Here are examples:

Above First Pic. Fixed lot 0.01, Daily limit 0.1%, target achieved after 50 points.

Second Pic. Fixed lot per 1000, Daily limit 0.1%, target achieved just after 10 points.

Now examples of using account currency:

First Pic. Fixed lot 0.01, Daily limit $2, target achieved after 20 points.

Second Pic. Fixed lot per 1000, Daily limit $2, target achieved just after 4 points.

By using % and account currency your daily, weekly and monthly targets are automatically changed if lot size changed. Same is the case with Draw-down. Similarly, Weekly and Monthly targets change with the change of lot size especially when use "Risk per trade" and "Margin percent use".

These parameters lack consistency.

Points are consistent irrespective of lot size. Community members are welcome to provide any other option which provides consistency .

Here are examples:

Above First Pic. Fixed lot 0.01, Daily limit 0.1%, target achieved after 50 points.

Second Pic. Fixed lot per 1000, Daily limit 0.1%, target achieved just after 10 points.

Now examples of using account currency:

First Pic. Fixed lot 0.01, Daily limit $2, target achieved after 20 points.

Second Pic. Fixed lot per 1000, Daily limit $2, target achieved just after 4 points.

By using % and account currency your daily, weekly and monthly targets are automatically changed if lot size changed. Same is the case with Draw-down. Similarly, Weekly and Monthly targets change with the change of lot size especially when use "Risk per trade" and "Margin percent use".

These parameters lack consistency.

Points are consistent irrespective of lot size. Community members are welcome to provide any other option which provides consistency .

