Ultra Hedge *Beta* - JPow

Hi Guys,

I´ve been working a new system lately. An ultra hedge system. What does that mean I will explain soon:

Well, rates are rising globally. This will lead to alot more volatility for forex because it´s getting more interesting to park money in cash. Our martingale system needs to become more well-conceived.So I developed this setup.

We working with different Phases and the same pairs. What I got so far;

Pairs are marked as: N = neutral / S = Sell / B = Buy

Phase 1: CHFJPY (N) / EURCHF (S) / EURJPY (B)

Phase 2: GBPCHF (N) / CHFJPY (S) / GBPJPY (B)

Phase 3: USDCHF ( N) / EURCHF (S) / EURUSD (B)

Phase 4: EURUSD (N) / USDJPY (S) / EURJPY (B)

All simple, its just Stochastic who either buys or sells. The (S) part is just reversing the signal. The "N" is the decision maker. So it´s supposed

to 2 vs 1 (the hedge).

This backtesting is hard and not really possible so I set up a live signal: https://www.mql5.com/en/signals/1745827?source=Site+Signals+My

Any suggestions for improvements? Is it possible to connect the the pairs for each phase? ( maybe via the magic number?) So it closes every phase individually. Of course the "Phases" can be expanded to more pairs.

Anyway here are the sets.

Ultra Hedge.zip ( the magic number need to changed for every pair)

Hello everyone, Since this week I let run Phase 1 on a real account (1000$, ECN Roboforex). So far, aprox. 1,5% win per day. But I think it is to dangerous for long turn. I would like to avoid to increase my balance. So my question here: Has anyone created a more conservative set file? Is it desidned to get less aggressive if ww switch the timeframe from 5 to 15 min?

It all comes down to the SetFiles (buy, sell, both) for each pair and how the pairs are working together (magic numbers).

Unfortunately my knowledge on all the settings (+750) and how they influence the behaviour, is far from being enough to create my own SetFiles. Therefore we can just hope that people involved in this topic share theirs.

My approach to this is a lot of testing and doing simulations. But in the end the risk is still there!

