GA Take Profit $ per 0.01 (net of lots)

Hi everyone. I will first present my strategy and facts so at the end of the post I suggest a new feature for CP EA.

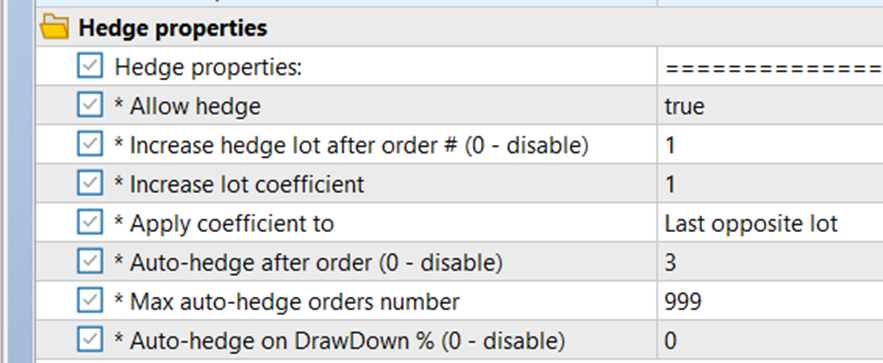

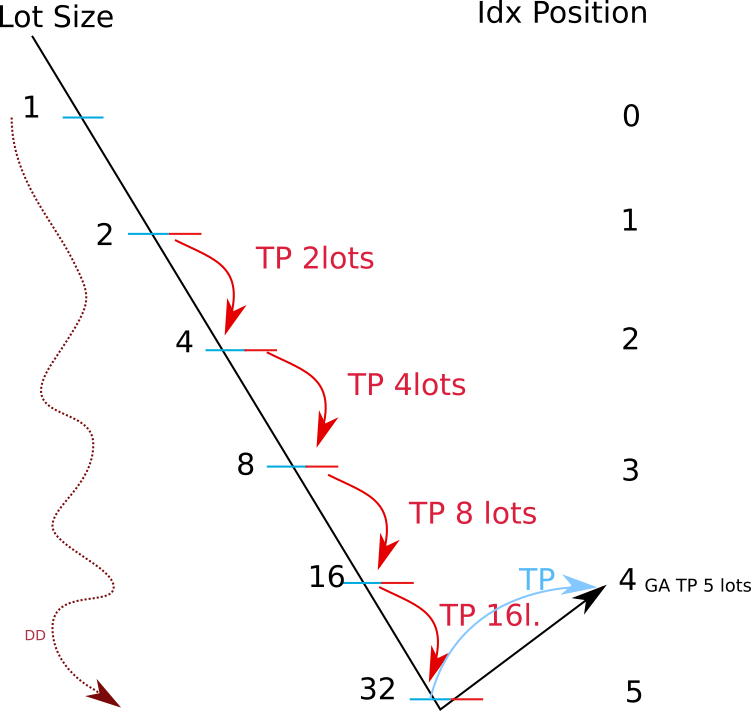

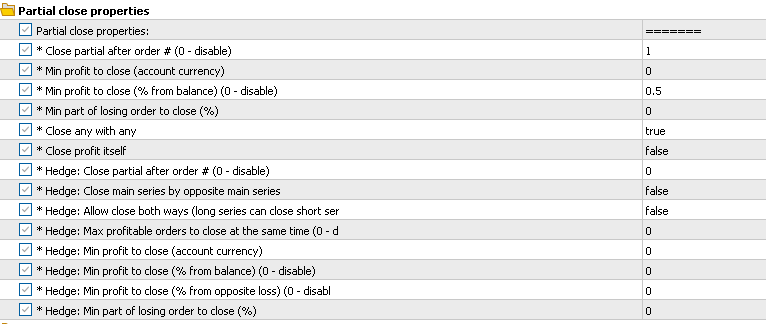

I currently use a hybrid (automatized and manual) defensive strategy for trades that goes in opposite direction of my entry. I use the EA to open any type of trade using the EA indicators and after the “n” martingale (generally 3rd – 5th), every new position will have a hedge at the same price, that I manually manage to stop with some gain. I do this by setting the hedge section as follows:

