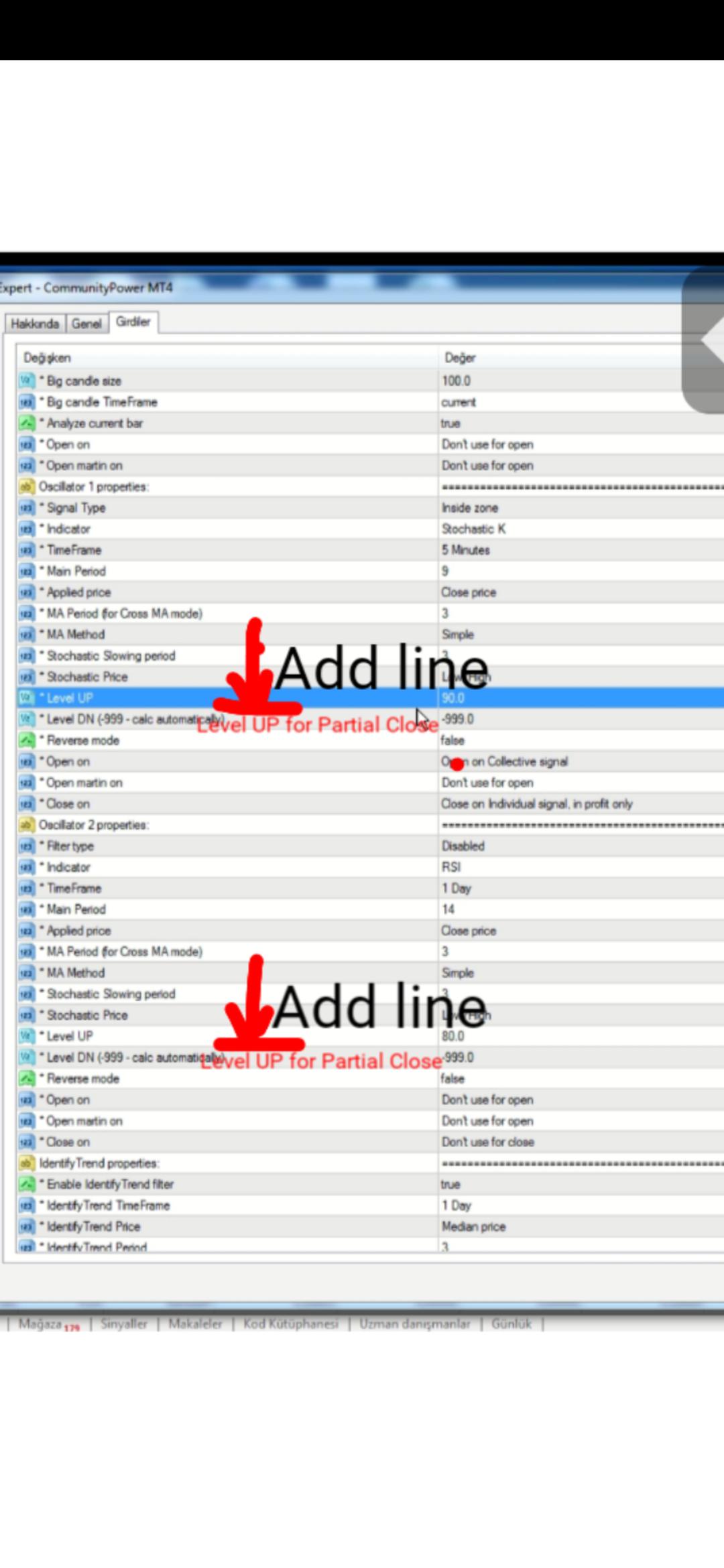

"Close partially with profit" + "Only after deal N" + "New martingale deals only on signal"

A martingale focused in lowering floating losses

A strategy in which if the martingale is over "x" number of trades open (or "x" floating loss) it starts to close the martingale partially everytime the signal changes to the opposite direction.

