Indicies strategy

Dear forum friends, hi :), this is a real rare forum!

This is a strategy I used for indices and some commodities, in the past (got it from a trader that used it for a couple years).

I believe it's possible to automate with CP, only the last part of using pending orders and TP levels might be tricky.. ?

Unfortunately, I have no time at the moment, so would really appreciate if someone picks up the glove and tries :)

Any suggestions are welcome, too :)

Buy orders:

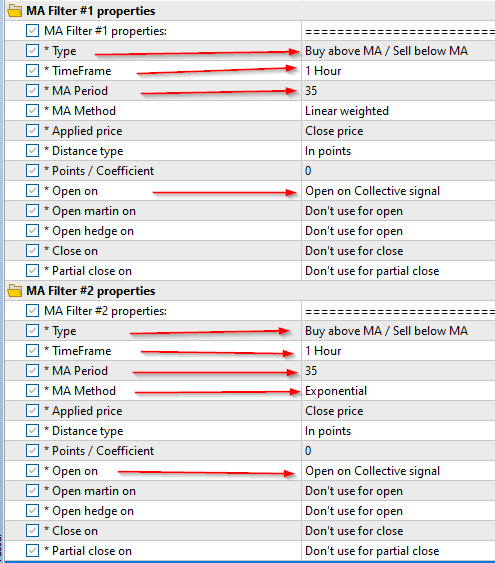

On the 1H and 30Min and 15Min and 5Min and 1Min Timeframes, these conditions should be met:

The 35 Weighted Moving Average is above the 35 Exponential Moving Average and

price is above the 35 Weighted Moving Average and

price is above VWAP

Then - on the 1Min timeframe look for:

The 1st or 2nd positive MACD Histogram Bar (that went from negative to positive) and

it is the 2nd or more consecutive green candlestick (so close>open)

Then - place a buy order 1 tick above the high of that candle + place a stop loss: 1 tick below signal candle

Take Profit 1: 100% of the signal candle (1:1)

Take Profit 2: 200% of the signal candle (1:2)

Take Profit 3: 300% of the signal candle - optional, mainly if leaving a runner (1:3)

* Other possible take profit levels and stoploss - fib levels from signal candle

Cancel pending orders:

If MACD histogram became negative before triggering buy order

or

Price went below the signal candle's low (without triggering the buy order that was above that candle..) - maybe an input that sets how many candle's after no trigger, pending orders should be cancelled.

Additional inputs:

Time filter (start + stop time of the EA)

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Sell orders (opposite..):

On the 1H and 30Min and 15Min and 5Min and 1Min Timeframes these conditions should be met:

The 35 Weighted Moving Average is below the 35 Exponential Moving Average and

price is below the 35 Weighted Moving Average

and price is below VWAP

Then - on the 1Min timeframe look for:

The 1st negative MACD Histogram Bar (that went from positive to negative) and

it is the 2nd or more consecutive red candlestick (so close<open)

Then - place a sell order 1 tick below the low of that candle + place a stop loss: 1 tick above signal candle

Take Profit 1: 100% of the signal candle (1:1)

Take Profit 2: 200% of the signal candle (1:2)

Take Profit 3: 300% of the signal candle - optional, mainly if leaving a runner (1:3)

Take Profit 2: 200% of the signal candle

* Other possible take profit levels and stoploss - fib levels

Cancel pending orders:

If MACD histogram became positive before triggering sell order

or

Price went above the signal candle's high (without triggering the sell order that was below that candle..) - maybe an input that sets how many candles after no trigger, pending orders should be cancelled.

Screenshot of strat