Trading the spread of multiple symbols

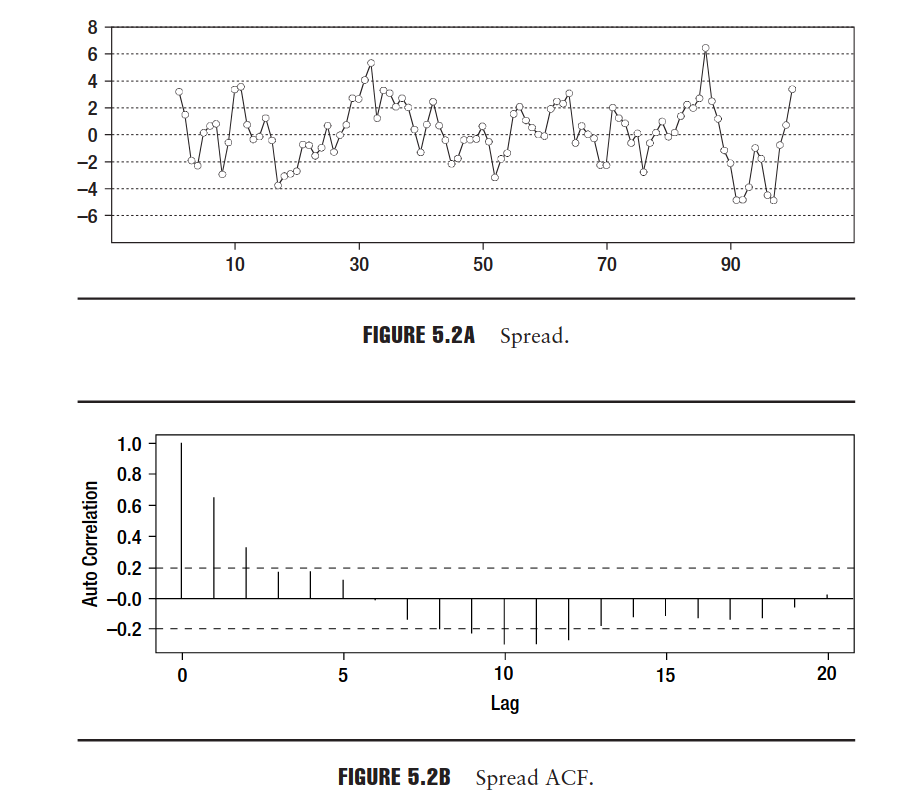

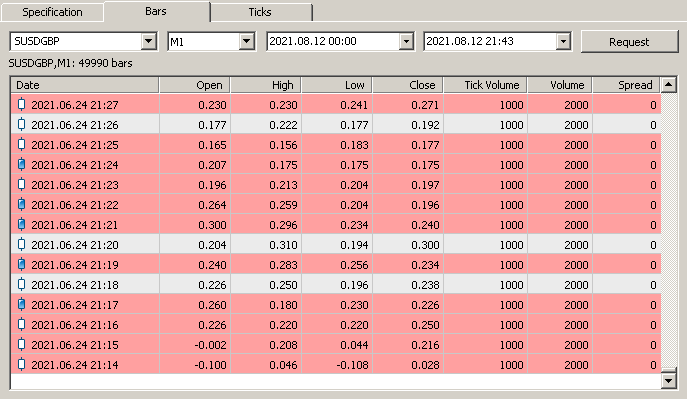

Hi, from my initial research I think it might work very well to define a custom price as

p1 - x * p2

where p1 is the price of e.g. EURUSD

and p2 is the price of EURGBP

Basically, we are trading the spread here.

The main advantage of this approach is that the spread is always reverting. So If situations like covid as in march 2020 occur, the spread reverts because all assets went down.

If you are new to this concept, I can recommend this book: https://b-ok.cc/book/667720/3ffe3a?dsource=recommend

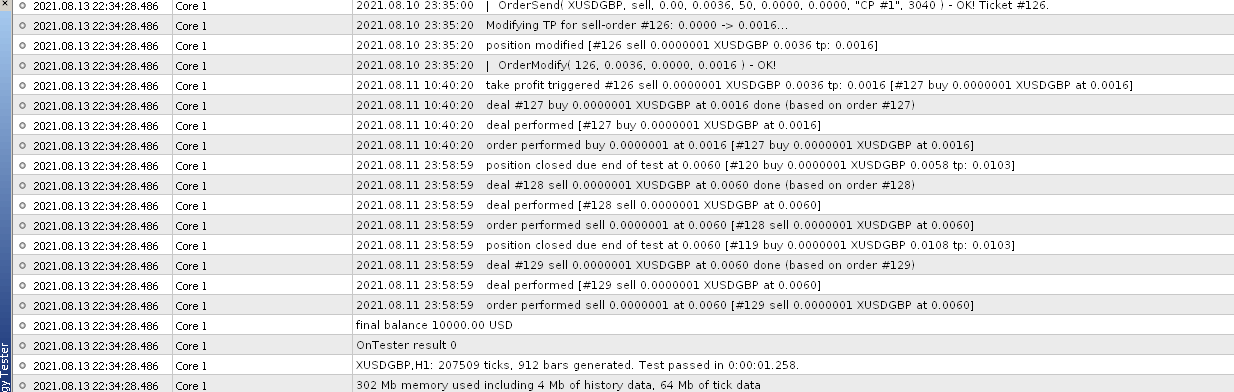

When the EA triggers an order to the custom symbol, there must be some specific logic which implemntes:

Going long of 1 lot with the custom asset, means:

going long of 1 lot of EURUSD and 1.3 short of EURGBP.

Vice versa for closing a position.

Hannes, have you tried to generate such symbol in MT5 and to backtest the EA on it?