S&P500 solid Strategy, low DD

Hi Guys, for the last week I´ve been working on a S&P500 set, which had a awesome results on my broker data. Now, where I backtested it with the history of Dukascopy (this one has more bars and ticks, you´ll see it on the backtests results), it performed far worse.

Anyway maybe the history of my broker or dukascopy is worse. Maybe check it with your broker (mine is admiralmarkets).

Suggestions from me: - RSI as a buy block. RSI > 70 no more buy orders.

- from time to time the trailing stop must be suited to the points level of the S&P500, because higher points = more higher counts of points where it can go up and down ( i hope it makes sense what I mean.

Anyway here are the results:

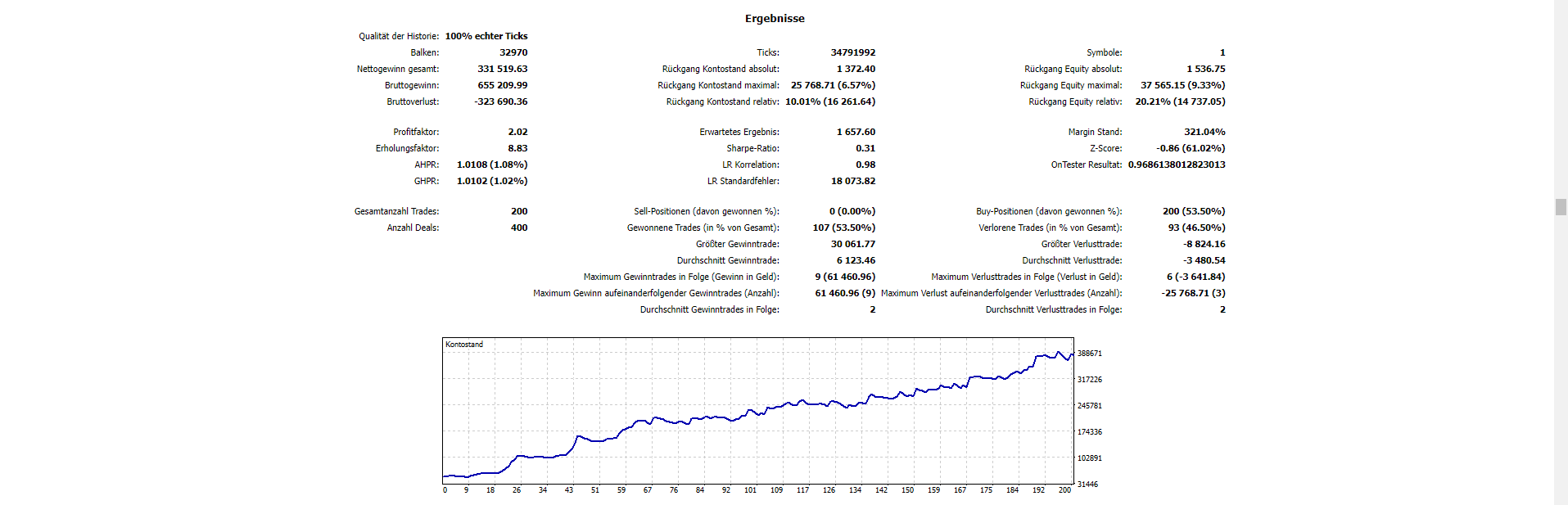

With my broker (Admiralmarkets)

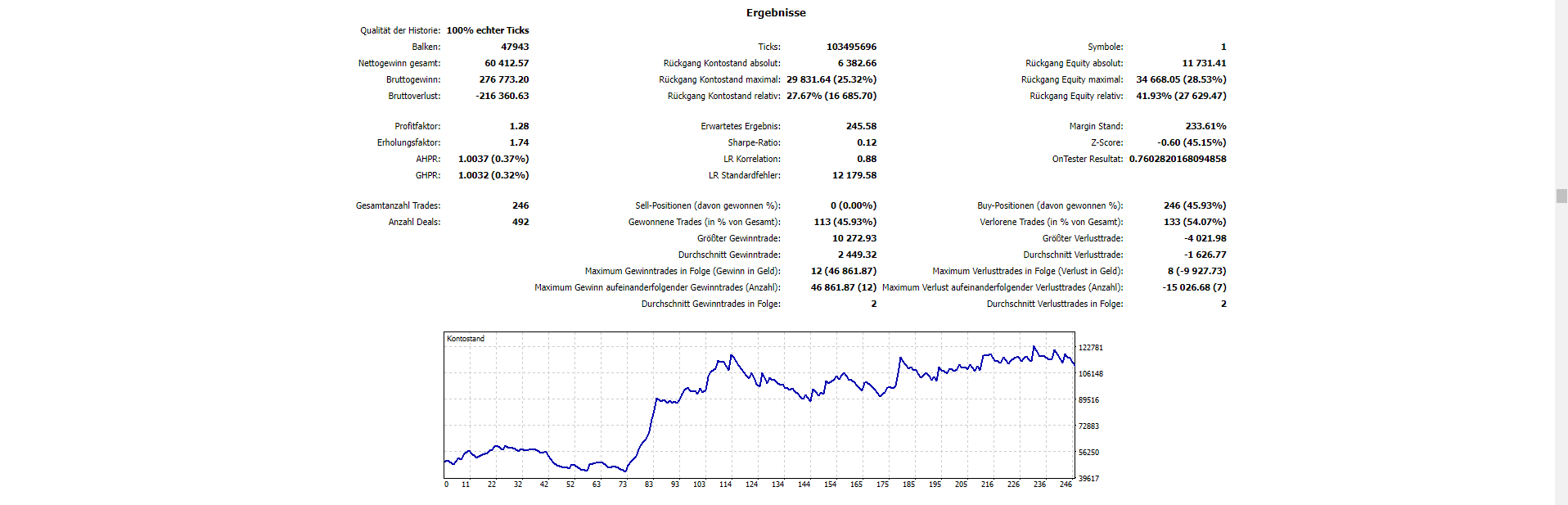

That one is with the dukascopy history.

As you can see the Dukascopy has more Bars ( Balken) and more ticks. Maybe you have suggestions Here is the file.

Thank you.

Your entry signal is excellent. I am studying the following variations:

- Apply Martingale after closed loss = True

- TakeProfit calc mode = Coefficient to Volatility

I am liking the results so far, will share once have something more solid

Thank you, glad to hear that! I´m also kinda afraid of the different outcome of dukascopy and my history. Maybe we find out which one is more valid. I´d say the one from dukascopy because it hase more ticks and bars in it.

Anyway looking foward to your upgrades :)!

Btw if you change the in martingale the lot increasing mode to martin sum: previous lot sum, the profit rises in almost 3x. But yes, the DD is heavy.