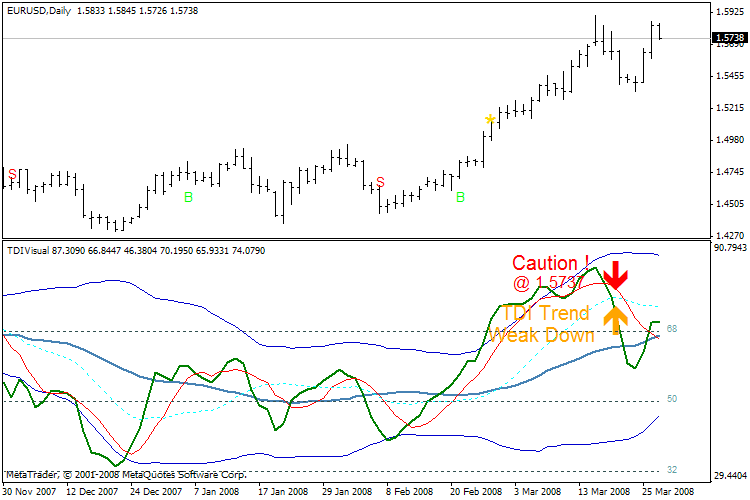

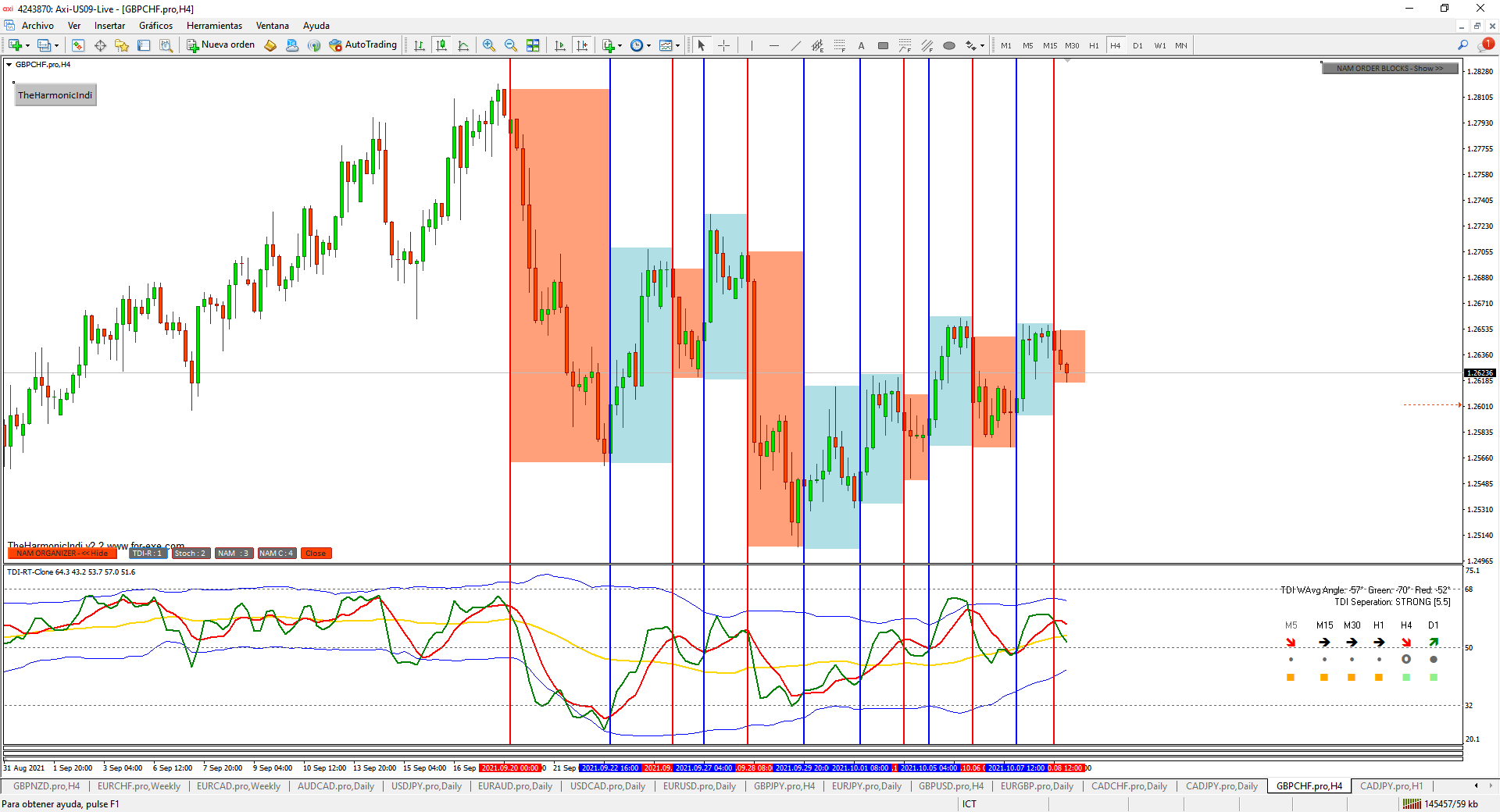

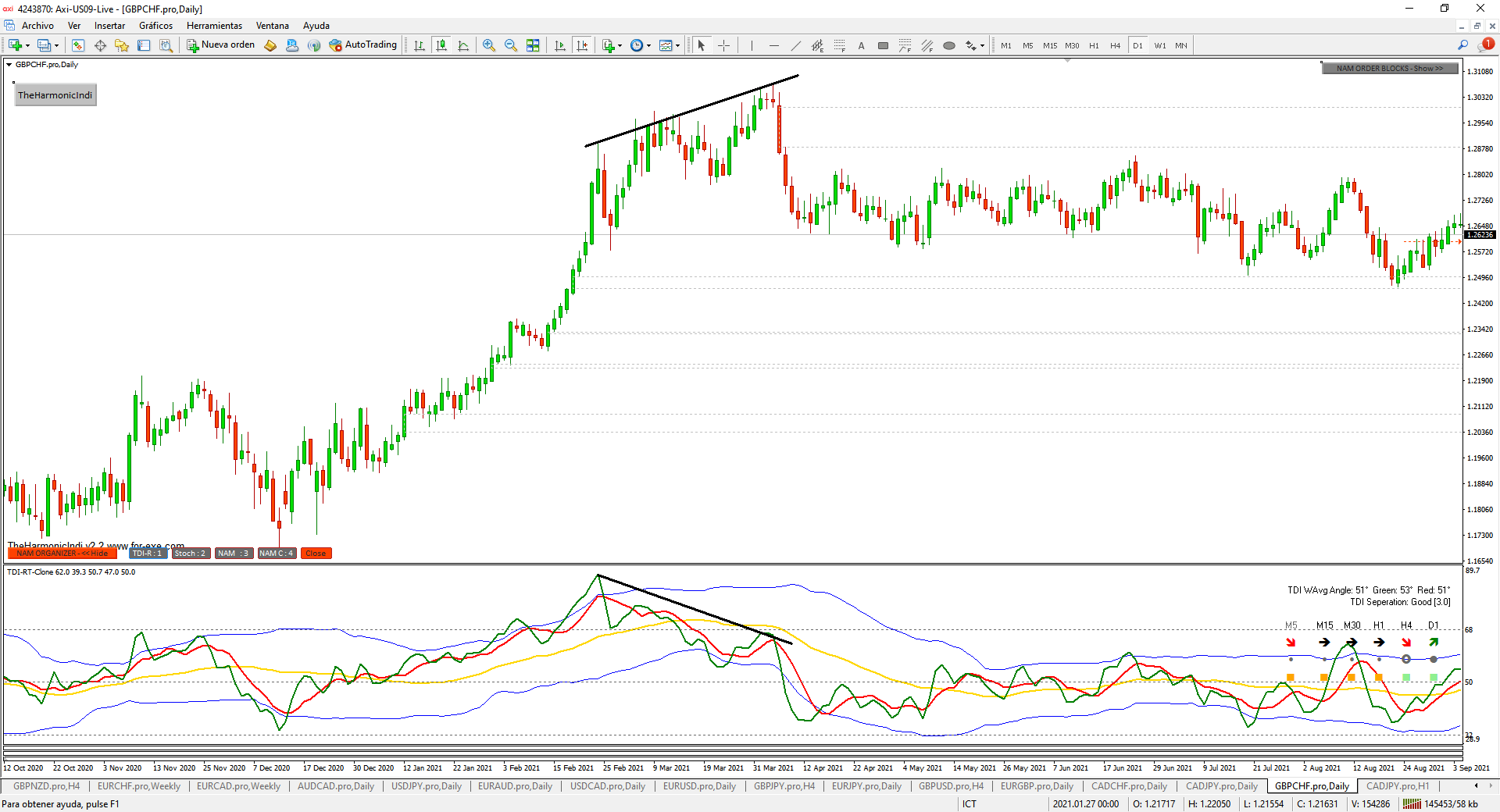

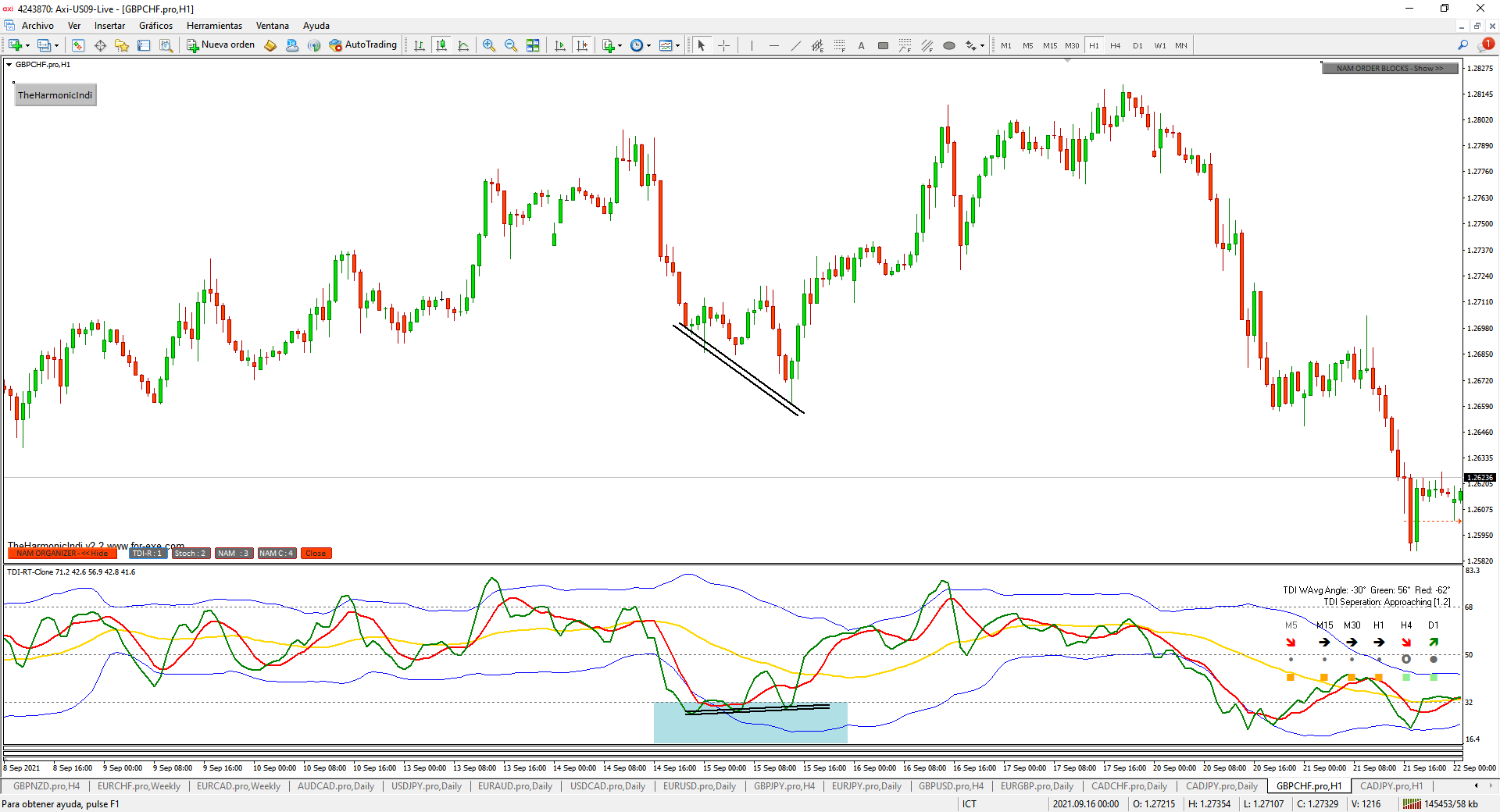

TDI with more Signals

Hello,

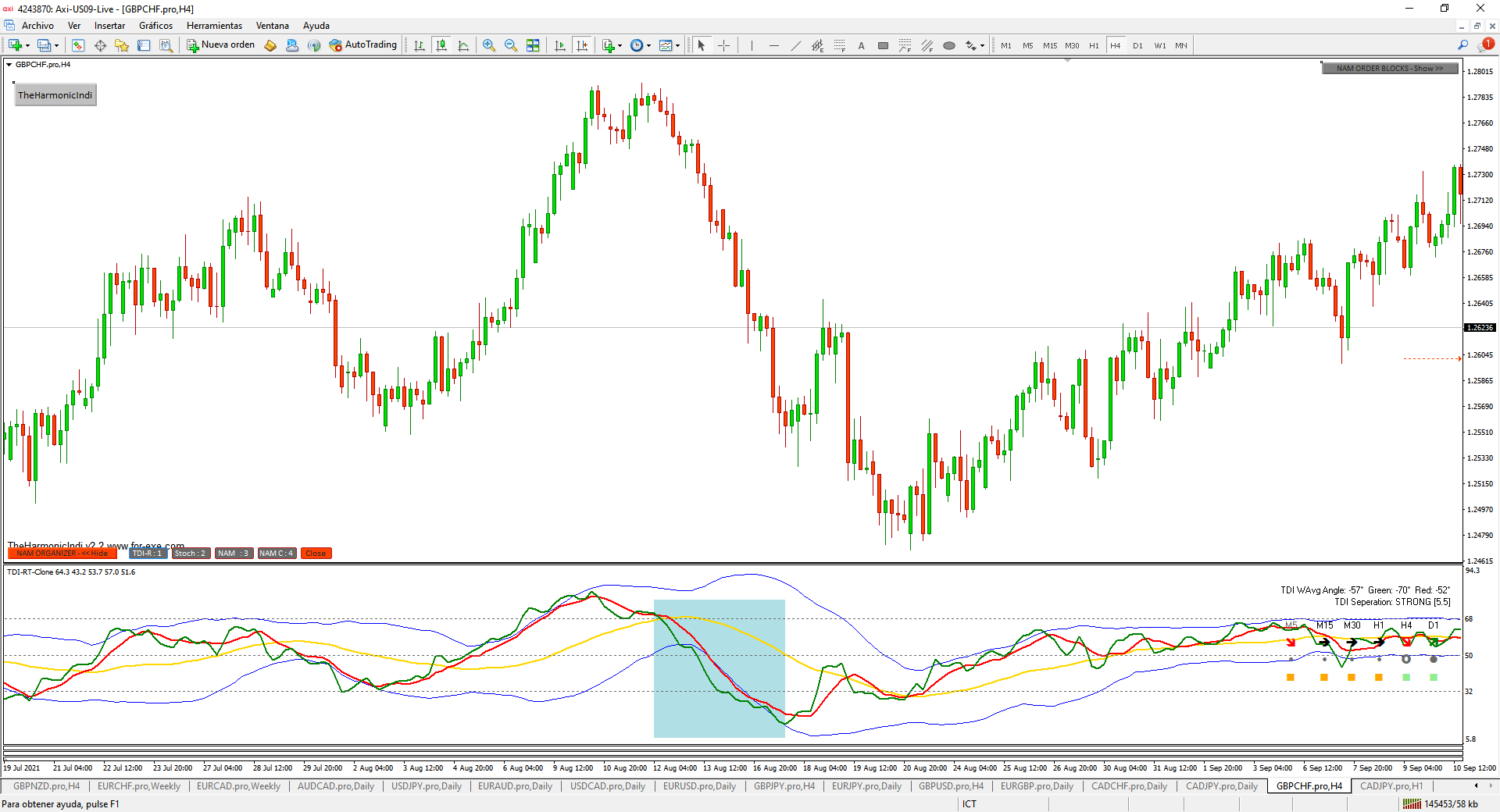

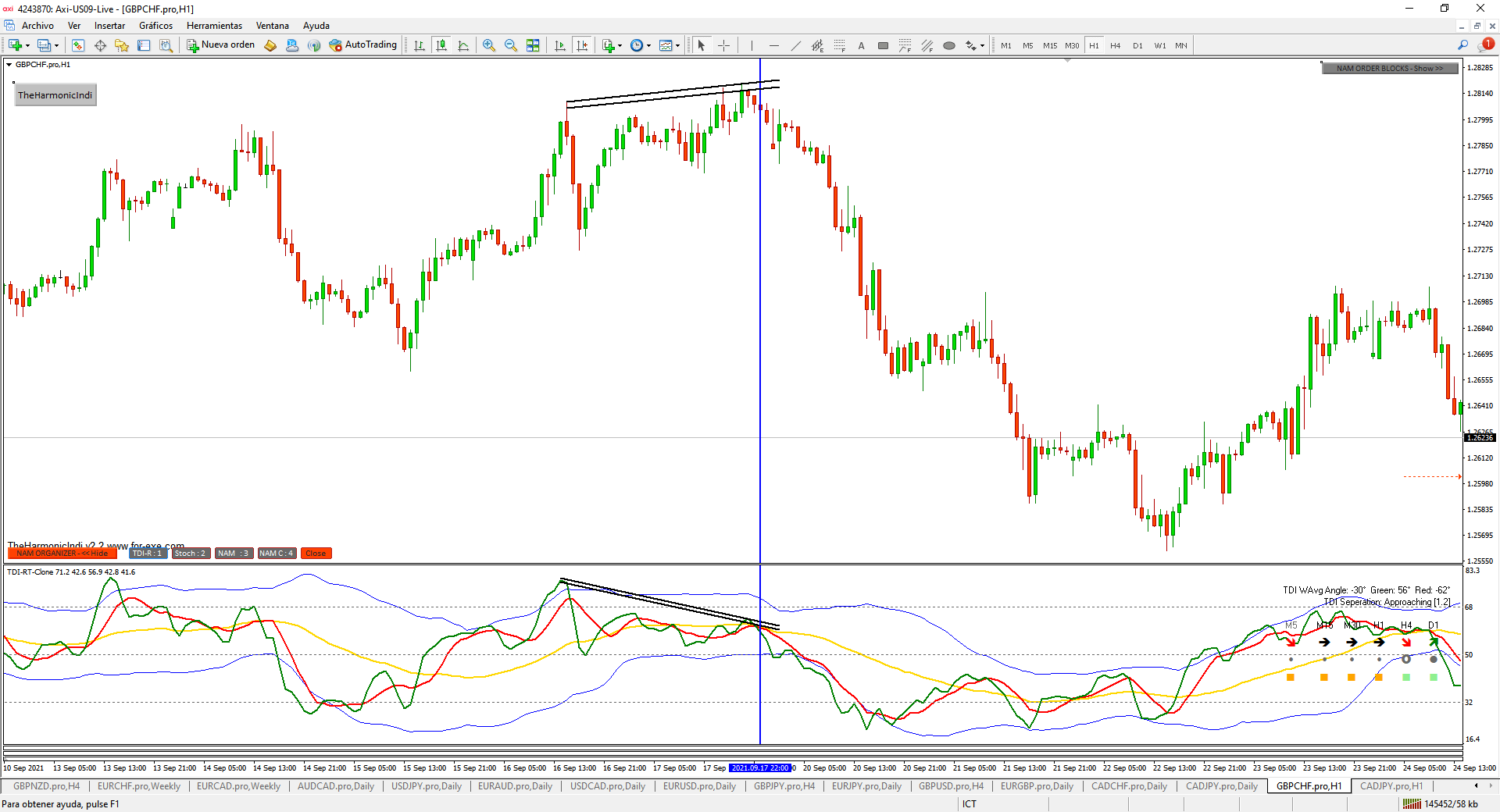

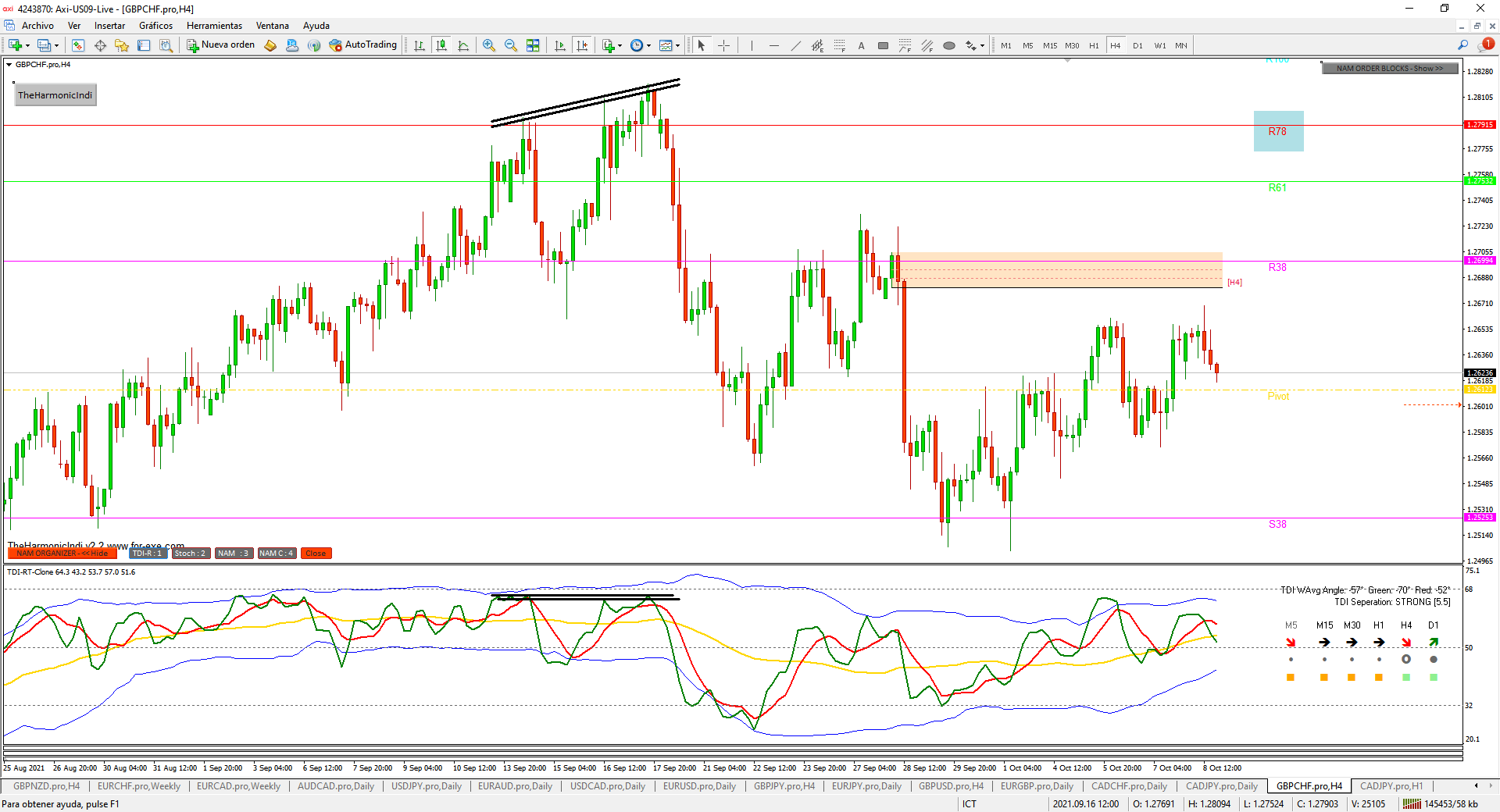

