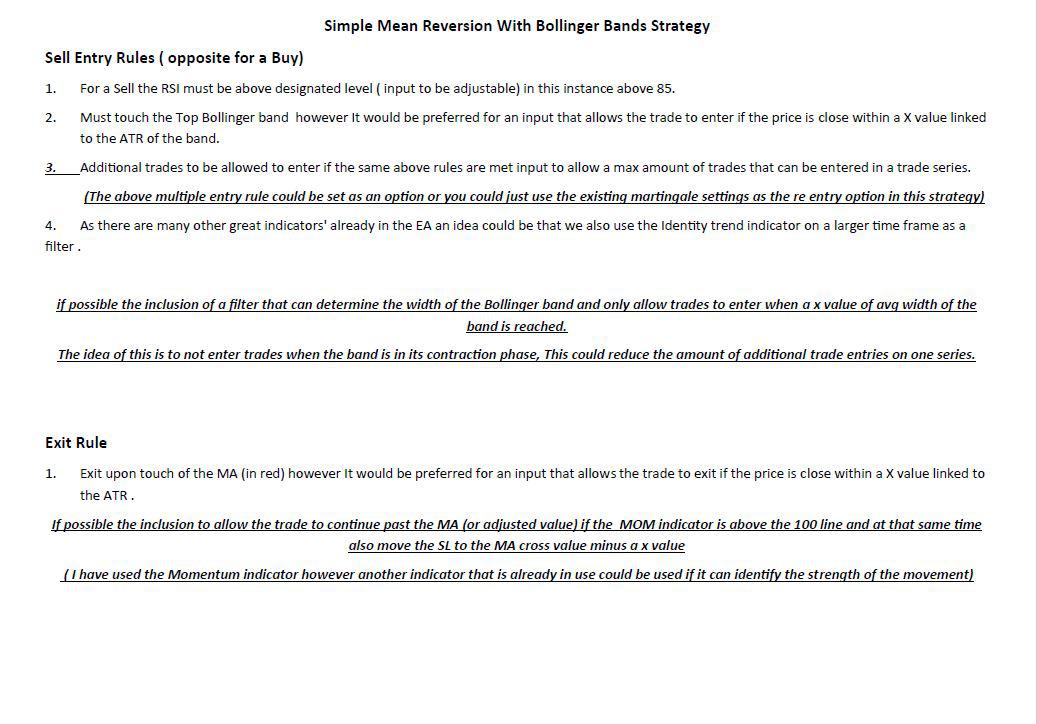

Simple Mean Reversion With Bollinger Bands Strategy

simple mean reversion strategy.pdf

its not as sophisticated and not in the same league as some of the strategies i have seen on the forum but its a simple one that works...

the only issue is that i normally trade this manually and i know i have human bias at play when trading it live, hopefully it can work if this is taken out.

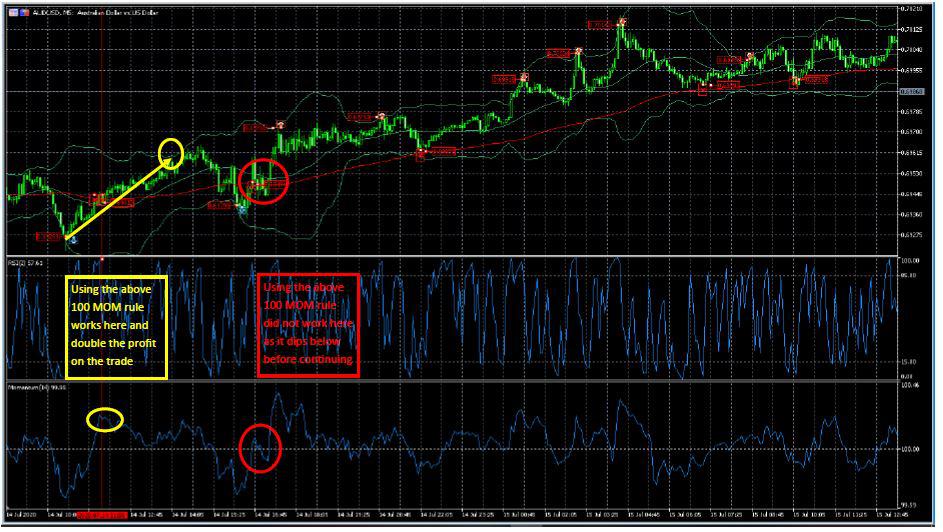

the chart i have used for display purposes if the M5 but it can be applied to all time frames.

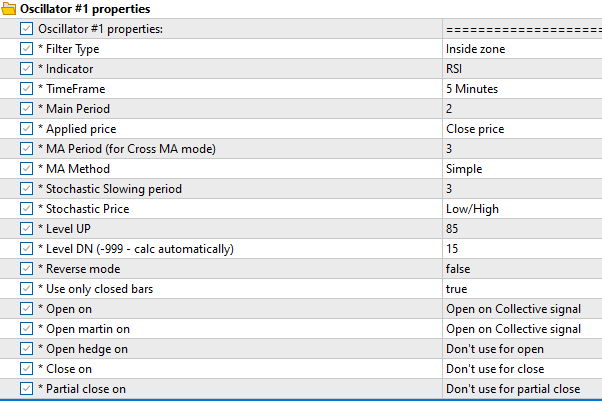

RSI filter already implemented.

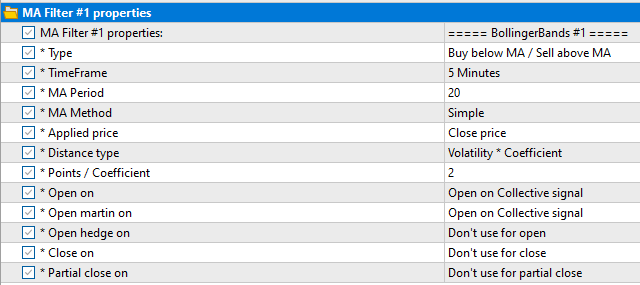

BollingerBands - is a channel built from MA with distance calculated as StDev*Coeff. We already have MA filters, so all we need - is to enable calculate distance as Coeff*StDev. It will be more universal then BB filter.

Also we need to allow close by MA cross.

The only thing I can't understand - is how MOM should be used. Please, clarify this point.

Thanks.