Decrease Stop Loss depending on trade duration

As this is my first suggestion please gladly correct me if this idea doesn’t make sense. 😊

Regularly you enter a trade when the entry signals you chose show up/down. Then there are three possibilities:

- The trade actually moves into the desired direction; hence you pretty soon enter the win area.

- The trade moves against you and pretty soon the stop loss is hit. Even though this sucks, this is why you do set it 😊.

- The trade stays between your SL and your TP for some/a long time.

Possibilities 1. and 2. are daily business. However, when a scenario 3. takes place, this has some severe disadvantages:

- When this runs over a period of several days you need to pay swap fees.

- The margin you use is blocked so you can not use it for other (more promising) trades.

- Over all, if after a longer time period the asset price eventually moves in one direction or the other, it is more like a coin toss rather than based on what your entry conditions were.

Furthermore, in case 2., when the stop loss is hit, this can also be due to a rapid movement directly after the trade has been opened (depending on which indicators you used). Hence, it can occur, that your SL is hit right before the price bounces back into the direction you wanted it to go.

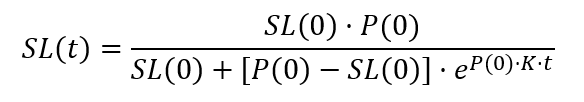

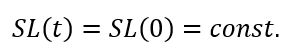

My solution to this would be a time dependency of the stop loss depending on the amount of time that passed after opening the trade. I suggest the following formula according to logistic growth.

With the following formula signs:

- SL(0): Initial Stop loss you set

- SL(t): Current stop loss after t time steps after the trade has been opened.

- P(0): Asset price at the moment when the Trade has been opened

- K: Exponential damping constant (“How quickly is the SL decreased”)

- t: Time after the trade has been opened

When the trade eventually hits the win area and a trailing stop is applied, this should override the logistic SL function.

By implementation my hopes are to improve my trading strategy by giving the trade a little more space to breathe directly after opening but cutting it of after a certain time when it does not “take off”.

Hi, I was going to suggest the same thing, I was using RSI to make entry trades and sometimes it would be immediate, no SL needed, others it would do a quick bounceback then hit (large SL needed, risky), others it would sit at a small profit or loss for a very long time, I too wanted to be able to close if the market ranges for a certain period after my initial signal, just close these off as the trend identified didn't continue it stopped, would be very useful to have more flexibility with stop losses, exactly as above, where it starts large to accommodate a bit of fluctuation, then closes in over time, ultimately just closing the trade after a certain number of bars if trend didn't continue