GRID Strategy

Hello community, I hope you are all well.

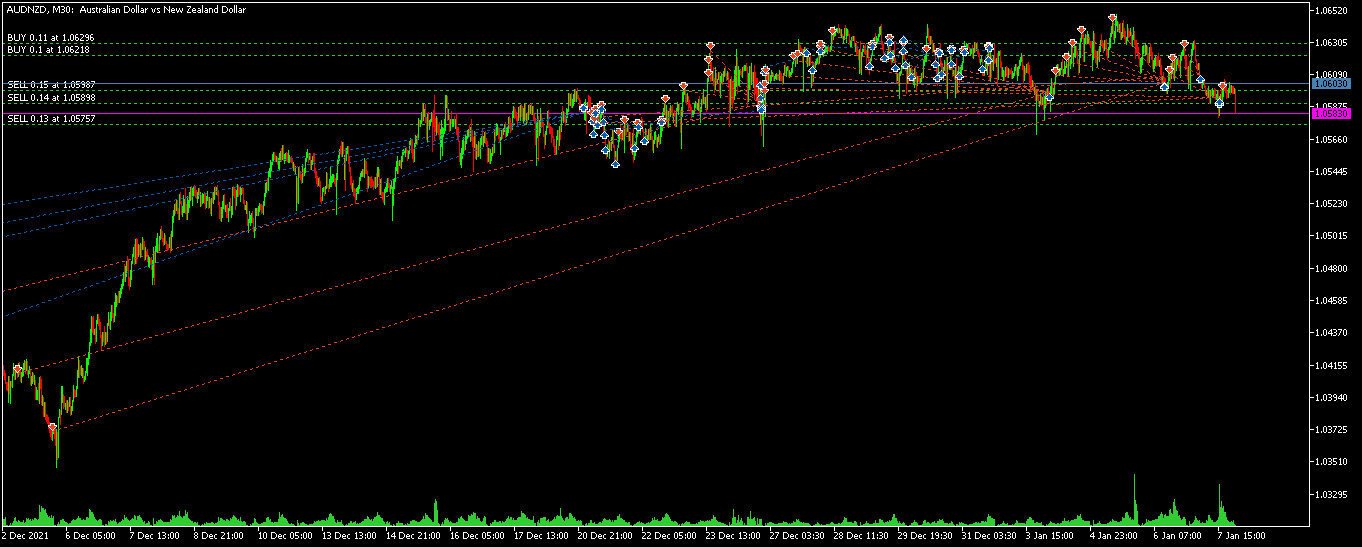

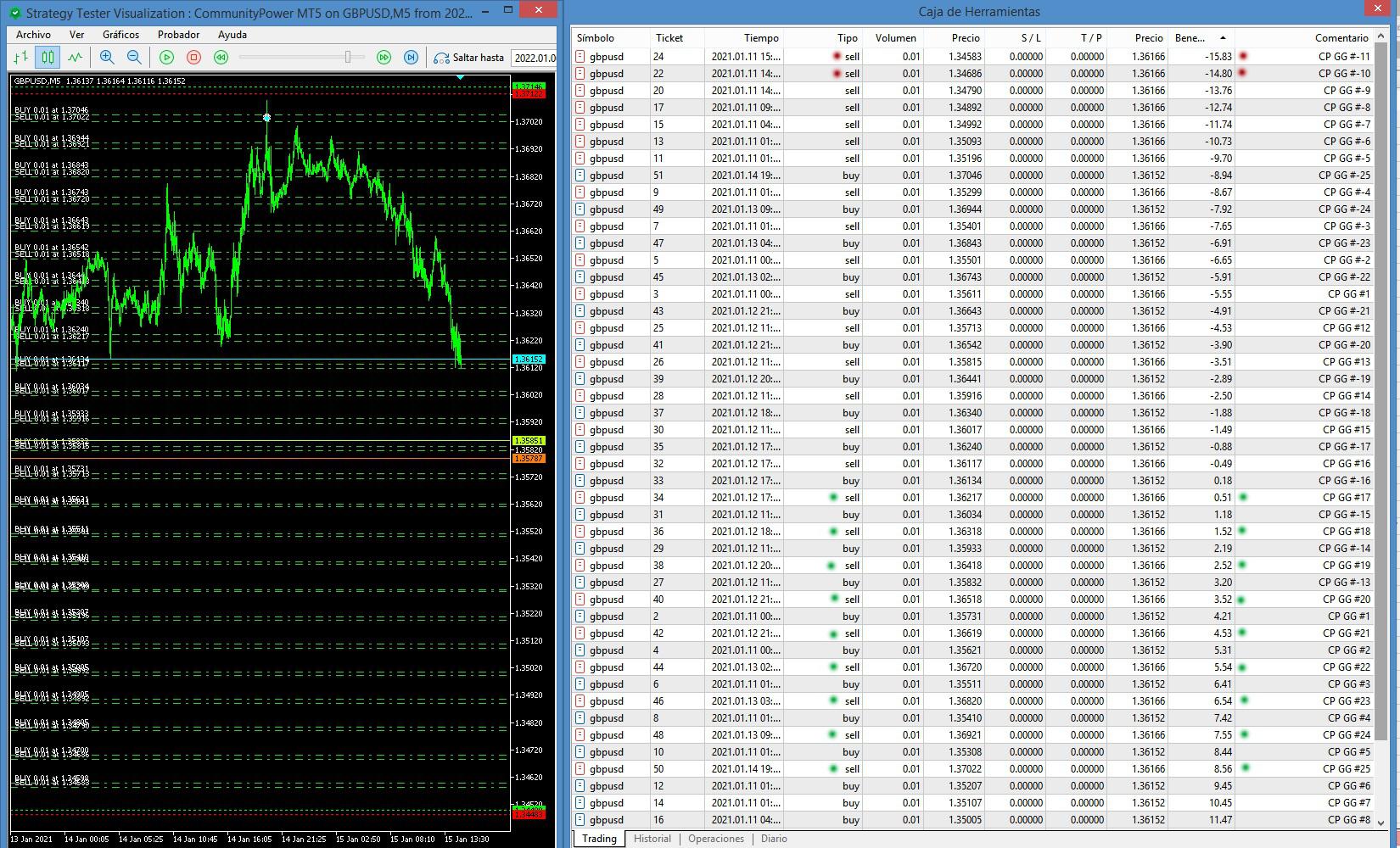

The intention, is to always hold 1 buy and 1 sell every 200 pips. If the EA finds a SELL line alone (without a buy at 200 pips, then the EA opens a BUY, and vice versa), thus staying in the market constantly.

Let's assume this scenario in a CENT account:

1- The EA opens 1 BUY and 1 SELL order every 200 pips.

2- The price goes up and opens 2 orders plus 1 BUY and 1 SELL order.

3- The price goes up more and opens 2 orders plus 1 BUY and 1 SELL.

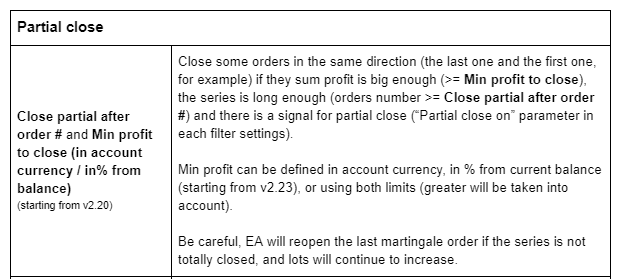

4- The price keeps rising and the EA closes a BUY with more profit and makes a partial close of the SELL that has more loss.

5- The EA checks to see if there are BUY and SELL orders 200 pips away, if there are no orders 200 pips up or down, the EA opens a BUY and/or SELL order.

6- The price continues to rise and opens 2 more orders, 1 BUY and 1 SELL.

