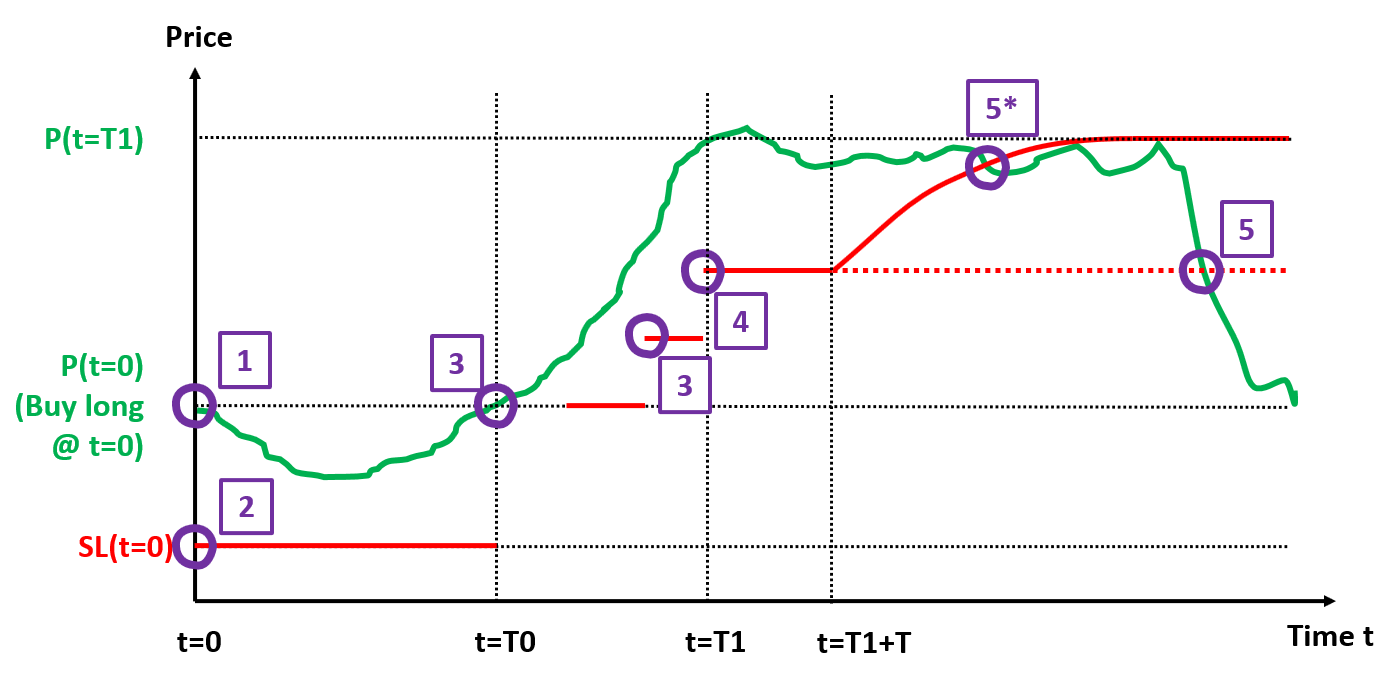

TrailingStop decrease after time

When it comes to risk management, it often pretty much comes down to the famous risk/reward ratio especially when looking at trading from a stochastic view (expected value…)

We already have some powerful possibilities to set SL and TP based on points or based on volatility (very nice feature, like it very much 😊).

However, setting a fixed risk/reward ratio is not yet possible over the total time of a trade (correct me please if I’m mistaken). Here is why:

- When you open a trade, a fixed Risk/Reward ratio can be set based on points or based on volatility

- However, when the win area is reached, I want to use a trailing stop loss. This too, can be based on points or on volatility and can be different to what the condition for SL was when the trade was opened. So, this can change the risk/reward ratio drastically.

What I am suggesting is the possibility to set the Take Profit always based on the current Stop Loss. To illustrate, I will give an example here:

- We start a trade with a SL based on volatility (e.g., 50 points). We set a Risk/Reward ratio of 0,5. This means, that the Take Profit will be 100 (=50 / 0,5).

- When volatility increases, let’s say the stop loss becomes 100. This will raise the Take Profit to 200. Until here, we can implement this by using the respective factors for volatility in the SL & TP Options.

- However, when we enter the win area, let’s say we want to use a trailing stop of a fixed 20 Points. The Take profit on the other hand will not be adjusted, as it is still based on volatility and remains 200. This leads us to a risk/reward ratio of 20/200 = 0,1 which drastically affects the expected value of the trade.

I would suggest implementing the option, to set a fixed Risk/Reward to calculate the Take Profit. So, let’s go back to the example from above. This would then lead to:

- We again start a trade with a SL based on volatility (e.g., 50 points). We set a fixed Risk/Reward ratio of 0,5. This means, that the Take Profit will be set to 100 (=50 / 0,5).

- When volatility increases, let’s say the stop loss becomes 100. This will raise the Take Profit to 200.

- When we now enter the win area with a trailing stop of a fixed 20 Points, the Take profit will be set to 20/0,5=40. This ensures our initial risk/reward ratio of 20/40 = 0,5.

Maybe it is not directly apparent what good this will do. But when analyzing trades mathematically, it is often much easier to have a fixed risk/reward ratio as you can idealize the trades as Bernoulli Experiments with fixed probabilities.

This idea is not so clear as previous )

TrailingStop is usually used when some profit is already reached. SL moves to BreakEven.

How to calculate the TP size based on zero SL? )

Another question: why do you need TP if you use TS?

Let's think about "TS decrease coefficient" (based on the position life time) to close more profit )

What do you think?