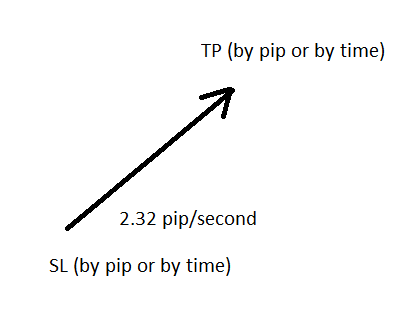

Trade based on the velocity of price moving for a small profit with a large number of trades

I will present my ideas on how to trade by taking advantage of market volatility in a very fast time. by utilizing the speed of movement of the pip within a certain time which I call velocity. This strategy requires a data tick which is the smallest timeframe.

t1 = interval 1

t2 = interval 2

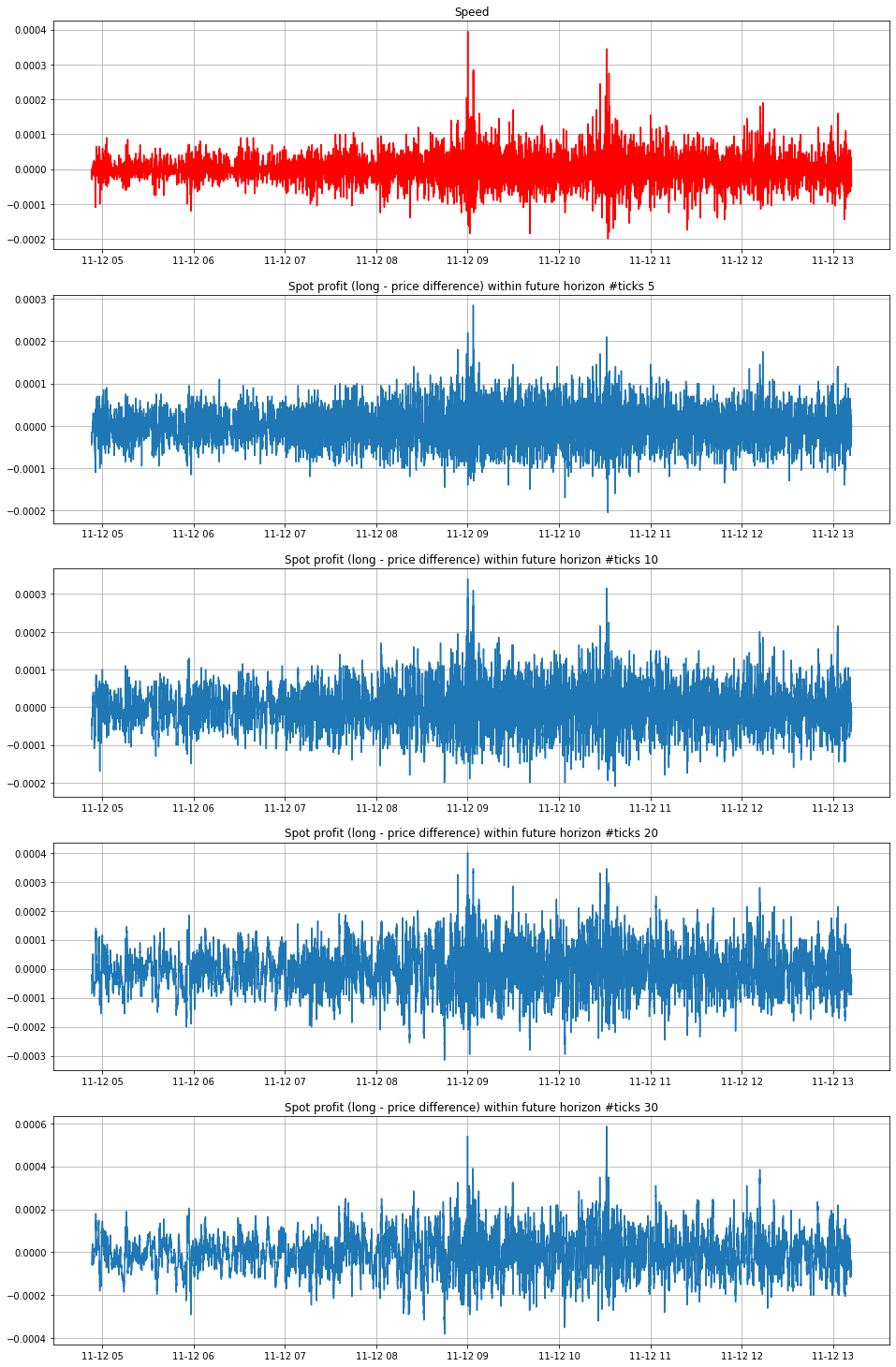

v1 = The average speed of the price during the last t1 minute (pips / second)

v2 = The average speed of the price during the last t2 seconds (pips / second)

acc = The limit by which a significant difference of v1 and v2 can be considered for opening a position

This strategy is expected to produce a high level of accuracy with small profits but a very large number of trades.

- The prices used in the calculation are assumed to be the average of the bid and ask prices.

- When calculating the average price speed, if the previous tick price was smaller than the current tick, the speed is added. If the previous tick price is greater than the current tick, the speed is reduced. As a sign of the direction of price movement. An example of calculating the average is on attachments.

- If the difference between v1 and v2 is greater than acc%, then open a position

- Trade can be closed by pip target or by time + spread

- Requires very low latency

- Expected to very helpful during unexpected sudden moves

Attachment:

Good idea.

But Trailing SL and profit booking shud be very important. Thanks.