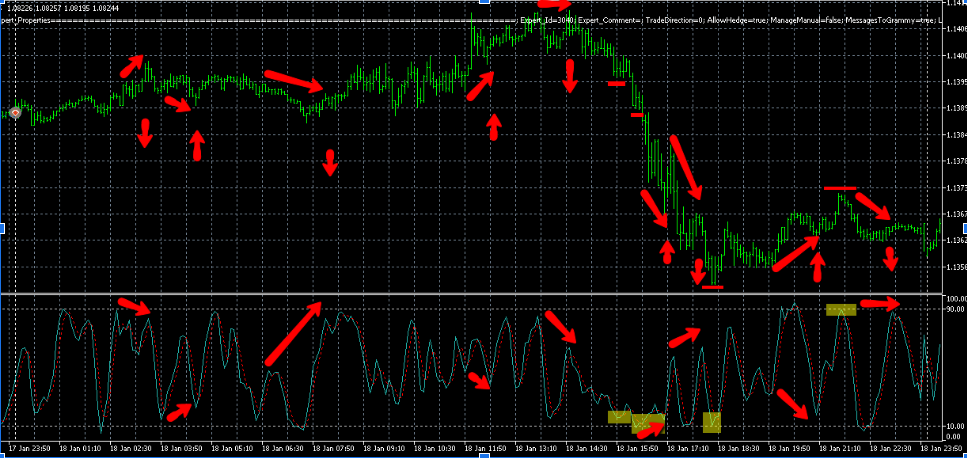

Another use of stohastic

I've been thinking of strategy that follows the trend with the use of stochastic. Now it is used to define the oversell and overbought zones, then open in the revers direction. The other idea is to set stop orders in the same direction.

Determine the trend by divergence of the stochastic.

If the price has formed a new maximum, but the stochastic has not, then only sales. If there are open buy orders, we close them; if there are pending buy orders, we delete them.

If the price has formed a new low, but the stochastic has not, then only purchases. If there are open sell orders, we close them; if there are pending sell orders, we delete them.

Placing orders.

If only purchases, then we wait for the stochastic to form a maximum in the zone > 80, then we place a pending order to buy above this maximum, and put the stop loss under the price of the previous stochastic minimum.

If only sales, then we wait for the stochastic to form a minimum in the zone > 20, then we place a pending sell order under this minimum, and put a stop loss above the price of the previous stochastic maximum.

How it works on non-trending sections:

The price goes down, reaches a new low, but the stochastic does not reach a new low - we get a divergence and look only at the entry to buy. When we get the stochastic maximum above the 90 zone, we place pending buy orders just above the highs. We put the stop under the bars where the stochastic was at the minimum. And we move it as new stochastic minimums are formed.

Then a new maximum is formed, but the stochastic maximum is less than the previous one, we get a divergence, close buy orders and wait for sell signals. We get it at 13: 05 and place a sell order. Then we shift the stop loss. We get a divergence and close the sale. We are waiting for buy signals to be received after 18: 00. We place an order and tighten the stop loss. Again, we get a divergence - close the purchase.

How it works on the trend section

This is not a "strategy + set-file", this is new idea. Moved topic here, to suggestions.

And it is complicated idea, so we need a lot of votes to start it.