EURUSD - NON-MARTINGALE, Longterm from 2012!

Hey Guys I´m Working on a Non Martingale Set, and these are the results so far!

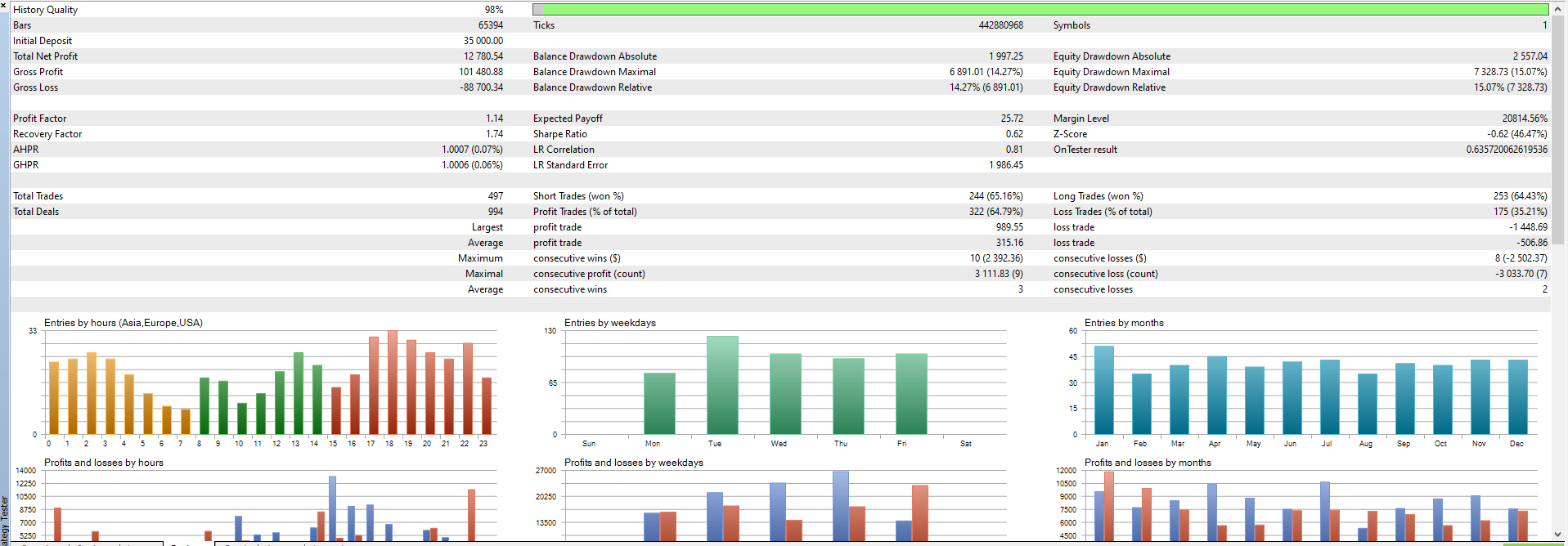

With the MACD given in this set, I rebuild the Aweome Osciliator as an entry and exit to create these results.