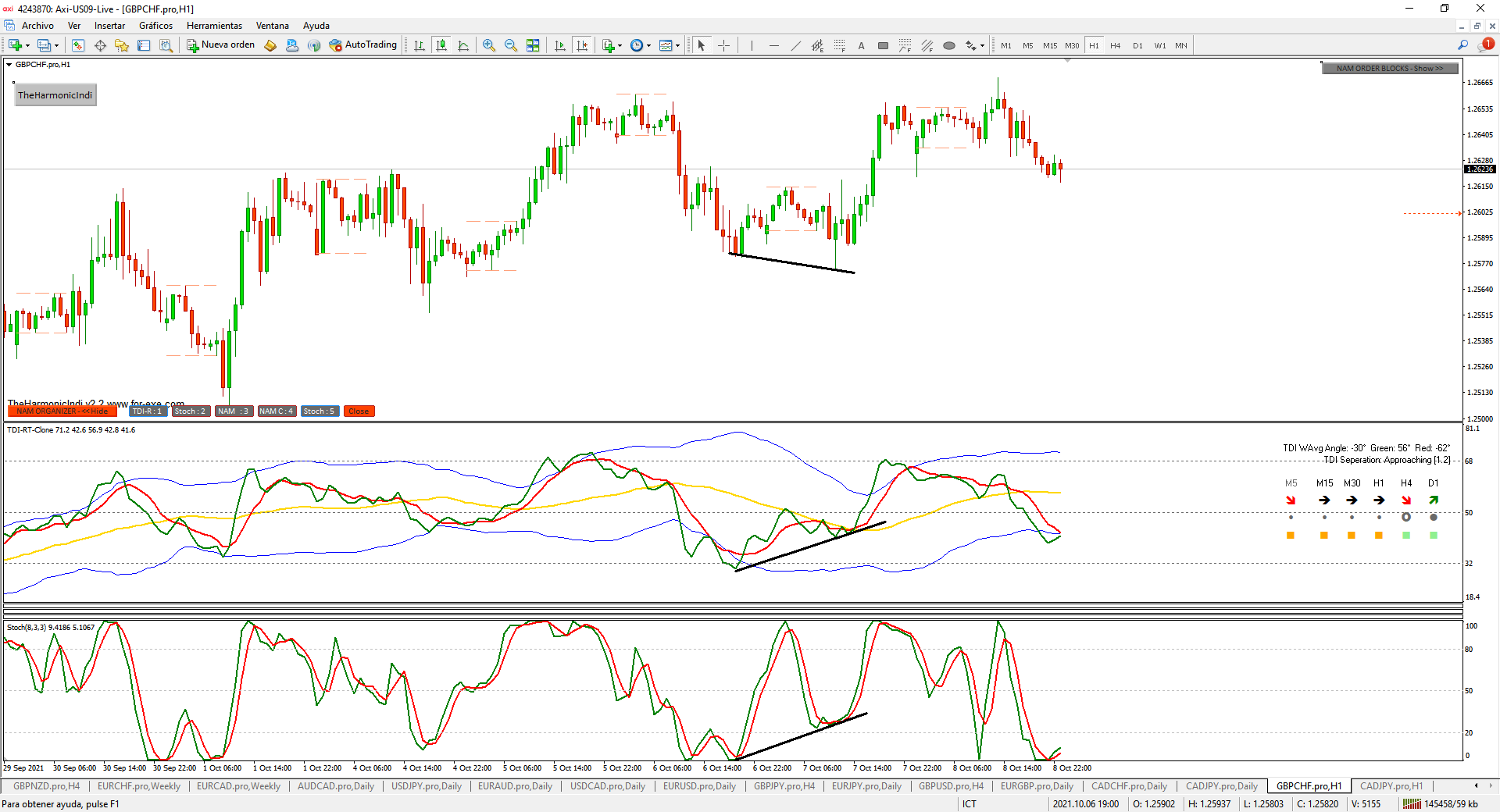

TDI is a great indicator. We could get more signals.

Could they be implemented in CP?

This hybrid indicator is developed to assist traders in their

ability to decipher and monitor market conditions related to

trend direction, market strength, and market volatility.