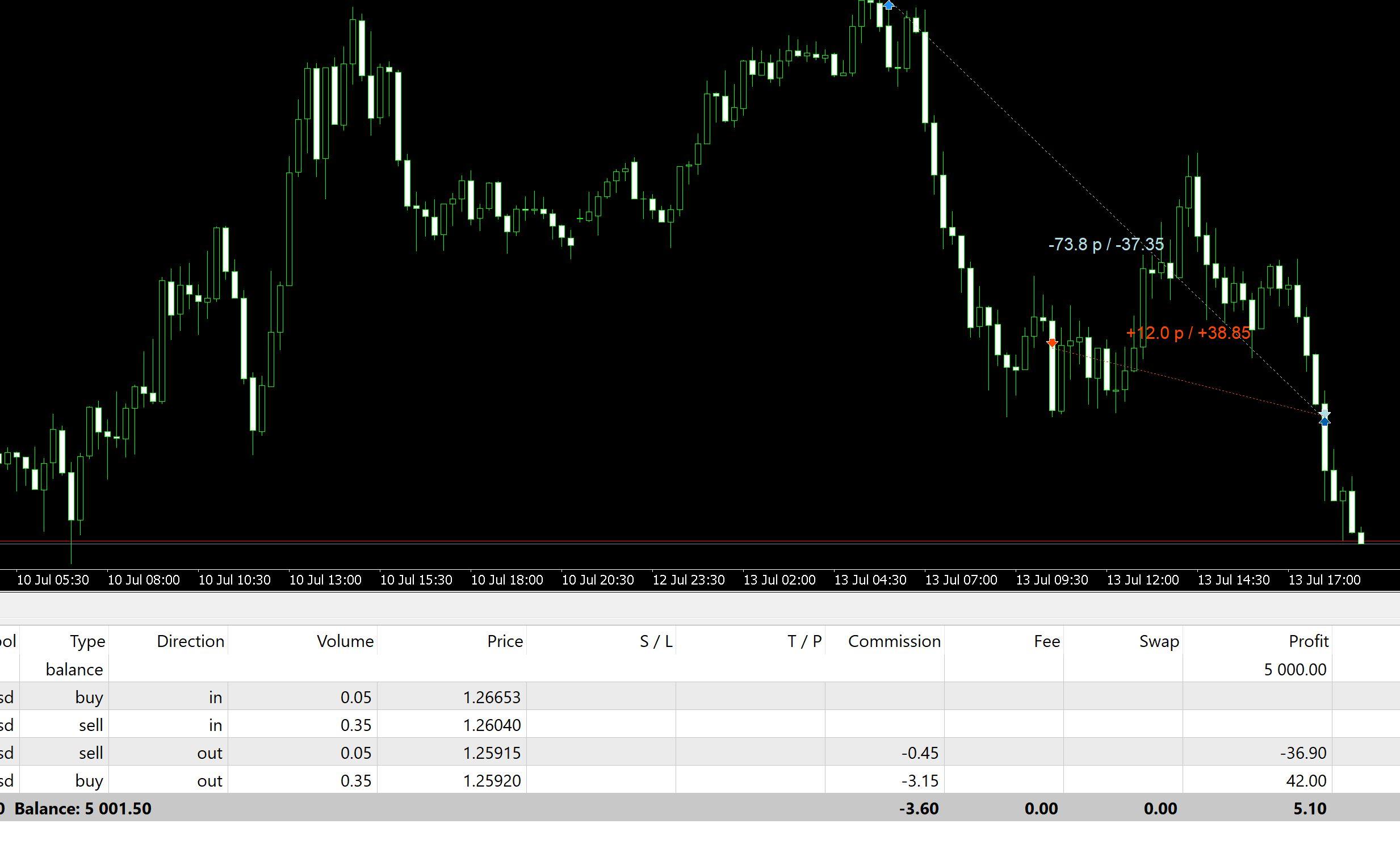

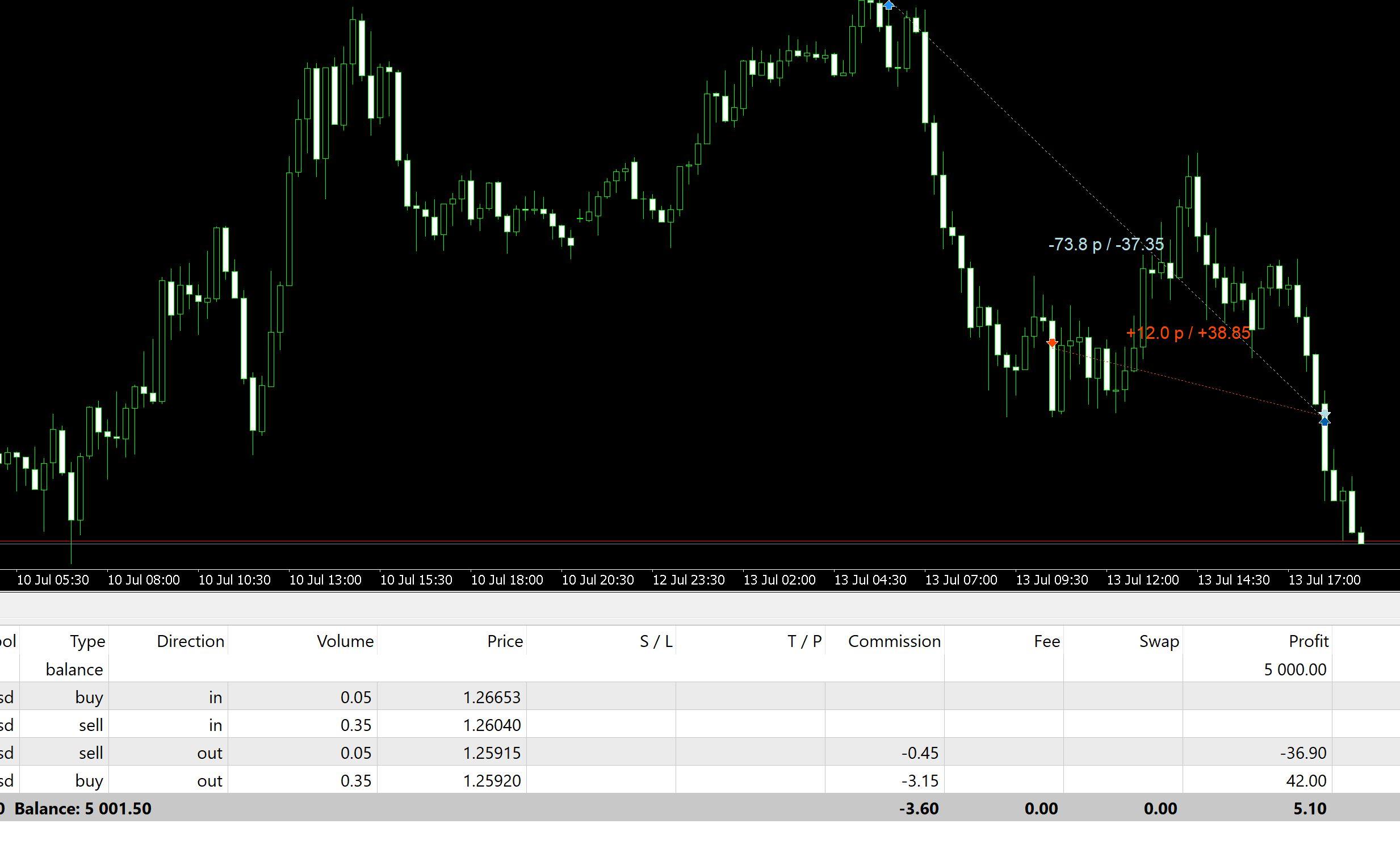

Please, answer my question about 2 opposite trades with different lots.

In your examples, no sense to use % profit with fixed lot, as well as no sense to compare fixed lot 0.01 with 0.01 per 1000 (they are just different). If you want to close $5 profit with balance $5000, set target profit = 0.1%. And you'll have the same results with fixed lot 0.05 and with 0.01 lot per 1000 (or with fixed 0.01 and 0.002 per 1000).

With 'lot per 1000', if you reach $10'000, your trades will be closed with the same profit in points: 0.05 lots will turn to 0.10 lots, and profit in percent remain the same.

I don't think we need one (actually, 3 or 4) more parameters.

But I am still open for discussion.

As far as i understand this EA and correct me if i am wrong. With Martingale and Anti Martingale calculations are in points. 5 points of first open position is the target of main series and when that target achieved system closes the main series. Or please enlighten me with bases of calculations of main series when more than one positions are open.

Whereas, in case of opposite positions system calculations are based on account currency.

I think to calculate the opposite series in points, Target in points of main series will be the bases of calculations just like Martingale. I hope i answered the question.

As far as i understand this EA and correct me if i am wrong. With Martingale and Anti Martingale calculations are in points. 5 points of first open position is the target of main series and when that target achieved system closes the main series. Or please enlighten me with bases of calculations of main series when more than one positions are open.

Whereas, in case of opposite positions system calculations are based on account currency.

I think to calculate the opposite series in points, Target in points of main series will be the bases of calculations just like Martingale. I hope i answered the question.

Ok, but you'll have different profit (in money) for different lot sizes.

And what about my explanations? Are they clear?

Do you agree that we don't need targe in points?

Why not to use % values? What is advantage of points?

What is the 'profit in points', if we have 2 trades: 0.5 lots with 25 points profit and 2.0 lots with 5 points loss? Why to use this complicated calculation?