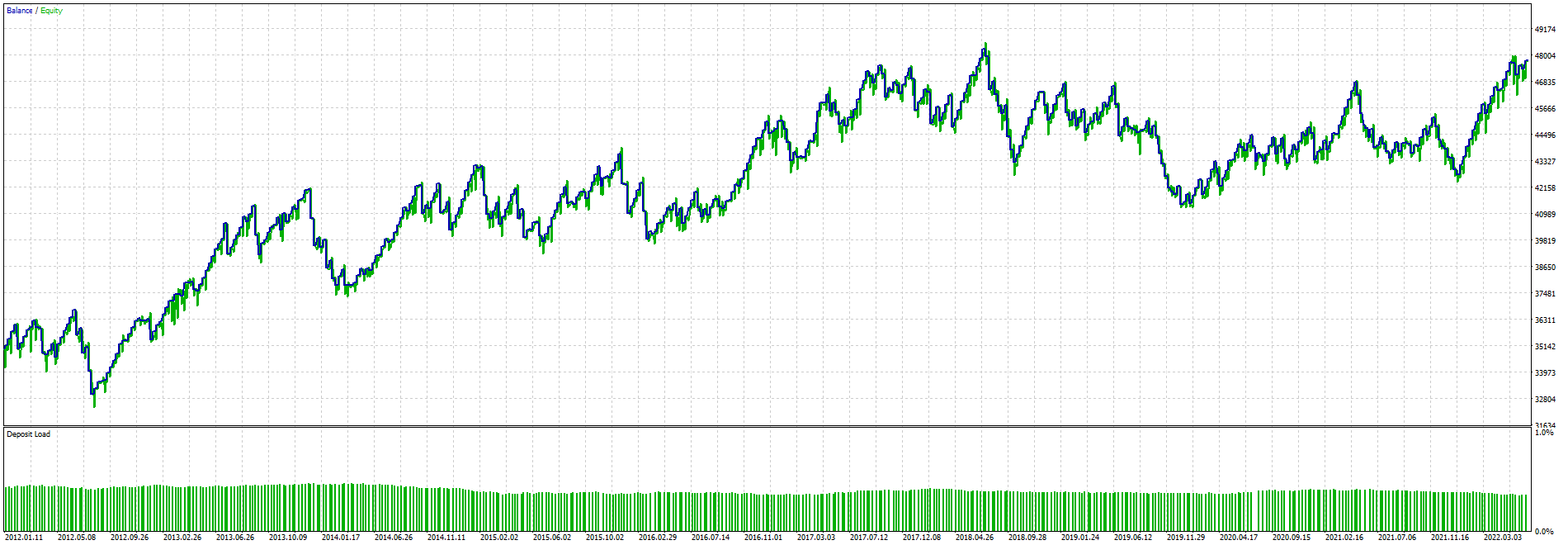

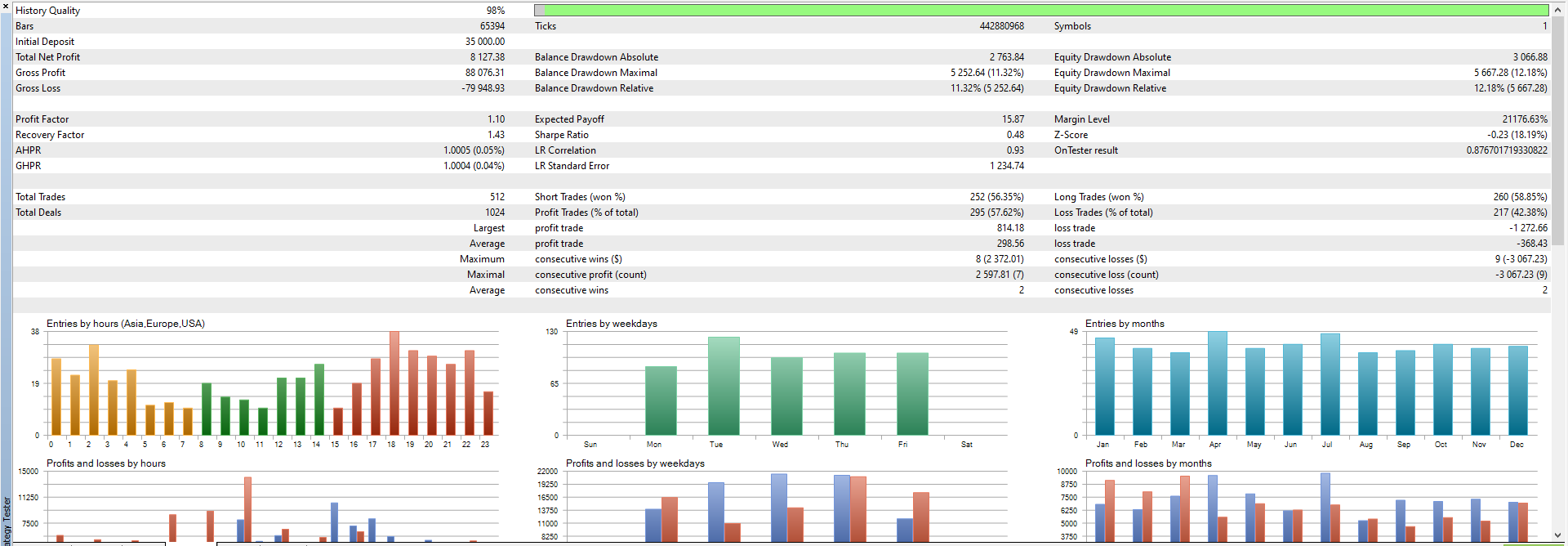

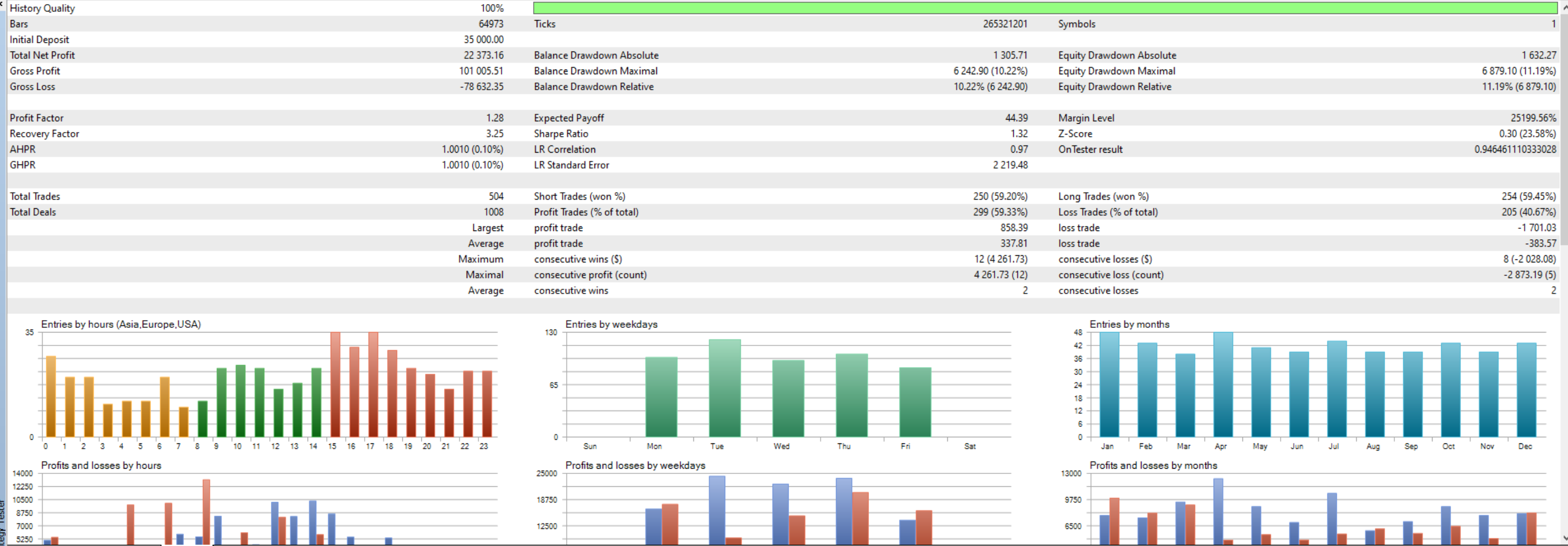

