Ultra Hedge *Beta* - JPow

Hi Guys,

I´ve been working a new system lately. An ultra hedge system. What does that mean I will explain soon:

Well, rates are rising globally. This will lead to alot more volatility for forex because it´s getting more interesting to park money in cash. Our martingale system needs to become more well-conceived.So I developed this setup.

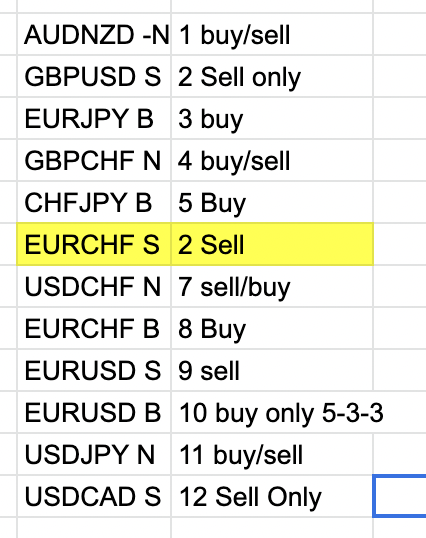

We working with different Phases and the same pairs. What I got so far;

Pairs are marked as: N = neutral / S = Sell / B = Buy

Phase 1: CHFJPY (N) / EURCHF (S) / EURJPY (B)

Phase 2: GBPCHF (N) / CHFJPY (S) / GBPJPY (B)

Phase 3: USDCHF ( N) / EURCHF (S) / EURUSD (B)

Phase 4: EURUSD (N) / USDJPY (S) / EURJPY (B)

All simple, its just Stochastic who either buys or sells. The (S) part is just reversing the signal. The "N" is the decision maker. So it´s supposed

to 2 vs 1 (the hedge).

This backtesting is hard and not really possible so I set up a live signal: https://www.mql5.com/en/signals/1745827?source=Site+Signals+My

Any suggestions for improvements? Is it possible to connect the the pairs for each phase? ( maybe via the magic number?) So it closes every phase individually. Of course the "Phases" can be expanded to more pairs.

Anyway here are the sets.

Ultra Hedge.zip ( the magic number need to changed for every pair)

news filter only applies in the closed position, right? but how do you do it so that it can be applied to open positions too?

I'm not 100% sure of the semantic of the setting here, but this is my understanding that above setting are:

News Filter is used

High impact news only

Holiday is taken as a high impact news

EA do not open during the time set (120m before and 60 minut after the news)

EA do not martingale,

EA do not open hedge positions

EA however could close existing position should there be a signal to close and in profit.