Risk management with only starting lot

Hello friends, I would like to propose a new idea for risk management in CP. As we all know, the initial amount has a strong influence on the subsequent behaviour of the opening of subsequent lots in martingale.

We already have two options to manage the maximum lot opening (max lot and max lot/1000) but I have noticed that working only on the opening lots (and leaving unchanged the maximums that can be reached later with the martingale) would result in a more effective risk management:

Let me explain better: if I now select as opening lot 0.01/1000 I will open with 1000USD 0.01 lots, with 10000USD 0.1 lots.

What I would like is for example to start with 1000USD with 0.03/1000 lots (and would open 0.3 with 10000USD) and move on from 5000USD with 0.01/1000 opening lot.

You can do something like this by now setting 0.03 lots "fixed" but it is not the same. Because it is true that you go to reduce the risk but, above a certain amount, they would be too few to increase exponentially.

I therefore intend a non-"fixed" starting option but one that can be scaled up (even once) once X amount of USD has been reached. So start with 0.03 lots (accepting a higher risk in the initial stages to gain as much as possible in less time) and then "lower the risk" by setting 0.02 or 0.01 lots (NOT fixed).

I have tested this setup on several sets in my possession and, where before they would have burnt the account with 0.03/1000, reached a certain amount and set a lower value, the account continued with large gains and very low risk and drawdown.

I hope this is feasible and that I have explained myself well

More precise numbers to clarify what I'm saying:

Example:

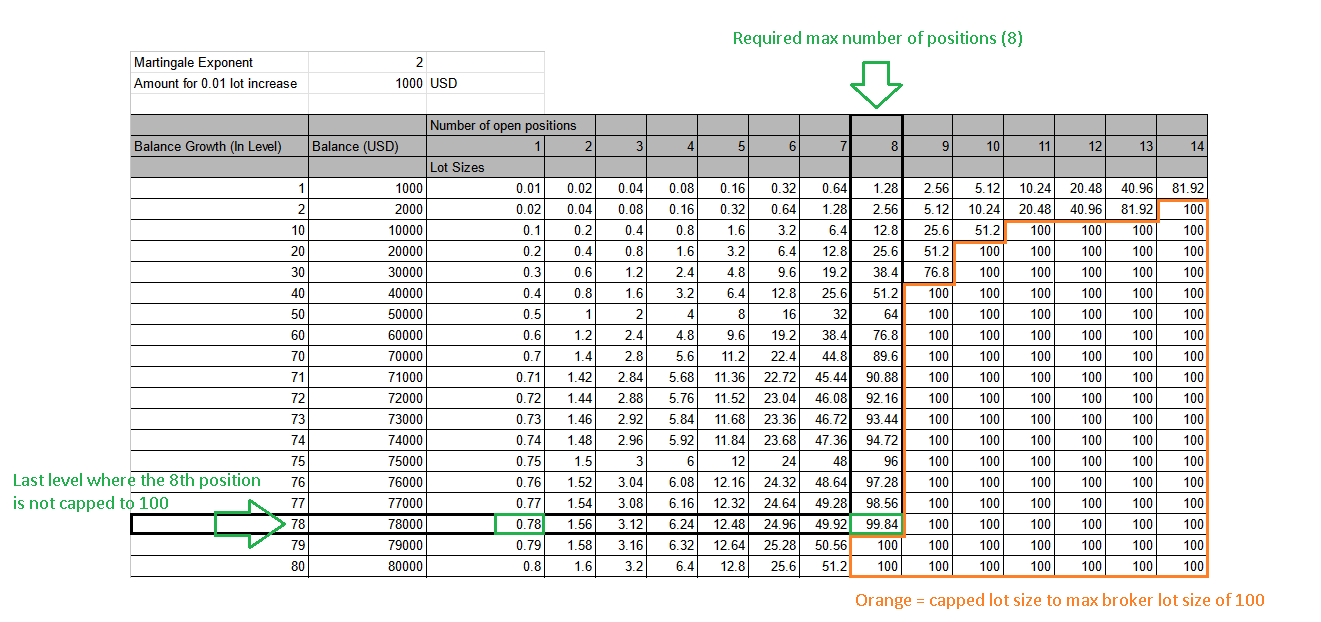

- You have a strategy that uses a martingale with a Lot Exponent of 2

- You know that your strategy requires to increase lots size by 0.01 every $1000

- You know that to survive your backtest, the martingale will have to open as much as 8 positions in total, with the correct Lot Exponent of 2 between each positions

- You know that your broker is using min lot 0.01 and max lot 100

Based on my calculations, for a Lot Exponent of 2, and increasing the lot size by 0.01 every $1000, as soon as it's reaching a initial lot size of 0.78 (when the balance is $78k), then that's the last initial lot size that will allow to have the 8th position below the value 100 (Max Broker size).

In this example, with an initial Lot Size of 0.78, the 8th position will have a lot size of 99.84 Lots, which is pretty much the broker max lot limit.

If we let the initial Lot Size growing to 0.79, the 8th position will have a lot size of 101.2 which is already too much.

By the time the initial Lot Size reach 1.0, the 8th position will have a lot size of 128, which will need to be capped down to 100, and therefore the ratio between the 7th position (64 lot size) and the 8th position Lot size (100) will not be a power of 2 anymore.

In that exemple, we would need to cap the initial lot size to 0.78, because if we continue to increase it, the difference between the 7th position and the 8th position will slowly drop from being 2x to being lower.