Fibonacci retracement filter

I was thinking about a new strategy to implement in CP.Maybe also someone can give some advices on how to improve it.

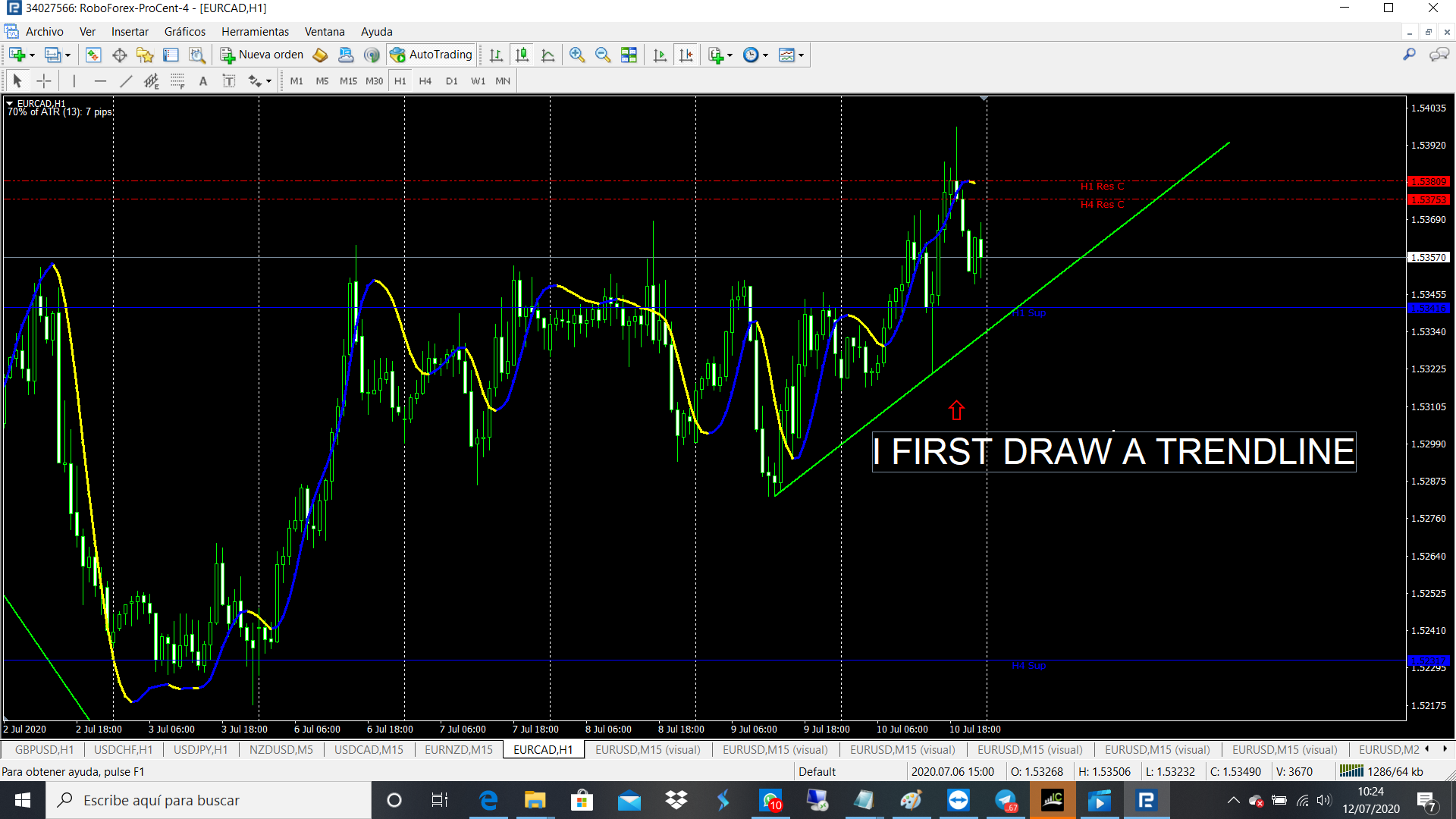

So the strategy works like this. We will draw a trend line on higher time frame like h1.

Then we will go to lower timeframe like M5 and we will try to best catch retracements.

To best catch retracements we will use fibonacci retracements. I will post a picture so it will be more clear for everybody.

Another confirmation of entry that i use when i trade, is volume. When Price approaching Fibonacci line, and there is decreasing volume, is Good confirmation.

PS: I still need to try this strategy and find best way to use it.

I renamed "Opposite direction" to "On trend reversal". Will be available in 2.25.6.