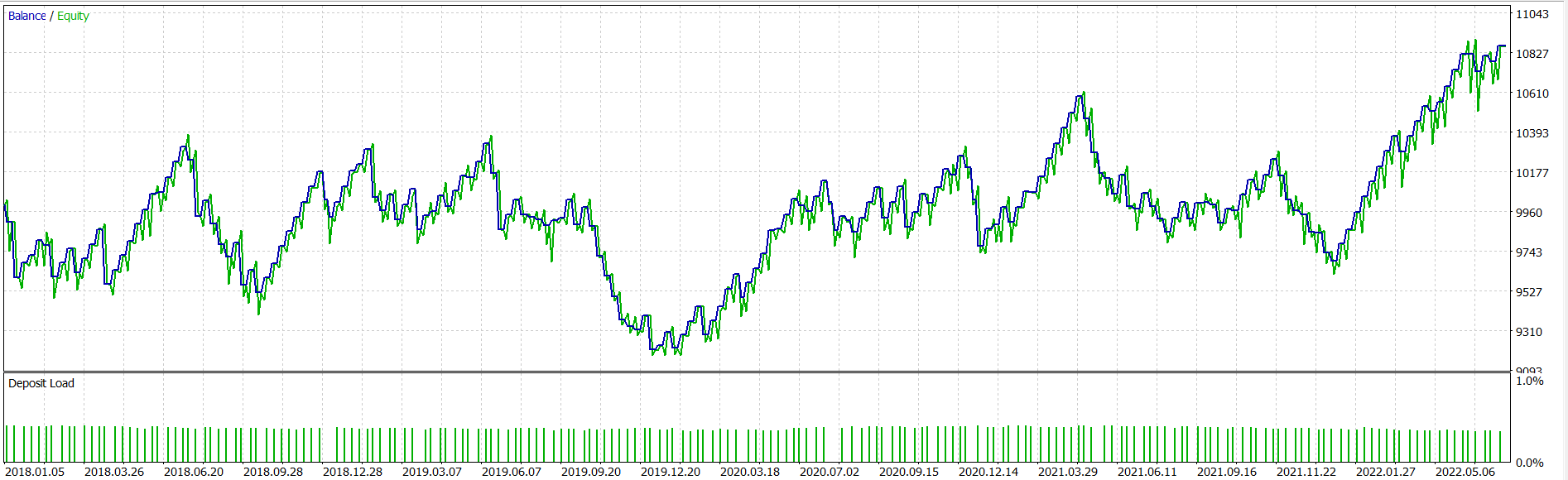

I backtested with Duckascopey and Admiral history.