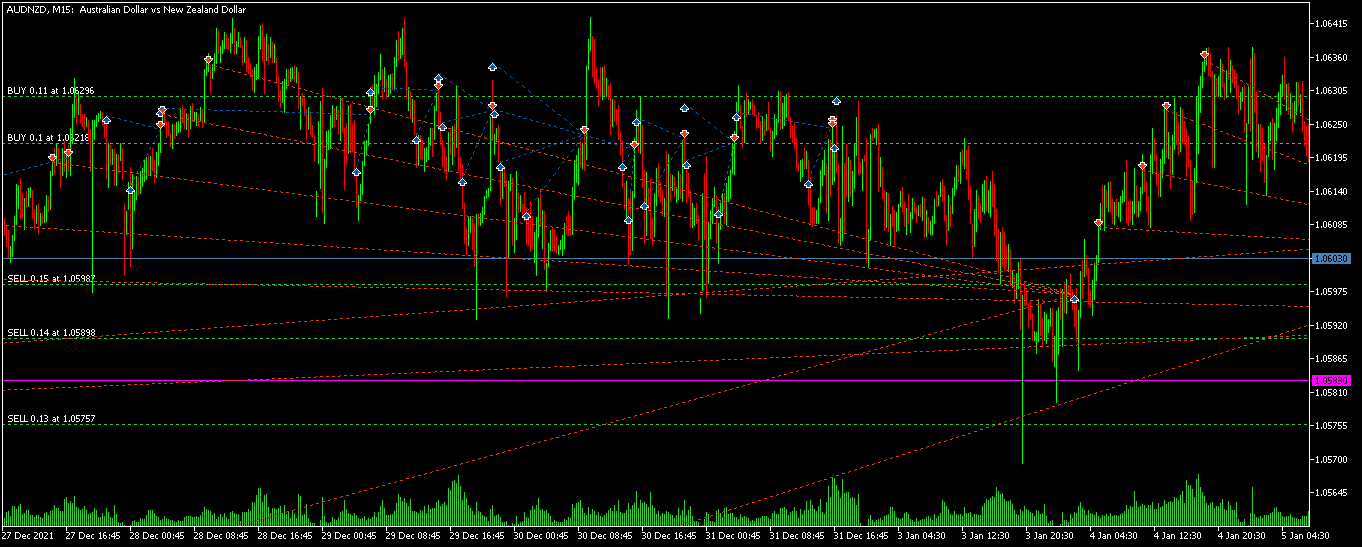

7- At this moment, the price changes direction and starts to go down.

8- The EA encounters an old SELL line (no buy, because it was previously closed), so the EA opens a buy order.

9- The price keeps going down and the EA closes a SELL with more profit and does a partial close of the BUY which has more loss.

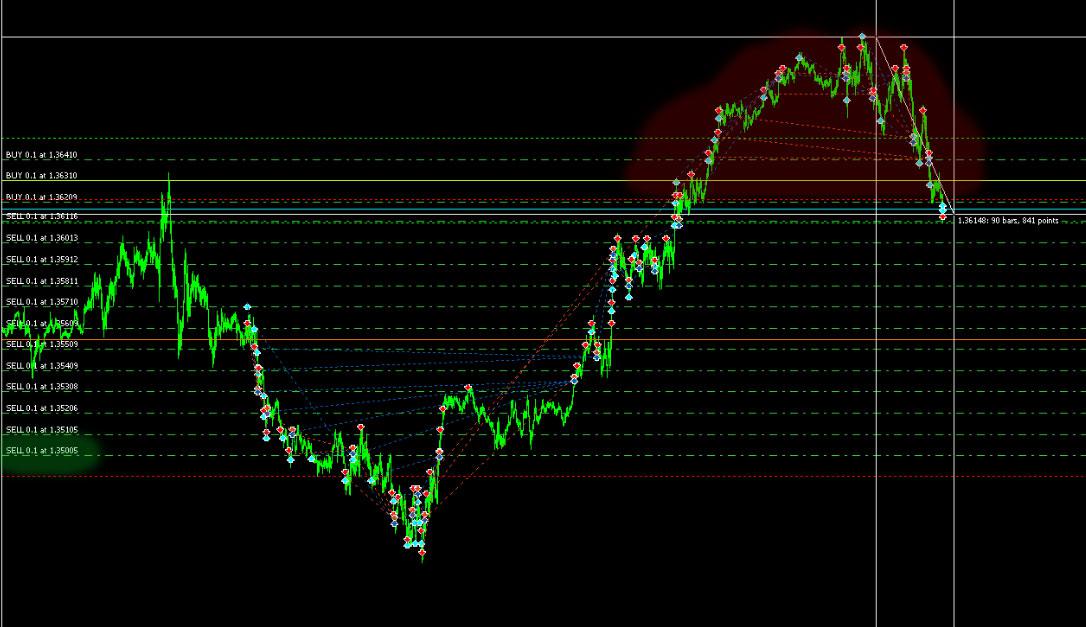

I currently do this with 3 EAs. 2 EAs that open orders in GRID, 1 in favor of the trend and one against. And a 3rd EA that does the closes, but not partial, but total, i.e. closes several winning orders for one losing order. But partial closes are better, but I don't have an EA that does it.The problem with my strategy is that when it closes winning orders for a losing order, it leaves gaps with sells or buys alone, so it takes longer to profit, since it has to get to the last order in favor of trend or the last order in favor of trend, to continue opening orders in GRID.

What do you think? I hope you get the idea.

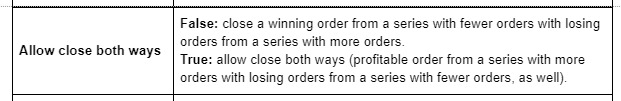

Thanks for the .SET, although it does not give priority to close the orders that have higher losses. In the meantime, I use CP to open the orders in GRID and the other EA to close the orders.

I don't trade with MartinGala, I trade with fixed lot. I open buy and sell orders every X amount of pips, depending on the pair to trade.

The only stone in the shoe of GRID strategies and even more with fixed lots, are the strong trends, and the only way to counteract them is closing those that have a larger amount in negative, along with those that have a larger amount in positive.

It is a pity that what I want to express is not understood.