Set for US500 M5 Buy Only

I have been working on a project to work with indexes, started with US500, but my goal is to cover:

- Asia / Oceania (HK50, JP225, AUS200)

- Europe (FR40, DE30, STOXX50)

- Americas (US500, USTEC, Bra50)

The name of the strategy is “Accordion”, because it stretches (during downtrend of the indexes) and shorten the number of positions during uptrend. The visual of the positions looks almost like an accordion playing :)

The strategy is basically:

- Using Exness as it allows swap free for indexes

- Buy only / no indicator / M5 timeframe / no stop loss

- Partial close (use all positive orders to close orders from top)

- Re open martingale to keep closing orders from top

- Few parameters to allow flexibilization to apply in almost every index

- Initial lot multiple 10x 0.01 (0.01 / 0.1 / 1.0)

- Add additional instances rather than multiply initial lot for different than 10x multiples for initial lot

- Need to adjust TP, martingale step size and min profit for partial close according to index volatility and contract size

- Lot multiplier 1.1x (this will affect type of set – conservative / moderate / aggressive)

- Partial close after order 2

- Initial lot multiple 10x 0.01 (0.01 / 0.1 / 1.0)

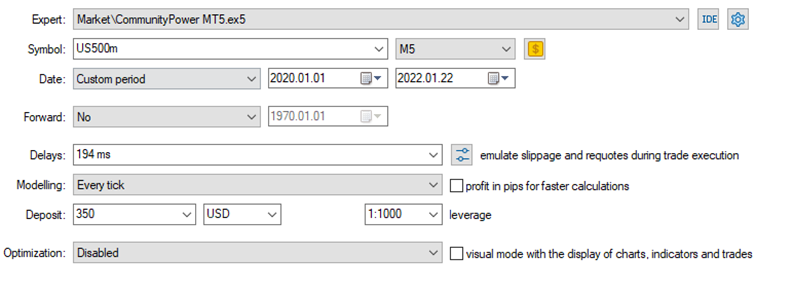

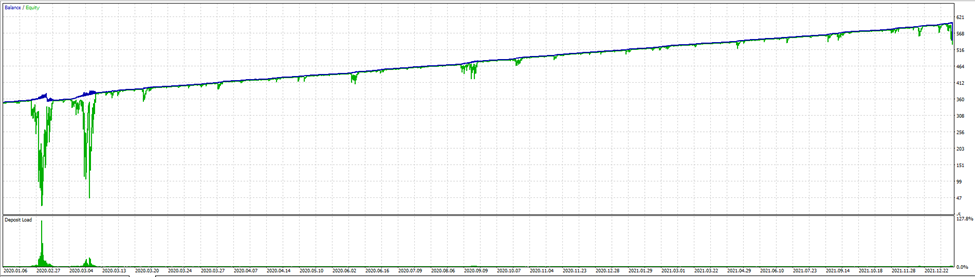

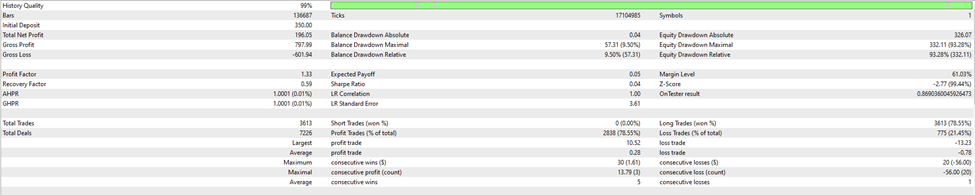

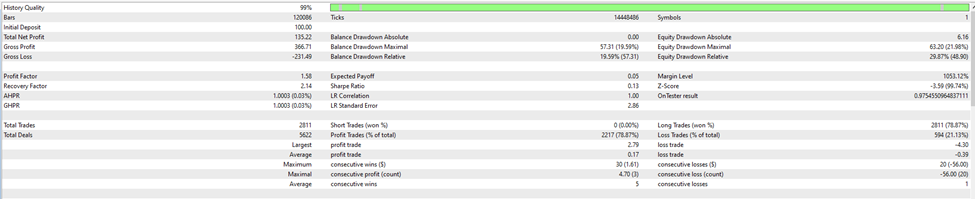

The attached set file was tested 2020-2021 and survive pandemic with $350 capital, but my goal is to develop additional settings to diversify capital exposure:

