Follow main Trend and Use price action continuation/reversal patterns to enter on lower timeframe

Hello Guys,

I think to improve the ea at the best, we need improve the entry strategy because , i like stochastic, but i think we can find better of just stochastic oversold or overbought, because i think is not enough precise sometimes. That's why we struggle also to find a set using only stop loss and not martingale.

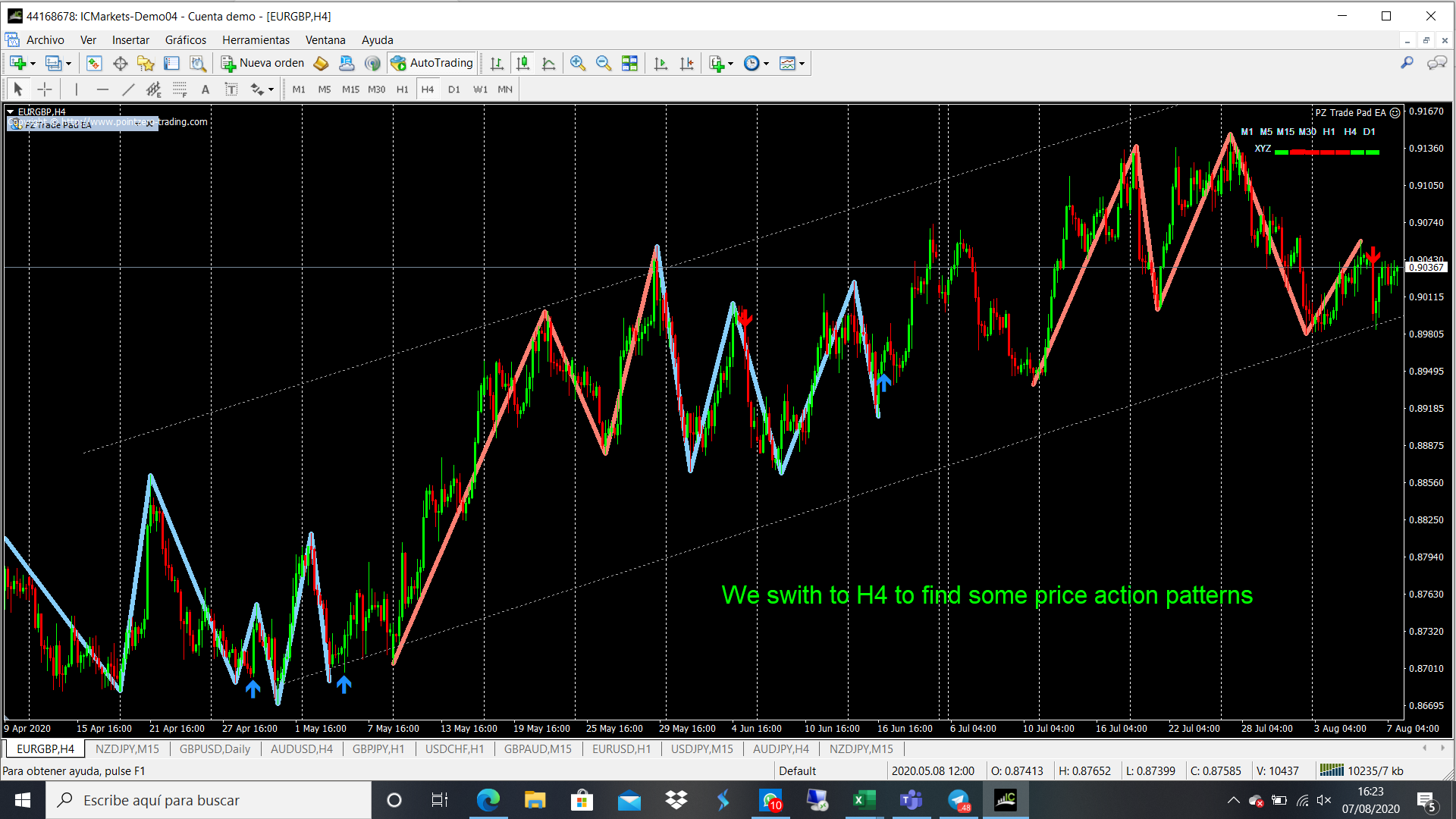

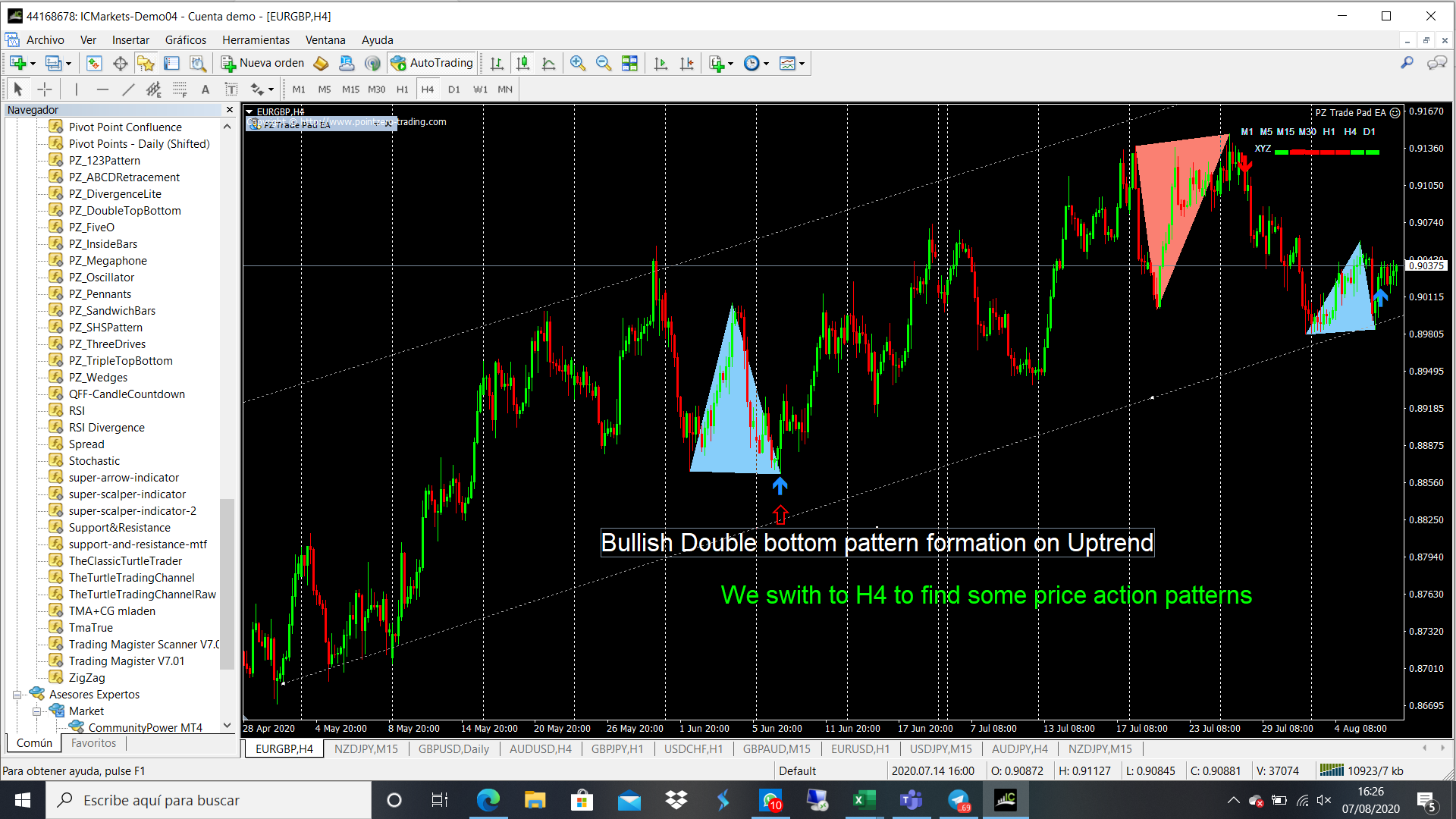

So what i thought and i am actually doing manually, is go analyze the main trend and find some price action patterns on lower timeframe.

We are gonna search for price action patterns breakout on lower timeframe because it will give more entry opportunities.

So I have indicator that spot this type of price action pattern;

- Head ans shoulder

-Wedges

-Pennants

-Double top/bottom

-Triple top/bottom

Little parenthesy: with this type of strategy (trend following strategy) the best would be to use only continuation patterns: in my indicator we have wedges and pennants, but there is much more for example rectangles, triangles, channels, flags.. The problem is that i dont have indicator for this patternsso for this strategy we are also gonna use reversal patterns such as Head and shoulder, double/triple top /bottom. I think reversal patterns will have a lower win rate comparedto continuation patterns but can also work pretty good.In the comment I will post now examples.