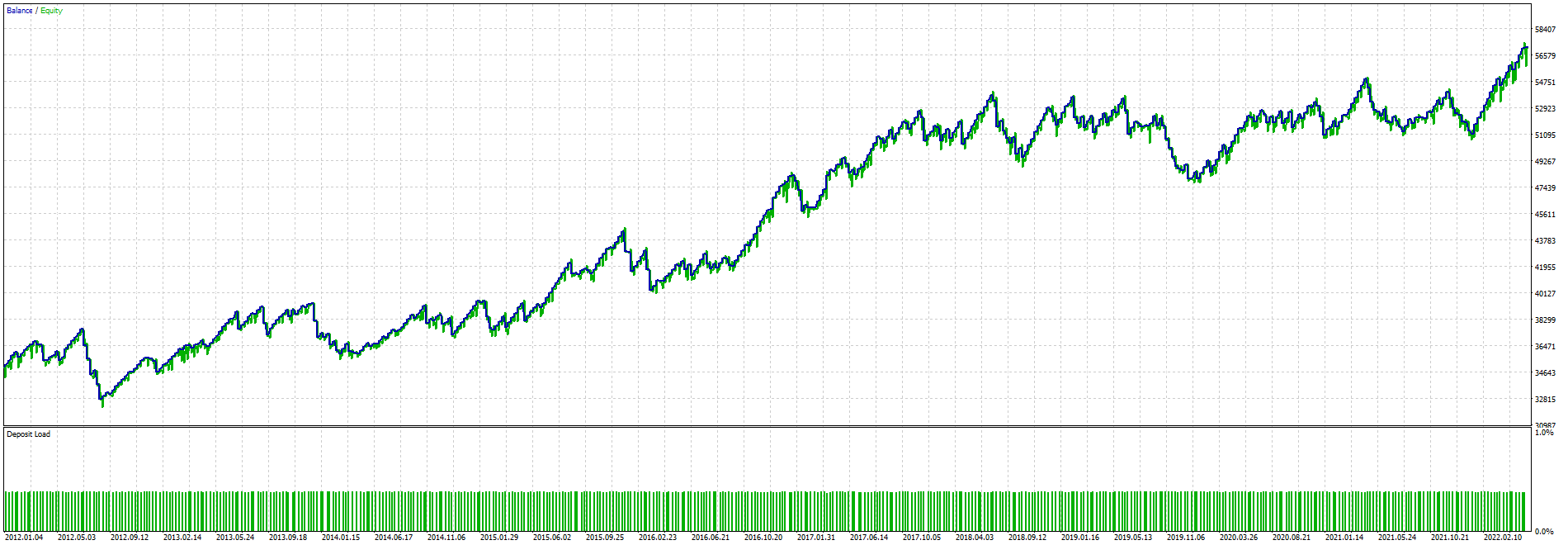

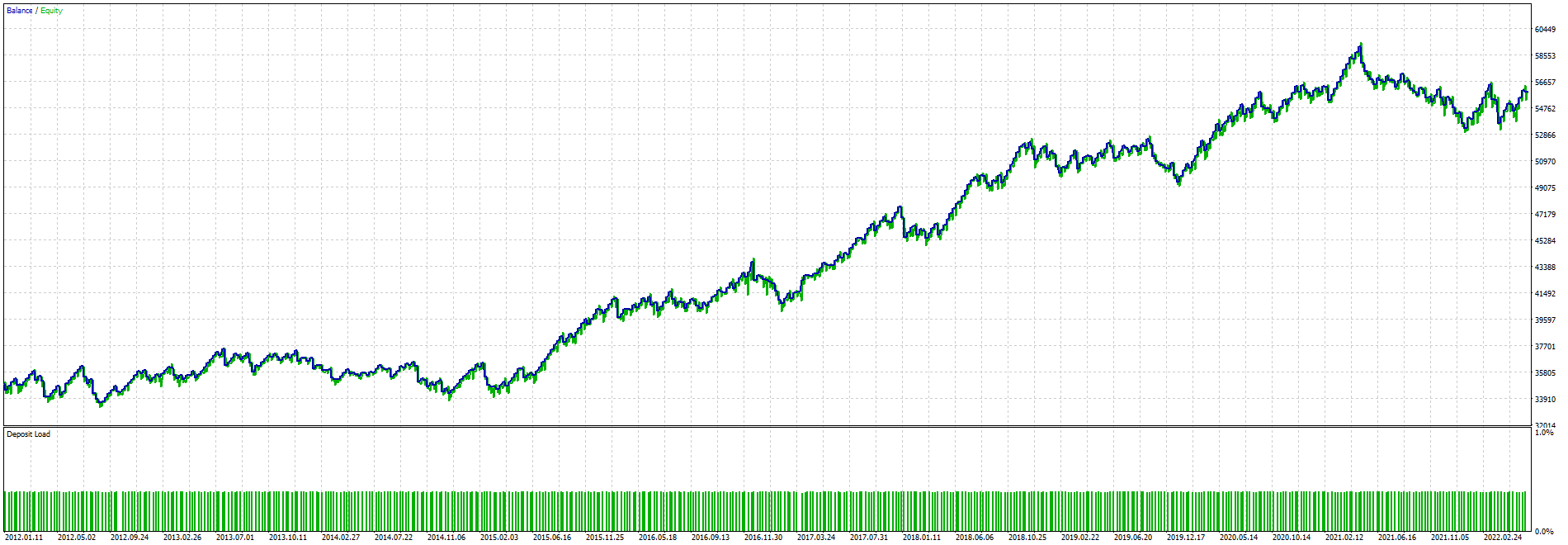

I can share two results. One where the performance is better in the last years and one where there is an over all good result. I guess they can be used but needs perfection! A perfection I´m trying to figure out by trail and error. Maybe someone has a smarter approach to perfect this non martingale set. Well, technically it is martingale to have the benefits but with 1 trade max. Anyway here it is, I hope for the support.

