Trading based on candles

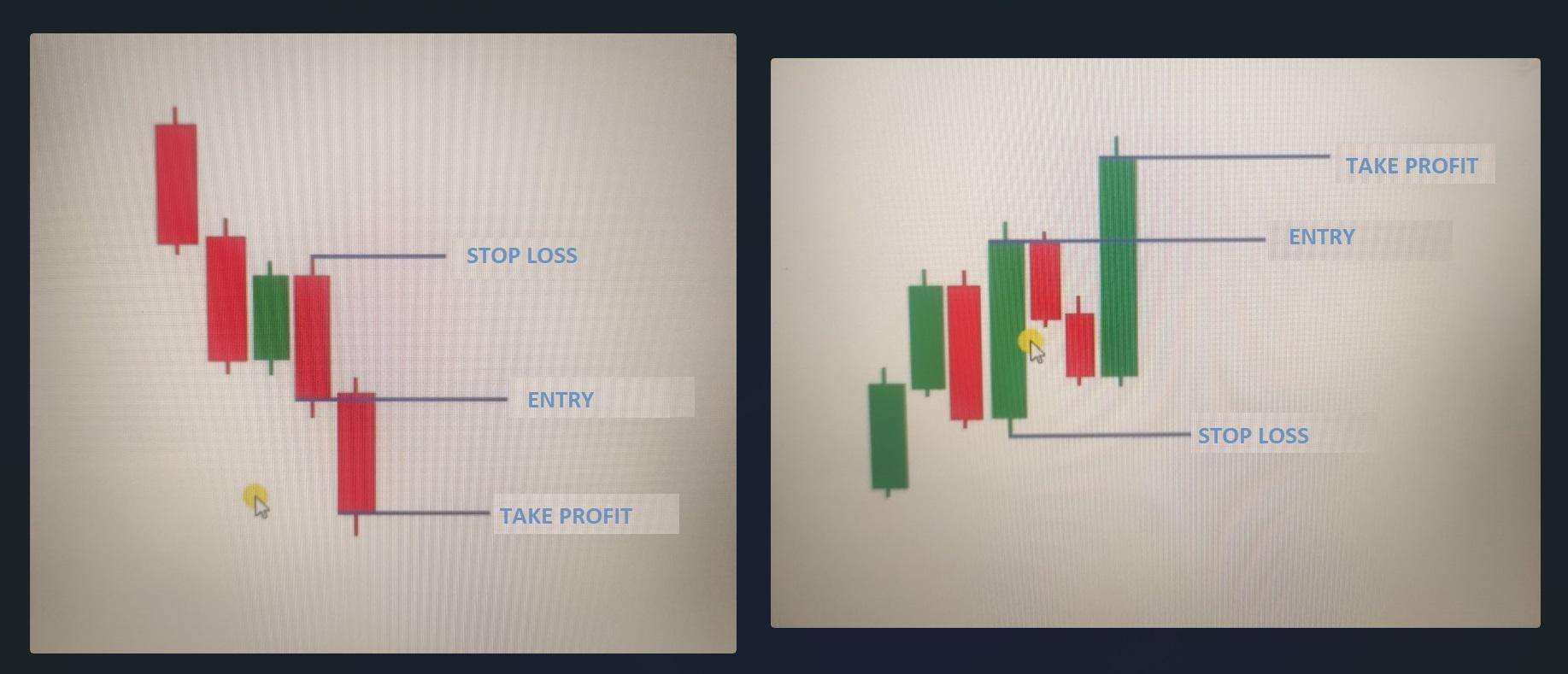

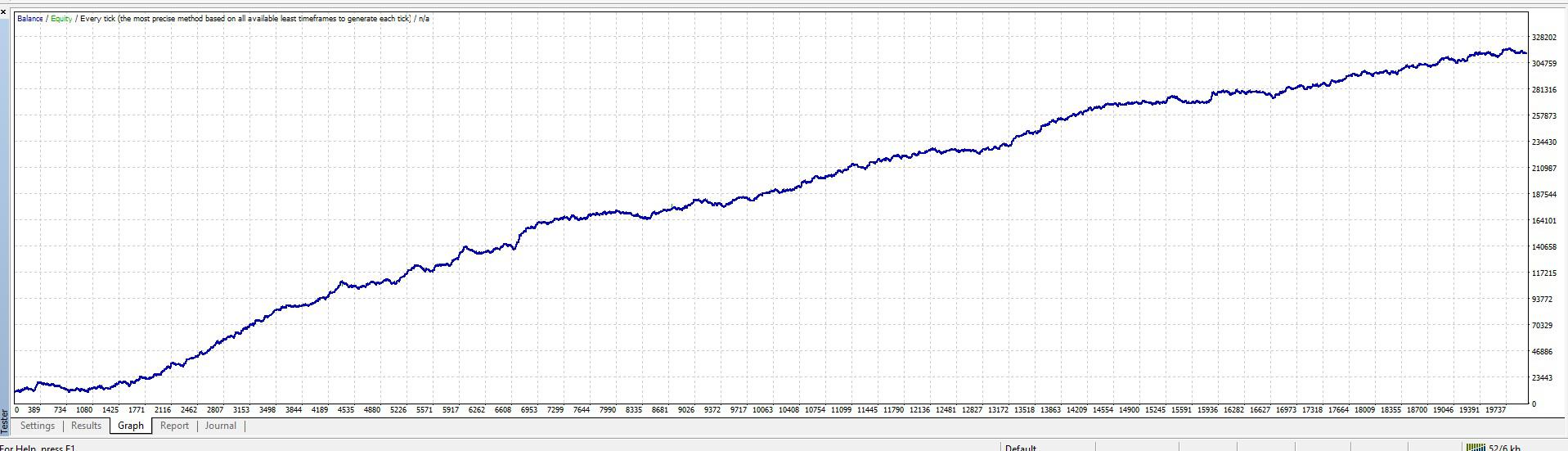

There are many candle patterns like tweezers, engulfing candles etc. If we can automate EA to identify these patterns on higher time frames, can give good risk reward trades.

Advantages :

1. Can use for scalping also with lower time frames.

2. No chance of blowing off the account as the risk is limited.

3. Risk reward can go upto 1:10 depending in the time frame and candle pattern.

4. Possibility of extending targets with trailing SL/ till next opposite signal candle.

I guess this is not difficult to implement in the EA.

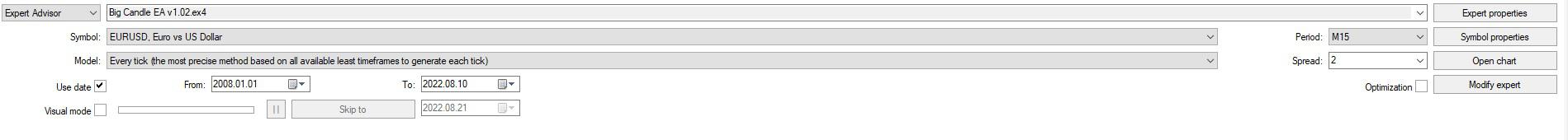

I just gave an example with tweezer bottoms and top in the below screenshot. Like this we can catch many trades with candle patterns.

If we can club this with TDI, Identify with open on cumulative signal, the results will be wonderful.

If this idea gets thru, will add some more suggestions on how we can improve this technique or what options are required while building the code. Thanks.

Hello.

Please add some price action tools like Support and Resistance or Breakout or etc...