Volatility Filter Enhancement

Hi All,

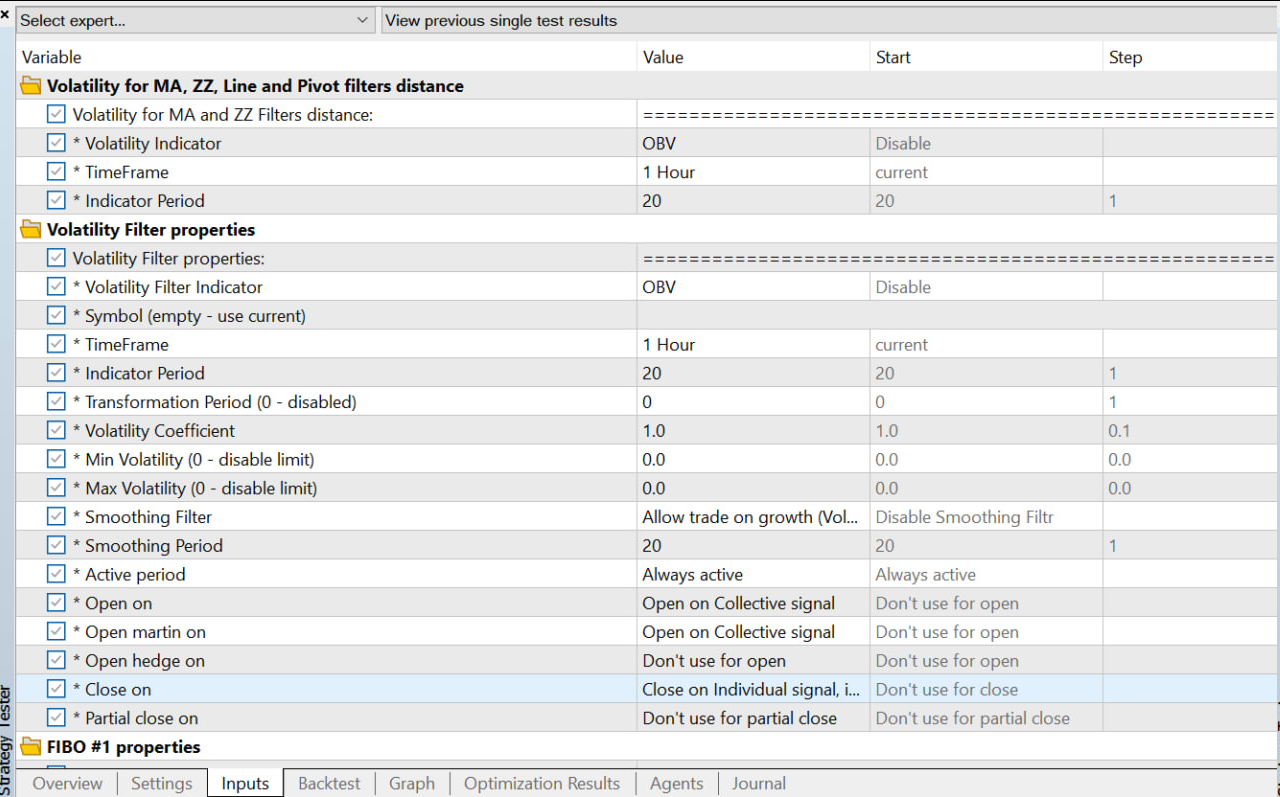

So currently we have the option to filter by volatility upper and lower limits, which is great to target specific market movements.

However, i think that adding another mode can alway help and be a bit more flexible than a point value:

1. Compare 2 volatility indicators periods, and trade based on that. For example, if the X-period ATR is higher than a Y-period ATR, then you get a signal to trade.

2. If the second volatility is equal to a coefficient of another. For example, if 0.5X-period ATR is equal to Y-period ATR.

these are just examples, there can be multiple ways to implement this.

Thanks!

Oh, this feature is available since v2.15 -- https://communitypowerea.com/docs/signals-and-filters#smoothing-filter

But I added another transformation, you can try it with 2.58.1 (will be available soon).

Thanks for this! Ill try it out