BTCUSD Oscillator settings for Trading

Optimisation for BTCUSD Oscillator and trading settings. I have just ran some optimisations under the following parameters

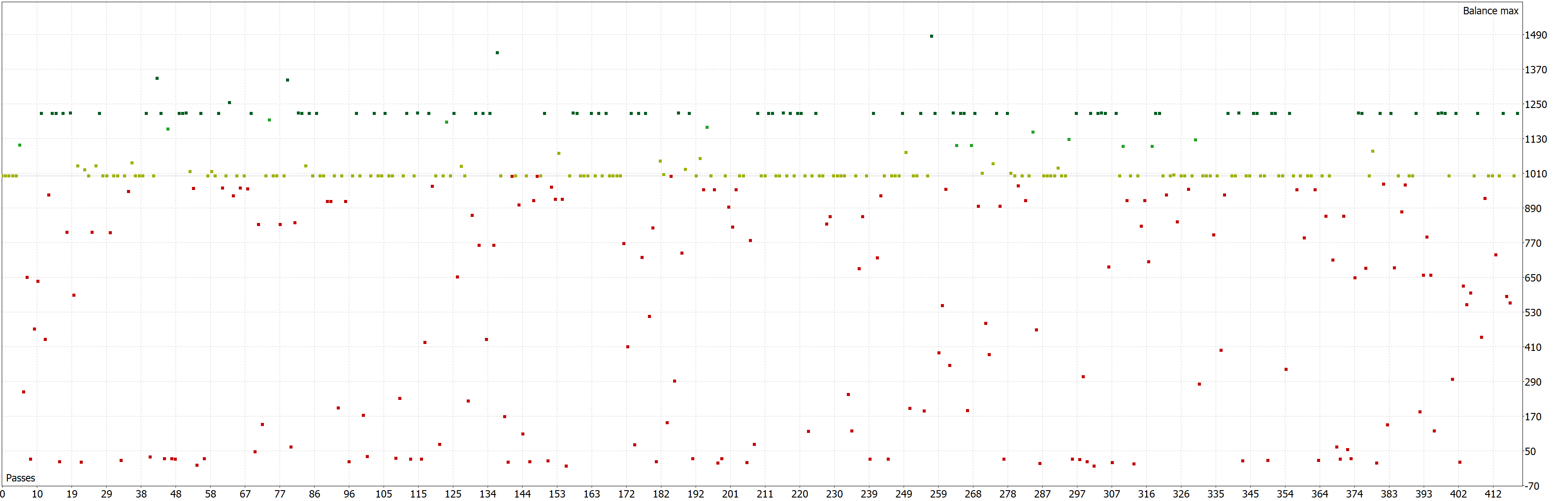

BTCUSD, M1, (for the year to date). I first ran complete optimisation on the signal, type and timeframe for the signal. Then, using the one which had the most trades, I would then use that for the next optimisation, which was for the 2nd oscillator.

Test 1

Set the signal 1 oscillator to cross out, cci and 3hrs

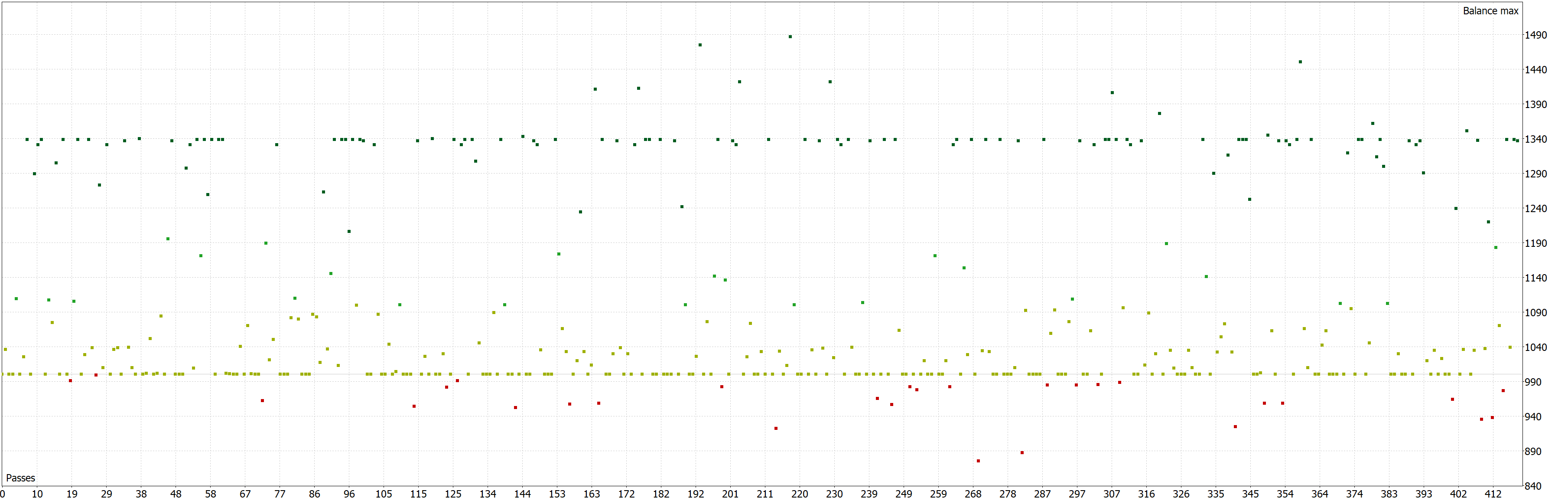

Test 2

So taking the 1st Report, using the 3rd option which had 282 trades, I have the following single report

Then picking the best one here, I ran the following single test.

From the graph, it shows a good recovery in periods of massive turmoil. It also shows a high percentage on winning trades, about 64-72%, S/L. And these are profitable ones. The av holding time is 25hrs, so you might end up paying holding costs to your broker, so this is what you will have to factor in.

Thanks!

Please, attach opt-files so anyone can repeat your results.