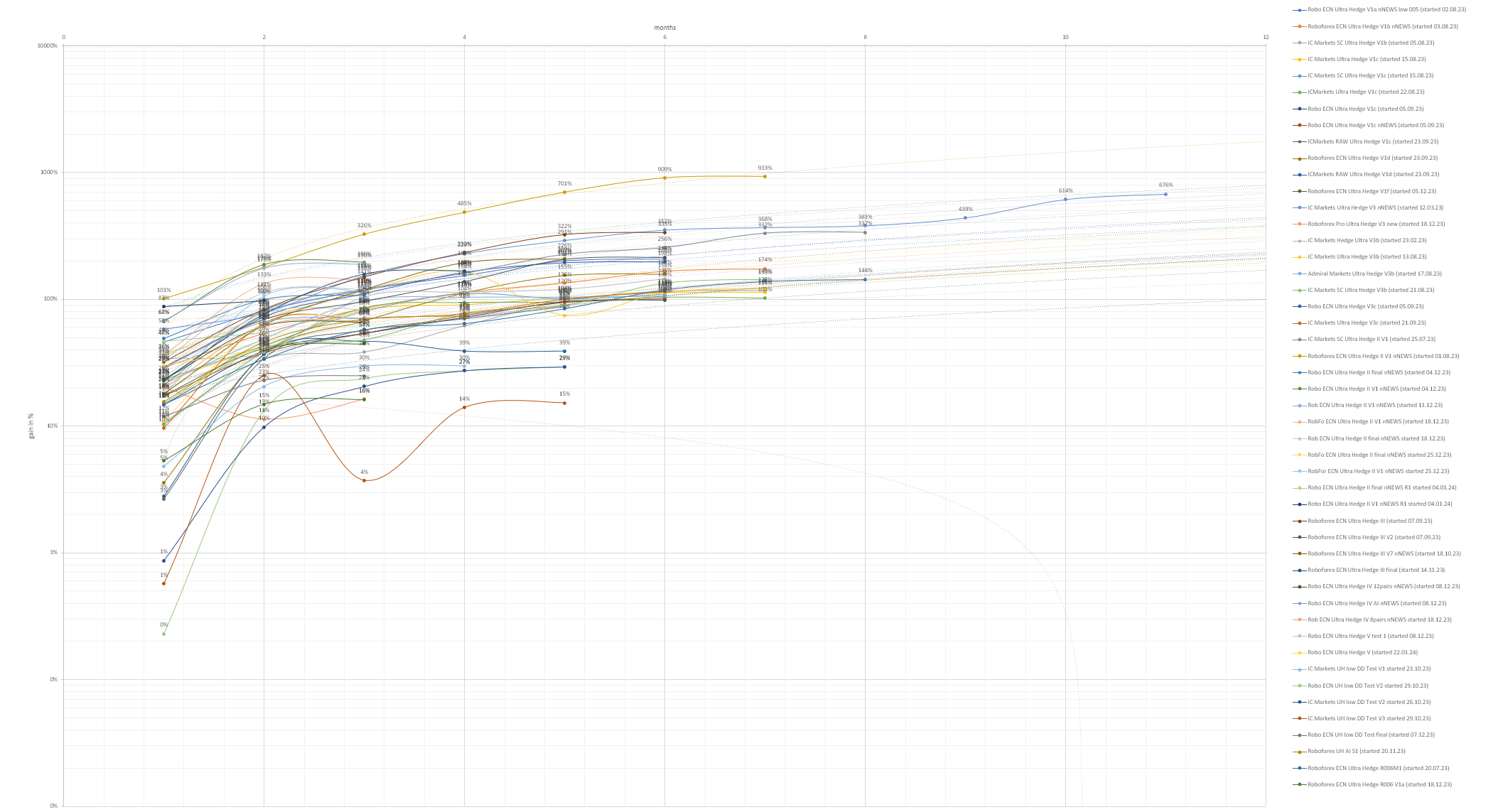

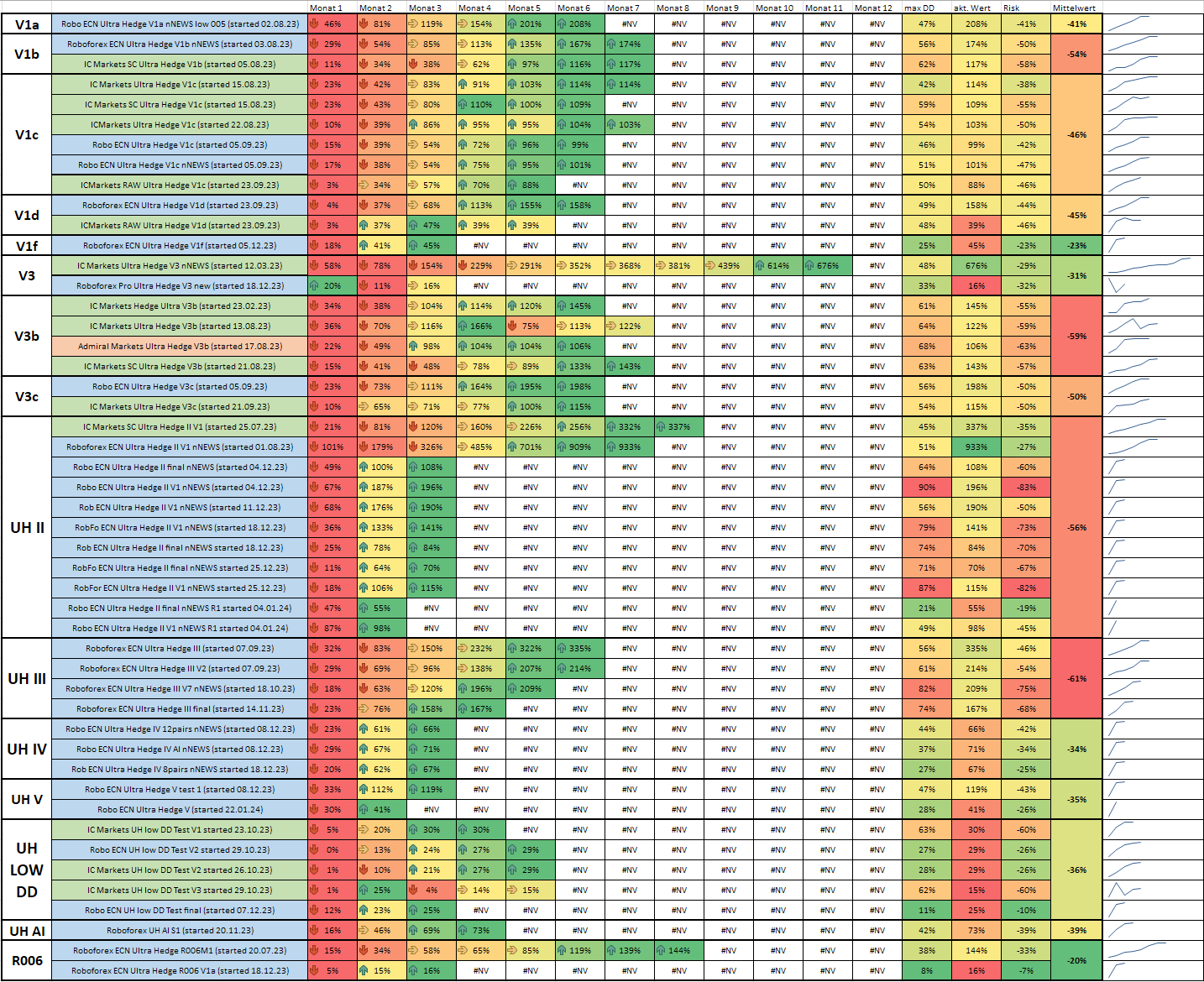

Ultra Hedge *Beta* - JPow

Hi Guys,

I´ve been working a new system lately. An ultra hedge system. What does that mean I will explain soon:

Well, rates are rising globally. This will lead to alot more volatility for forex because it´s getting more interesting to park money in cash. Our martingale system needs to become more well-conceived.So I developed this setup.

We working with different Phases and the same pairs. What I got so far;

Pairs are marked as: N = neutral / S = Sell / B = Buy

Phase 1: CHFJPY (N) / EURCHF (S) / EURJPY (B)

Phase 2: GBPCHF (N) / CHFJPY (S) / GBPJPY (B)

Phase 3: USDCHF ( N) / EURCHF (S) / EURUSD (B)

Phase 4: EURUSD (N) / USDJPY (S) / EURJPY (B)

All simple, its just Stochastic who either buys or sells. The (S) part is just reversing the signal. The "N" is the decision maker. So it´s supposed

to 2 vs 1 (the hedge).

This backtesting is hard and not really possible so I set up a live signal: https://www.mql5.com/en/signals/1745827?source=Site+Signals+My

Any suggestions for improvements? Is it possible to connect the the pairs for each phase? ( maybe via the magic number?) So it closes every phase individually. Of course the "Phases" can be expanded to more pairs.

Anyway here are the sets.

Ultra Hedge.zip ( the magic number need to changed for every pair)

Now with the Multi-Symbol version (version >= 3.0) you could try this option with this strategy.

Doc:

Multi-symbol

Thank you! This sounds promising. With this we could trade the entire strategy in one MT5 terminal with one account, correct?

Which .set files can I could use to adapt to this new version?

I'm on IC Markets.

This thread is filled with highly interesting results but I couldn't find the corresponding sets for the different, available versions (e.g. UH2 V1 for IC Markets) of the strategy. Or am I simply overlooking something?