Let´s find the needle in the haystack together.

___________________________________________________________________________________________

Of course the Profit can vary by increasing the risk per trade.

Greetings

JPow

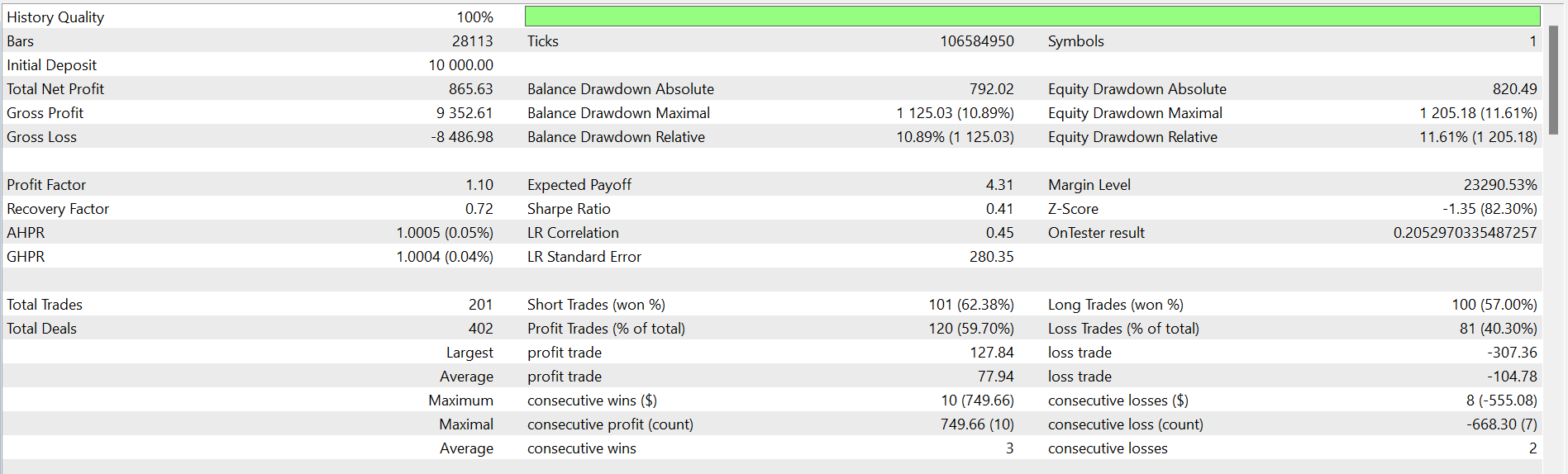

Y did u not use real ticks and gone ahead with ducas copy? The data will be inconsistent and unreliable.

I will test them with my broker Octa FX. In the meanwhile u may also check with real ticks.

Also plz share complete report so that everyone will be aware of the tick quality, etc.