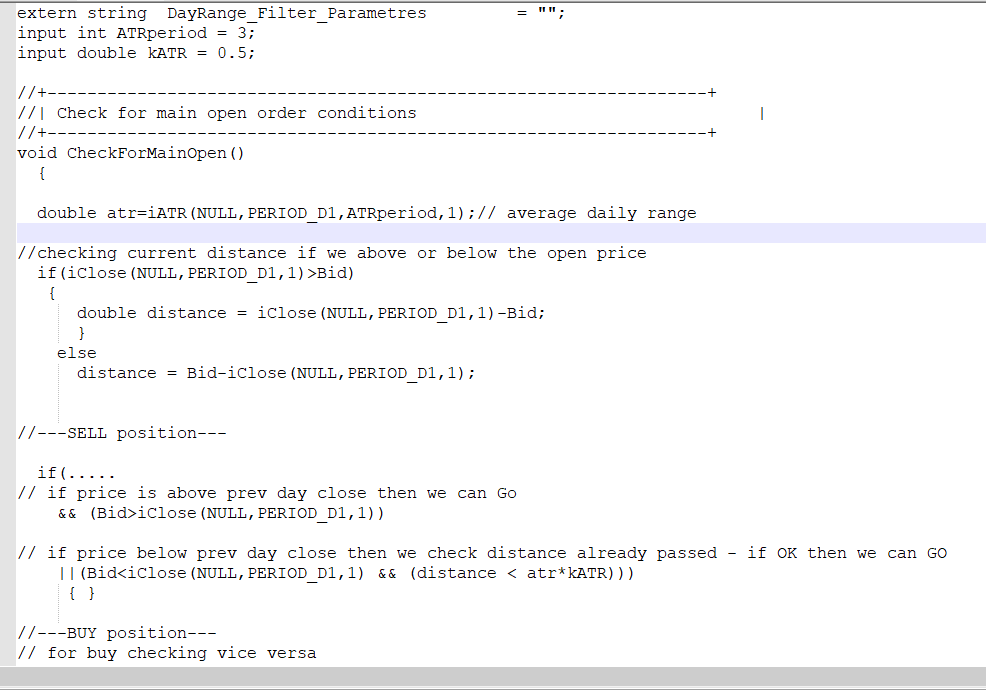

Daily range filter for position entry based on ATR

We can try to put a filter for position opening if the asset already passed a certain part of the daily average range.

ex. We have 100 pp per day on average for the last 5 days.

We have already passed 80 pp long from today's opening.

In that case, we need to ignore buy signals.

It might be used also as a signal for sell entry. The probability of profit in that case is increasing:))

Here is the part on the code I made for myself (sorry I just started to code so it looks not professional:))

Yep, it is good idea!

We already can use Fibo filter filter based on 1 D1 bar, but it will not allow to compare the range with ATR.

Let's implement Daily range filter as well