I have a strategy but no coding knowledge

indicators needed are

1. Moving Average Period 12, Method (Linear weighted), Apply to (Close)

2. Moving Average Period 40, Method (Linear weighted), Apply to (High)

3. Moving Average Period 40, Method (Linear weighted), Apply to (Low)

4. Commodity channel Index(CCI), Period 50, Apply to (close) Levels: (0)

5. Commodity channel Index(CCI), Period 20, Apply to (close) Levels: (100, -100, 200, -200)

6. Relative Strength Index(RSI), Period 7, Apply to (weighted Close(HLCC/4), Levels: 30, 70

7. Stochastic Oscillator %K (100), %D (100), Slowing (5), Price field (Close/Close), Method (Exponential), Levels: 20, 80

conditions for buy

1. Linear weighted Moving Average 12 closed above Linear weighted Moving average 40 Low and Linear weighted Moving average 40 High

2. RSI value must be above 70.00

3. CCI (Period 50) value must be above 0.00

4. CCI (Period 20) value must be above 100.00

5 The stochastic oscillator main line value greater than signal value

6. Buy at the closure of the candle that meet up with the 1 to 5 conditions above

7. Stop loss below the low of bull candle that meet up with the 1 to 5

8. Exit trade when RSI < 70.00, CCI (20) < 0.00, Bearish Candle formed below Moving Average 12

Condition for Sell

Will be opposite of the buying conditions

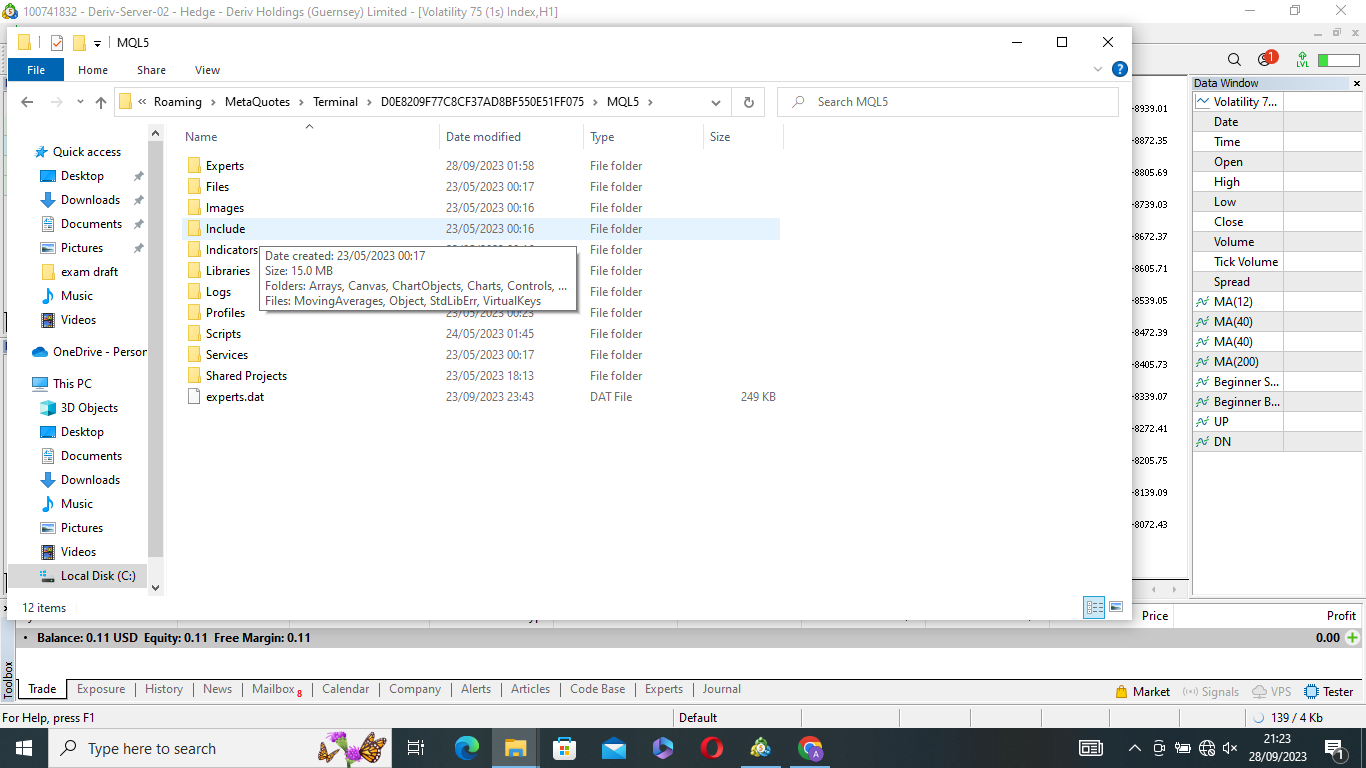

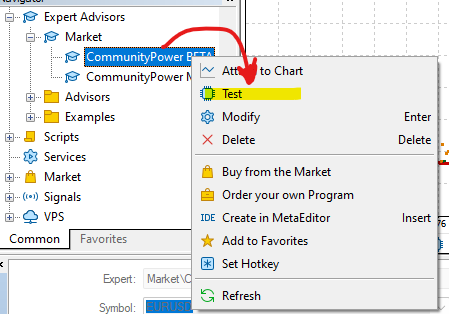

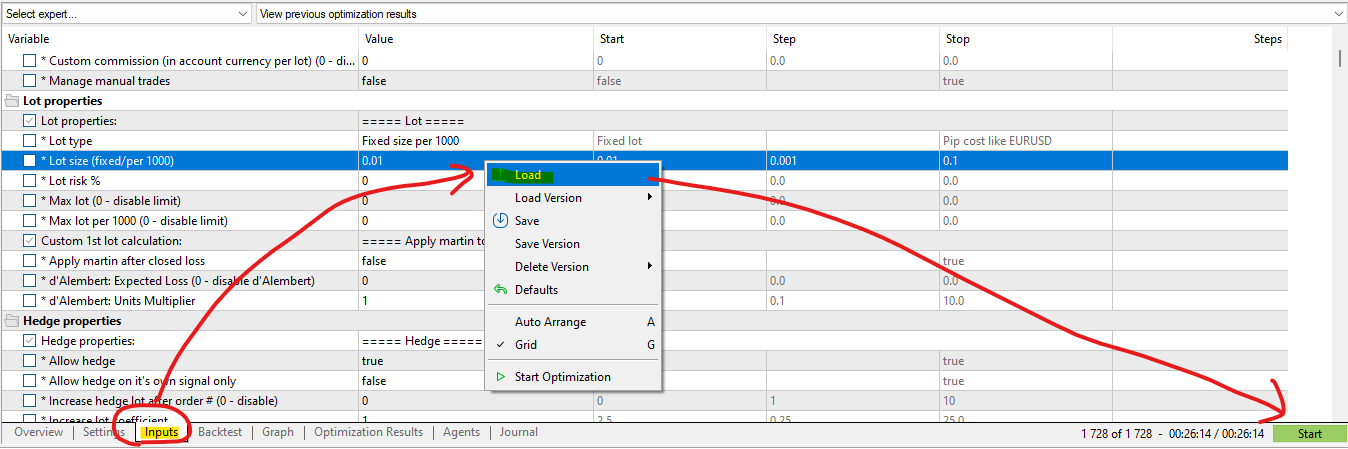

Here you have a version that you can start with, but I tell you that I don't think you can do everything you indicate. You have many indicators and there are conditions that cannot be met. It is best that you create a CustomIndy and use it in CP.

Test_v2.55.2.set