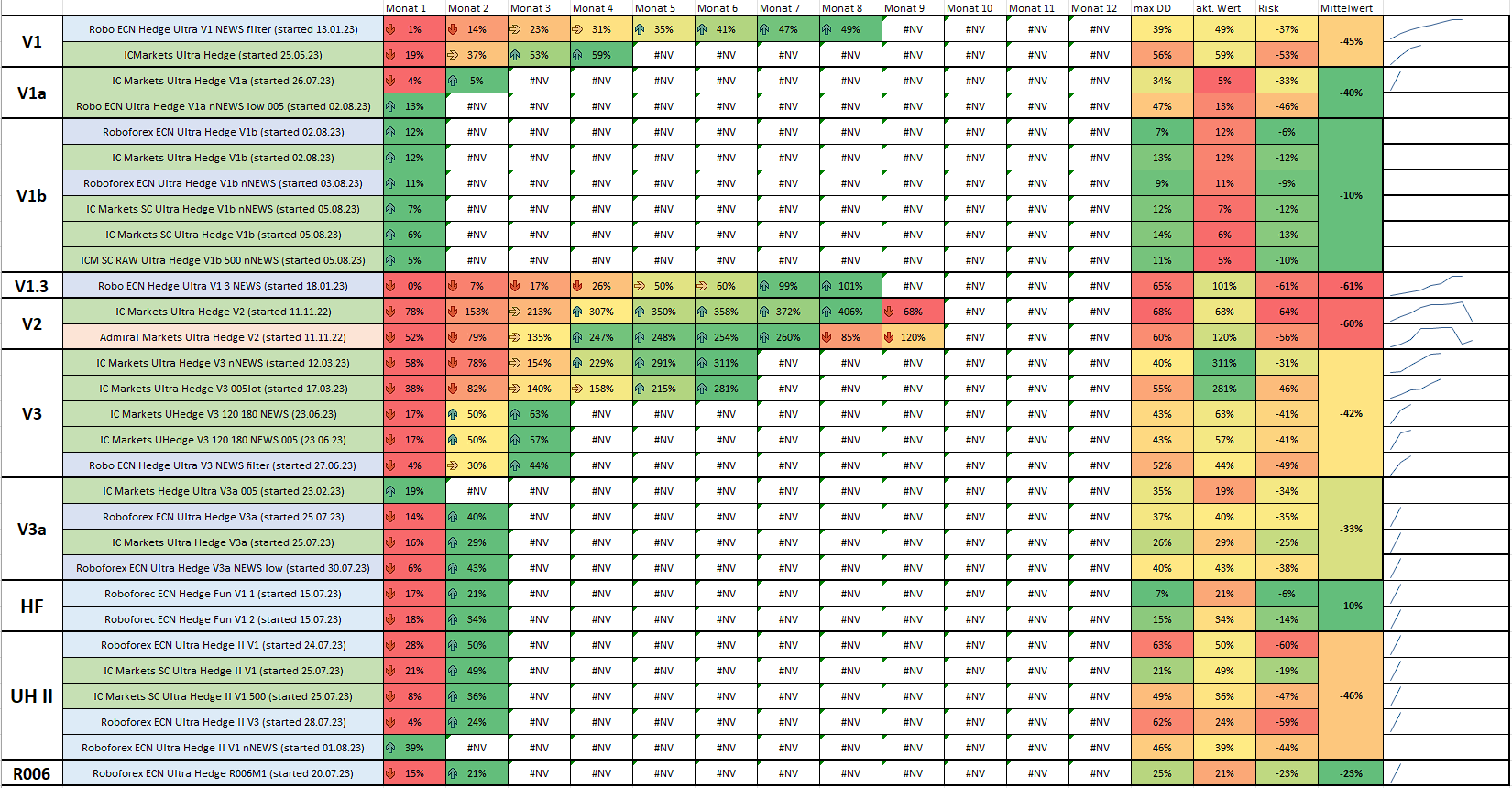

The provided UH R006M1.zip (page 52) from ferdinand looks really promissing for me.

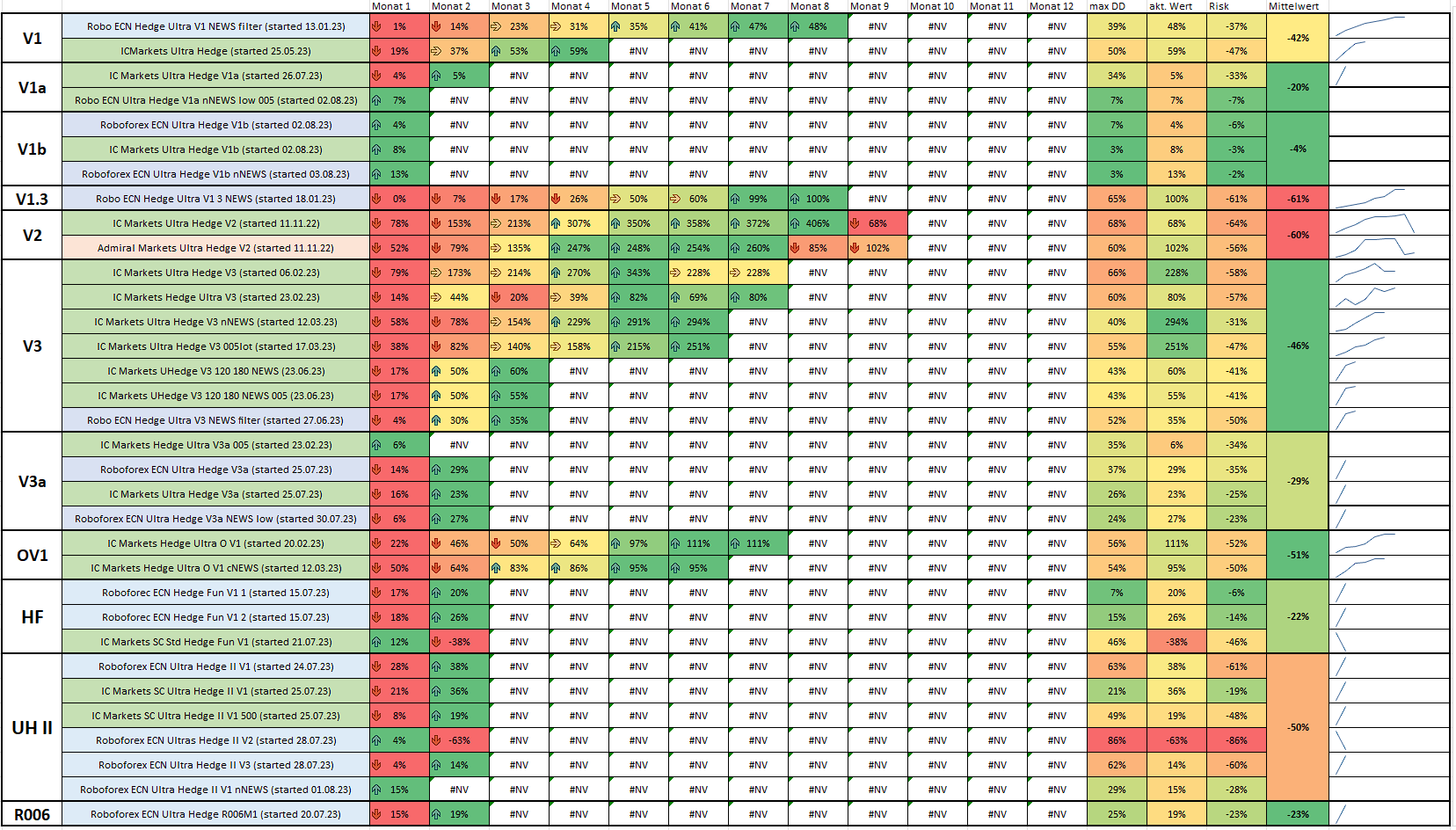

Almost all of the SetFiles from the initial version dumped to 0 in simulations of the year 2023.

Therefore I would recommend to use the version of ferdinand. Also try to avoid JPY pairs as long as the bank of japan keeps on devaluing their currency.