- Conservative set: 20% per year return – will never blow the account

- Moderate set: 30-50% per year return – may require deposit to survive once in a while

- Aggressive set: 100%+ per year return – may blow the account on crises

- Not getting millionaire but much better than available bonds

Next steps:

- Optimize lot multiplier for different type of sets and volatility / size of the indexes (example in 2018 US500 worth 2500 points - daily volatility was different)

- Develop sets for other indexes

- Test trend filters TDI, MA, etc. for martin filter and also to open sell positions

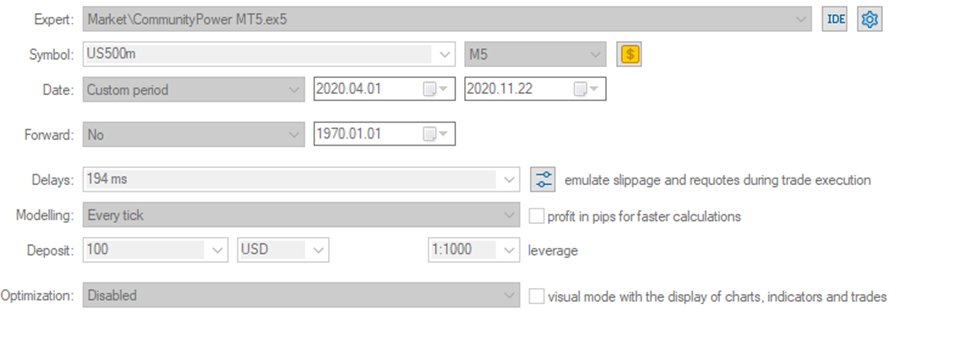

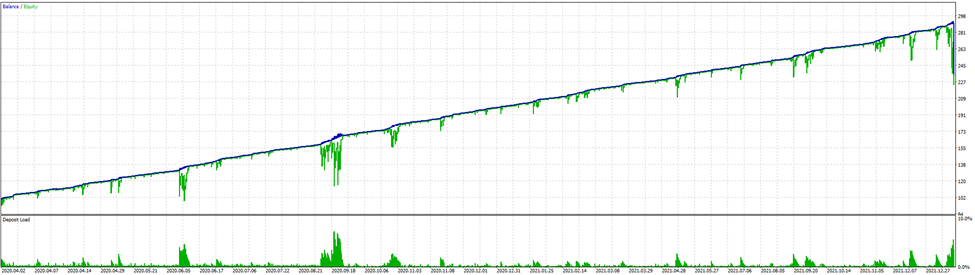

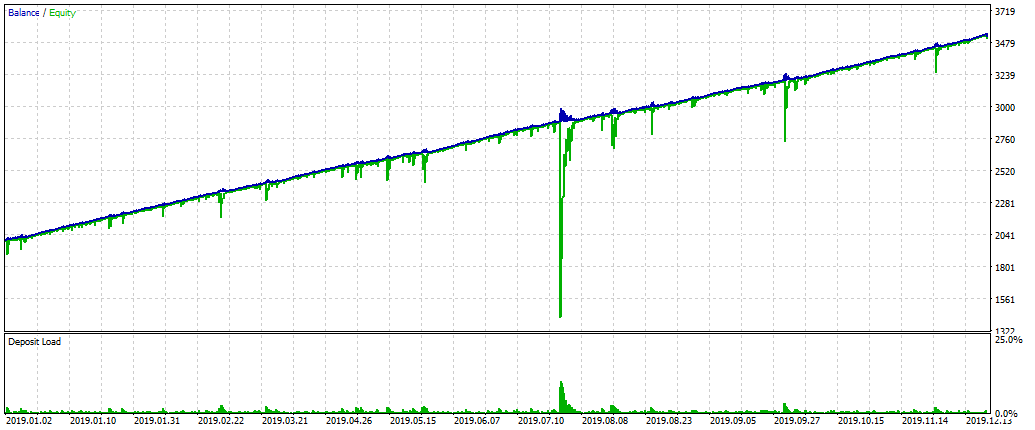

Below are BTs for two starting dates, 1/1/2020 and 4/1/2020 to demonstrate the different potentials of capital exposure management.

Started DEMO 1/23/2022 to verify behavior and impact of spread.

Backtest I - 1/1/2020

Backtest II - 4/1/2020

Started live with the following setfiles and brokers:

communitypower bra50 H1.set -> ActivTrades

communitypower us500 m5.set -> Exness