Ultra Hedge *Beta* - JPow

Hi Guys,

I´ve been working a new system lately. An ultra hedge system. What does that mean I will explain soon:

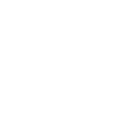

Well, rates are rising globally. This will lead to alot more volatility for forex because it´s getting more interesting to park money in cash. Our martingale system needs to become more well-conceived.So I developed this setup.

We working with different Phases and the same pairs. What I got so far;

Pairs are marked as: N = neutral / S = Sell / B = Buy

Phase 1: CHFJPY (N) / EURCHF (S) / EURJPY (B)

Phase 2: GBPCHF (N) / CHFJPY (S) / GBPJPY (B)

Phase 3: USDCHF ( N) / EURCHF (S) / EURUSD (B)

Phase 4: EURUSD (N) / USDJPY (S) / EURJPY (B)

All simple, its just Stochastic who either buys or sells. The (S) part is just reversing the signal. The "N" is the decision maker. So it´s supposed

to 2 vs 1 (the hedge).

This backtesting is hard and not really possible so I set up a live signal: https://www.mql5.com/en/signals/1745827?source=Site+Signals+My

Any suggestions for improvements? Is it possible to connect the the pairs for each phase? ( maybe via the magic number?) So it closes every phase individually. Of course the "Phases" can be expanded to more pairs.

Anyway here are the sets.

Ultra Hedge.zip ( the magic number need to changed for every pair)

