Use Moving average as stop loss

Idea

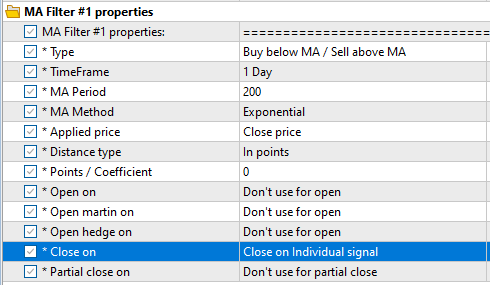

The idea is pretty simple so maybe there is already a way to implement this. I want to use the value of a Moving average (e.g. 200 EMA) to set the stop loss. The idea is the following:

- Let’s say we get an entry signal at price 100.

- Let the 200EMA be 80.

- Then I want to set the Stop Loss (constant) at 80 having a SL of 100-80=20 Points.

- The Take Profit should be the Stop Loss Times a factor that I would like to define (e.g. 1,5). In this particular case, this would mean: 20*1,5 = 30.

- Hence I would set the Take Profit to 100+30 = 130.

I know, that crossing the 200EMA can simply be set as closing condition. However, that has two disadvantages:

- The EA will always take the current value of the EMA and not the value when the trade was entered.

- I don’t know, how I would set the Take profit for the strategy described above.

Why?

There are a many trading strategies (e.g. based on MACD based entry) that work with the distance to an EMA to set the stop loss (and also TP based on fixed risk/reward ratio). Backtests have shown that it can be profitable with a win rate of 50-60% and profit/risk ratio~1,5. So this could be an interesting, non-martingale approach to make profit in the long run.

Implementation

I believe that it could be implemented quite easily (or at least easier than some other ideas that I have in mind :-)) based on the current MAs that are already in the EA. If it is indeed a new feature and community likes the idea, I will gladly propose a logical implementation approach.

Hendrik,

I like idea with TP as coefficient to the SL.

But I'm not sure I understand the idea with fixed SL based on the distance to the MA at the moment of deal open.

Why not to trail SL? What is the sense of the distance from the price to the MA at some point of time?