ea implementation with ichimoku

Hi Andrey, it is possible to add ichimoku indicator with customizable parameters, so as to filter the trend?

Hi Andrey, it is possible to add ichimoku indicator with customizable parameters, so as to filter the trend?

the filter should work this way, when the candles are below or above the kumo (cloud) and below or above the two red and blue averages tenkan and kijusen, there are high probabilities of a retracement or start of a new trend, combined with other input filters such as stochastic or rsi could give satisfactions if set well in the parameters

the two red and blue averages must be outside the cloud of course,

if the candles are above or below the averages but the averages are inside the cloud the entry is not valid

obviously the red average must be below the blue for the sell and above the blue for the buy

and you can also make multiple entries,

when the candles fall within the red average and are able to close below,

in the case of the sell, but decreasing the lots compared to the previous entry,

making a maximum of 3 or 4 entries

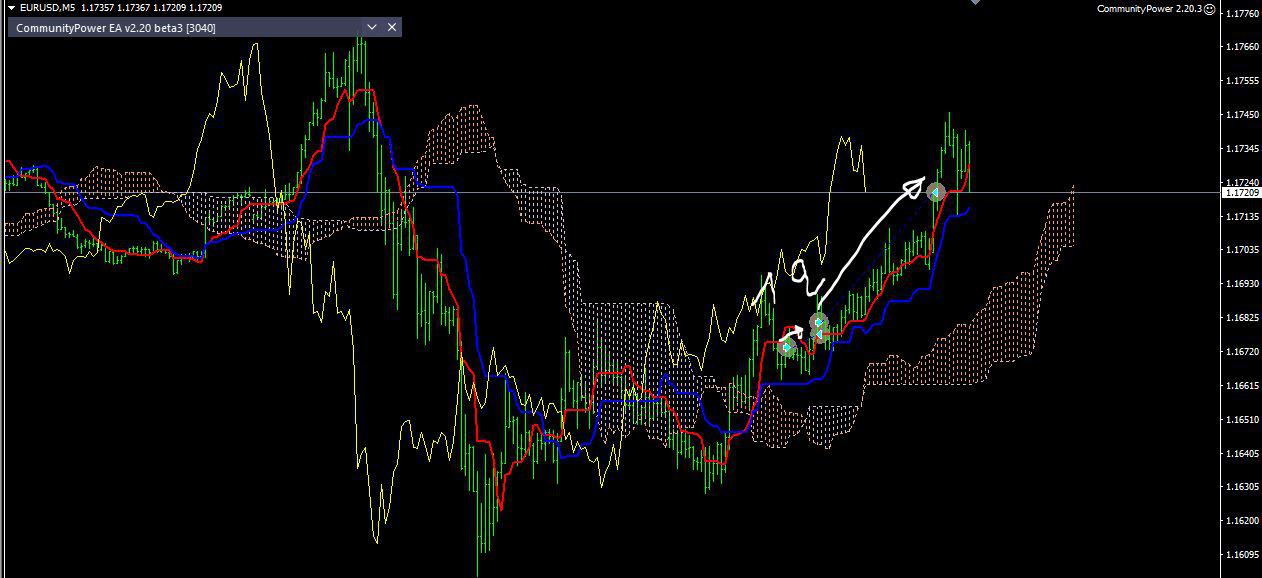

manual entry on eur usd and ichimoku, first trade closed by hand, entry second trade on successful candles automatic closing ea

Thanks for the details!

All these lines are simple MAs.

You already can use "Buy above MA / Sell below MA" mode of MA filters (turn on 2 filters together).

We can also add "MA shift" parameter to each filter to be able to emulate "cloud" (it is shifted).

But we will still not be able to analyze MAs disposition..

So, let's add Ichimoku as separate filter with complex rules:

Is everything correct?

Let's vote then.

Thanks for the details!

All these lines are simple MAs.

You already can use "Buy above MA / Sell below MA" mode of MA filters (turn on 2 filters together).

We can also add "MA shift" parameter to each filter to be able to emulate "cloud" (it is shifted).

But we will still not be able to analyze MAs disposition..

So, let's add Ichimoku as separate filter with complex rules:

Is everything correct?

Let's vote then.

the two ichimoku averages do not work as two classic averages, but I would say that to start trying it's okay, let's test it and see if it needs to be changed thanks andrey

Describe how do you want to use it. Show some charts.