Hi All,

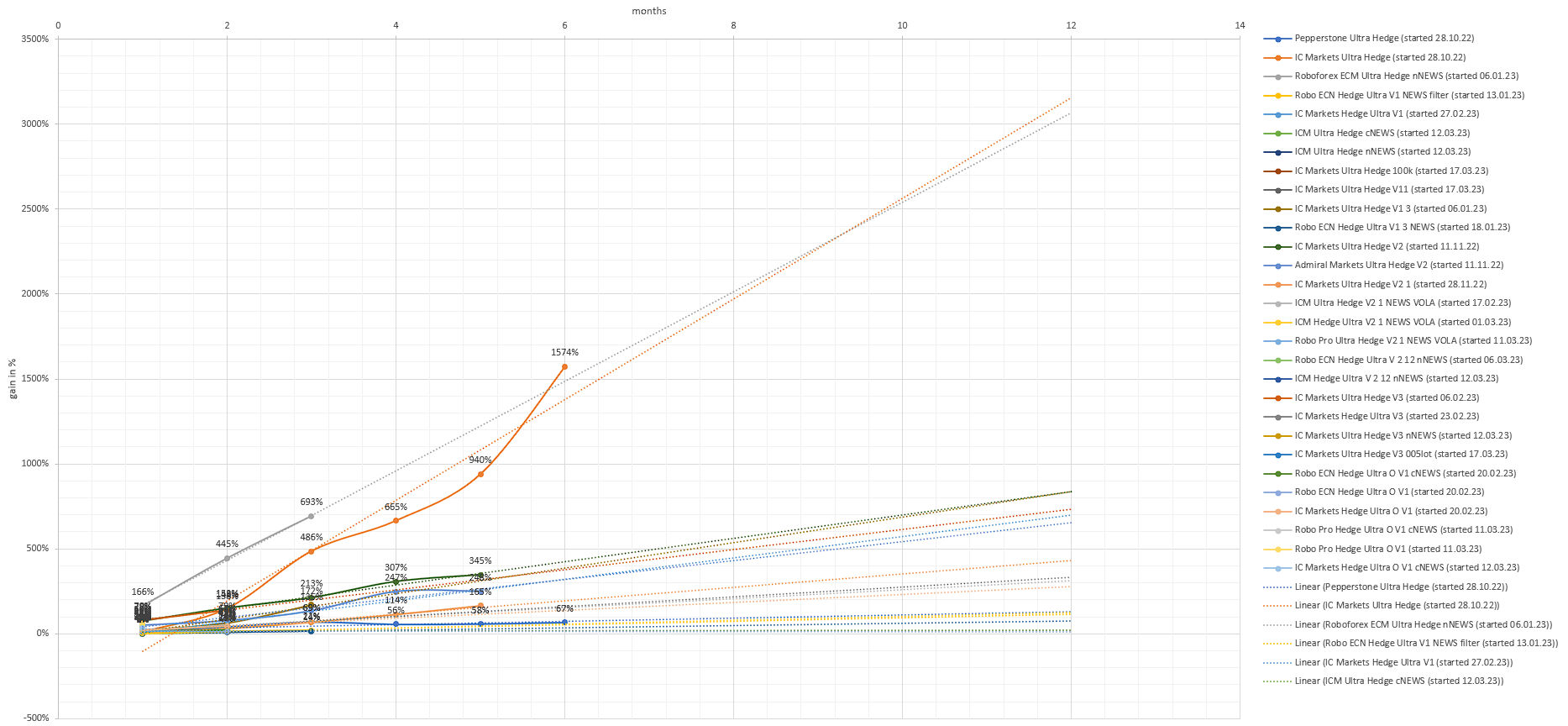

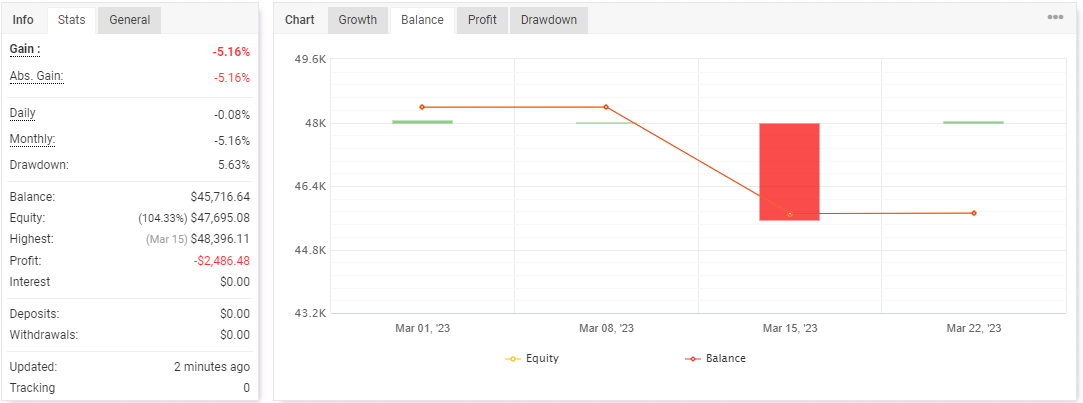

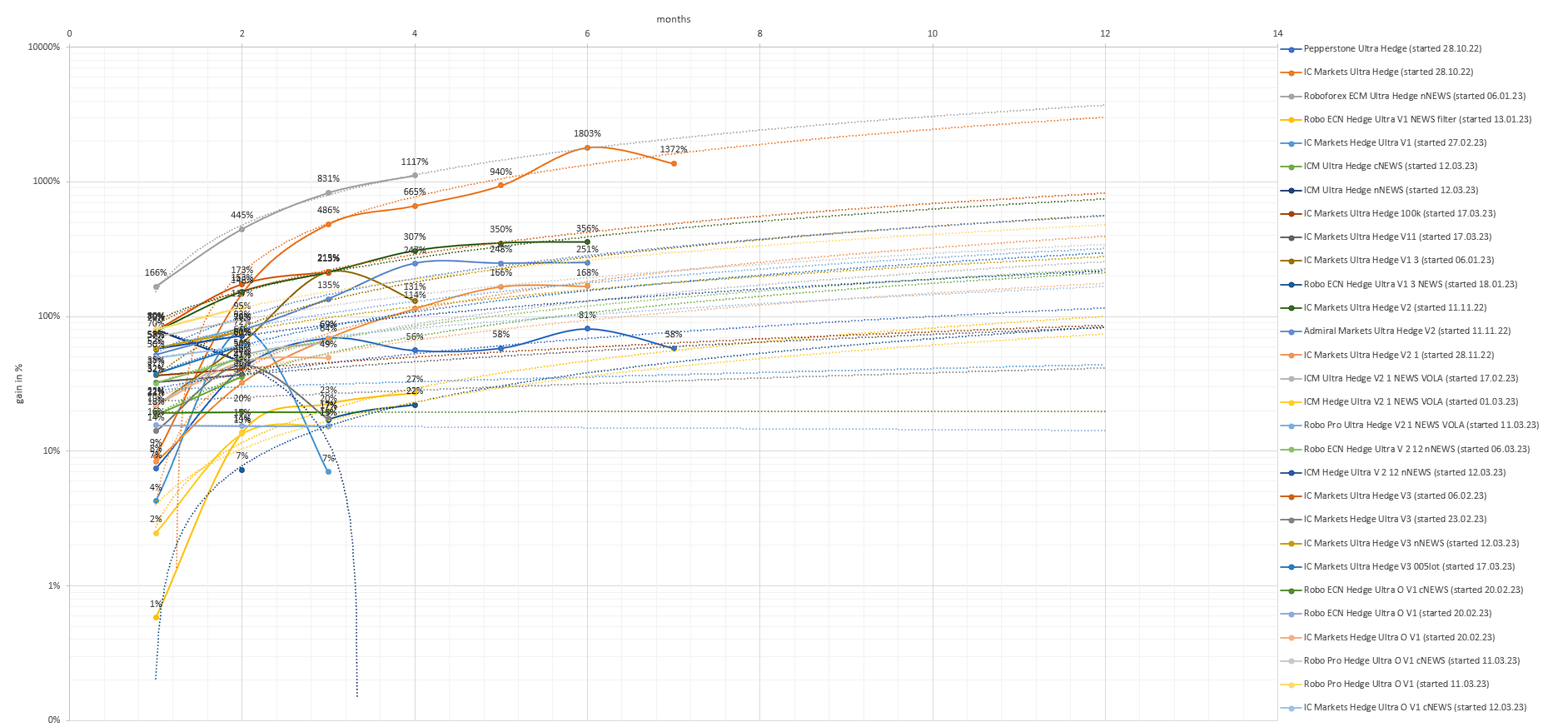

I've got some demo accounts running on three brokers testing the Opik V1 Ultrad hedge system. I've got some different risk management paramters in mine, namely a global stop loss equal to 5% of the total account balance. And therfore have slightly ammended the lot sizes parameters as well.

I'm doing some analysis on their performance and have found that opening positions on wednesday is significatnly more likely to result in a loss. For example see below, I've attached two graphs one showing the system performance of trades filtered by open times (Wednesday), and the other showing the same for trades filtered as opened on monday, tuesday, thursday and friday.

Wednesday Only

All other days

Has anyone had similar results, the only cause I can think of is the comparative decrease in voltatility on Wednesdays that makes Maringale trading less likely to break even.

Any other thoughts?