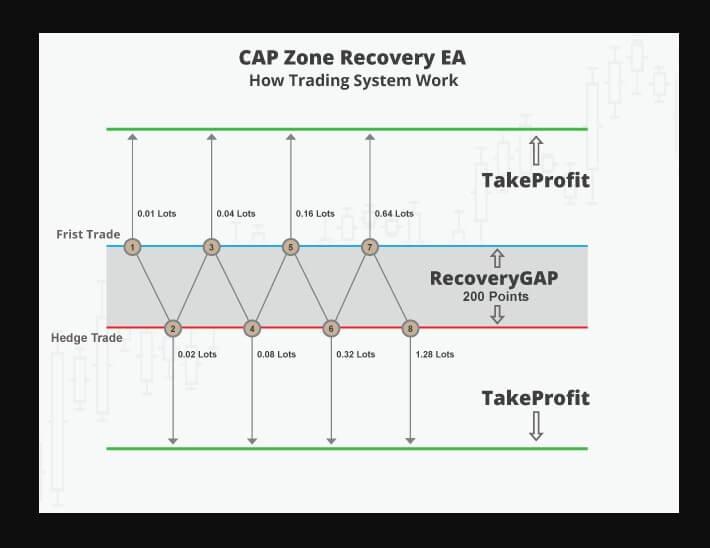

Open Hedge on Points Basis

I would like to suggest that we should have option to open Auto Hedge on Points basis. Currently i have issues with auto-hedge on DD percentage" that it fluctuates with account balance which changes whole scenario.

How would you rate the customer service you received?

Satisfaction mark by Mudassar Rasool 3 years ago

Add a comment about quality of support you received (optional):

Points from what? From the last opposite trade?