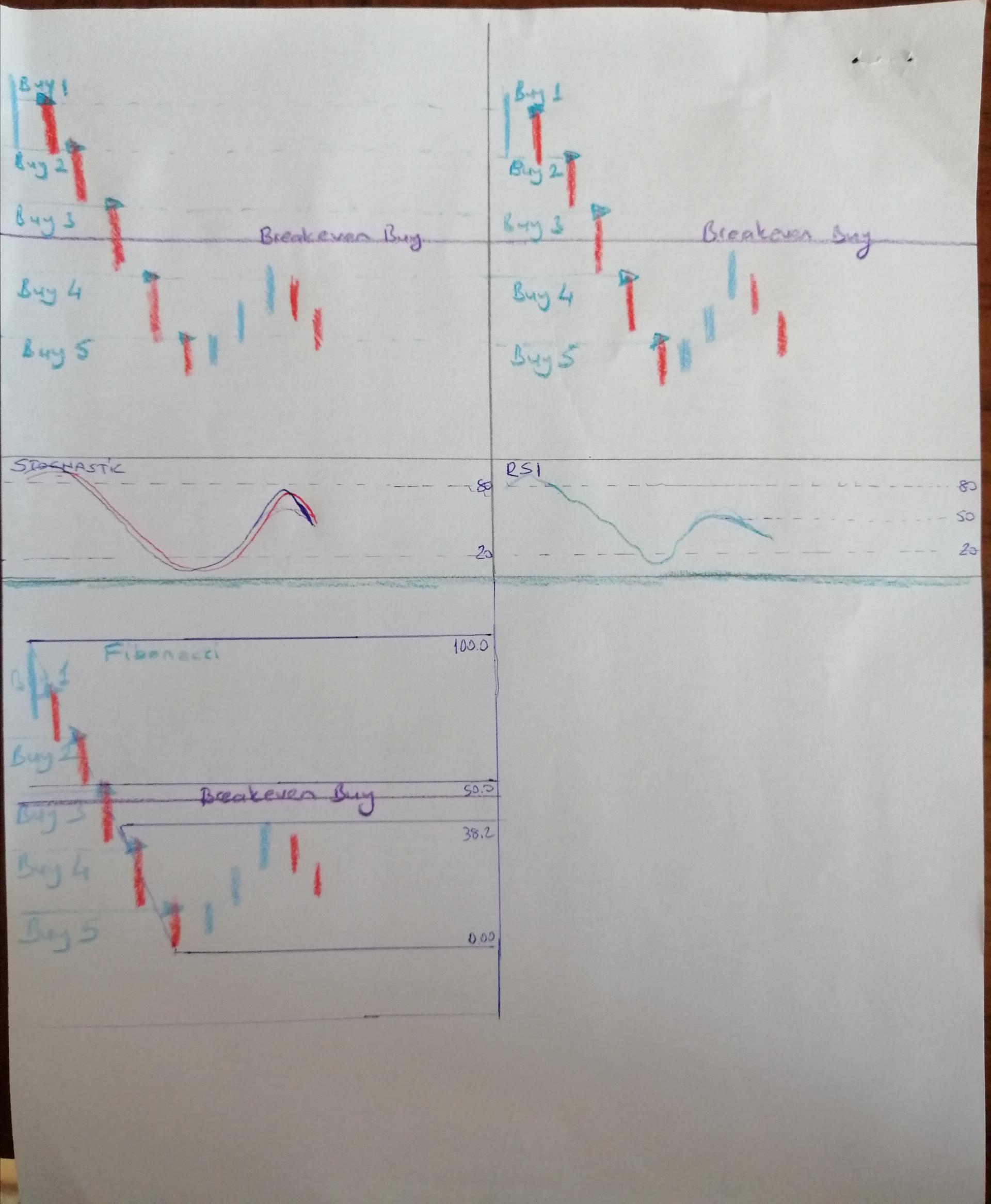

To exemplify: imagine that the 6th trade of a martingale becomes positive, and we already have a big floating loss, and the positive of the 6th trade isn't enough to close the prior 5 trades, but is enough to close the negative of the 5th, 4th and 3rd trades, so we would close the 6th, 5th, 4th and 3rd trades and let the 1st and 2nd open (and the martingale could even continue again). This way we would, hopefully, reduce the maximum potential DD

But there is a disadvantage. If the trend is strong, the oscillator condition may not be met. Existing levels can be high. I made sample drawings. The stochastic may return without touching the 80 level. The RSI may not rise to the 80 level or it may return from the 50 level. Fibonacci can make its first correction at the 38.2 level (or 23.6).