I agree with giulio. The stochastic is coded perfectly already and gets a great signal. But you could probably do what you want with the following optimisation strategy. I had a horrible situation where last week, first 2 days killed commodities on IC markets making 1.2k on a demo deposit with settings I am testing live. But on Thursday, everything went into freefall! and since I have naively optimised my settings without any attention to trend following, the stochastic would open a buy order, and everything would just keep falling. Needless to say it was awful. Lost 1.2k in literally 2 hrs. Thank god it wasn't real money. I only have myself to blame for not tuning and backtesting the trends.

So i had to completely change every set to avoid this. I would try the following approach.

1. Turn all filters and oscillators off or disabled or false. Then leave 1 oscillator on. Optimise it between 1M to like 30M. Ensuring that you maybe use close on "collective signal"

2. Either using the identify trend or macd, optimise them, limiting the time frame between 1H to 4H and using the close on setting as collective signal.

You can speed this up a little. I normally use a timeframe of maybe a month, using fast generic algorithms. You could take the following approach of turning everything off, then enable only 1 oscillator and 1 trend filter together over all periods of time and see what works. Just be prepared to leave on your computer for a few hours if you want to back test for a year and with your morning coffee, you will find a great

By just changing 1 oscillator and trend filter at a time, you can quickly set up the strategy to be the most effective. Then I would suggest you then optimise the pending enter settings 1 at a time. Then it's just the final step of setting a stoploss and trailing stop loss etc.