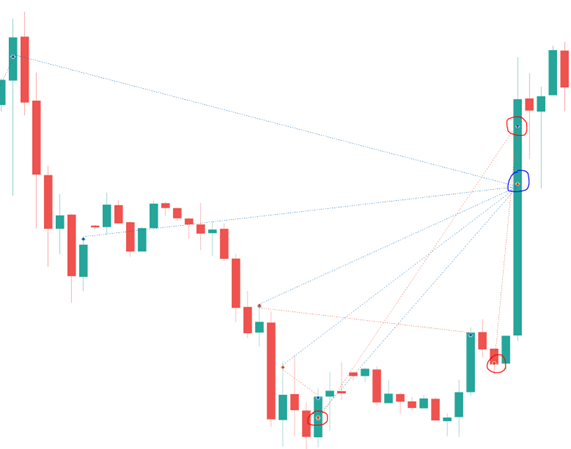

My first attempt on demo account indicated that I needed to set a take profit based on currency rather than points, otherwise spread would kill me. See picture below for the trade I made where buy (blue circle) and sell (red circles) positions were set to close at the same price, however spread killed me.

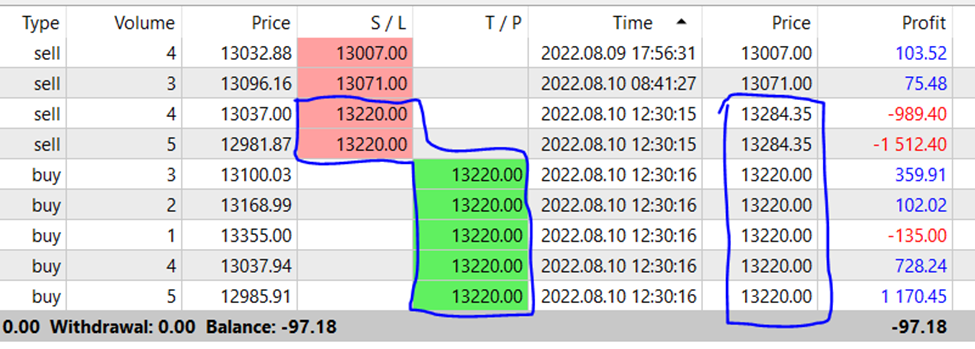

See below the same trade on MT5 history tab where spread affected the final $ result significantly, remember that the stop loss of the sell positions were all set at the same price.

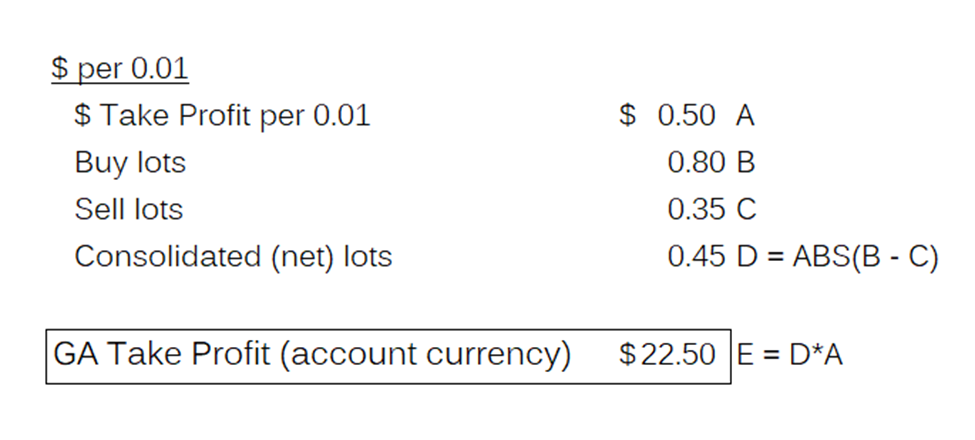

So, currently on my live account, I am running a zero spread live account, but even with that, there are small differences on bid/ask for opposite positions. This led me to manually set the GA Take Profit (account currency) parameter to net “x times” $ per every 0.01. I mean if my original Take Profit on my system is “x” points, I turn Take Profit parameter to zero and translate that to $ by 0.01 and multiple by consolidated buy and sell positions I have opened, every time that my consolidated positions volume change. Ultimately, this methodology gets around very well the spread issue when closing buy and sell position at the same time. See table below for example.

My suggestion on this is to implement a new parameter field to CP to close by Consolidated $ Currency by 0.01 on the Global Account section that will close all positions when such floating value is reached. This new parameter could be “GA Take Profit $ per 0.01 (net of lots) (0 - disable)” right after the “GA Take Profit (account currency) (0 - disable)”

Hi Tarso, this would be very interesting, and help to develop strategies using the hedge function on CP!