Even though comprehensive, the T.D.I. is easy to read and use.

Green line = RSI Price line

Red line = Trade Signal line

Blue lines = Volatility Band

Yellow line = Market Base Line

Trend Direction - Immediate and Overall

Immediate = Green over Red...price action is moving up.

Red over Green...price action is moving down.

Overall = Yellow line trends up and down generally between the

lines 32 & 68. Watch for Yellow line to bounces off

these lines for market reversal. Trade long when

price is above the Yellow line, and trade short when

price is below.

Market Strength & Volatility - Immediate and Overall

Immediate = Green Line - Strong = Steep slope up or down.

Weak = Moderate to Flat slope.

Overall = Blue Lines - When expanding, market is strong and

trending. When constricting, market is weak and

in a range. When the Blue lines are extremely tight

in a narrow range, expect an economic announcement

or other market condition to spike the market.

Entry conditions

Scalping - Long = Green over Red, Short = Red over Green

Active - Long = Green over Red & Yellow lines

Short = Red over Green & Yellow lines

Moderate - Long = Green over Red, Yellow, & 50 lines

Short= Red over Green, Green below Yellow & 50 line

Exit conditions*

Long = Green crosses below Red

Short = Green crosses above Red

* If Green crosses either Blue lines, consider exiting when

when the Green line crosses back over the Blue line.

The idea is obtained:

Yes I´d really support that idea to have more options for the tdi indicator