Global Indexes

Dear members of this amazing forum.

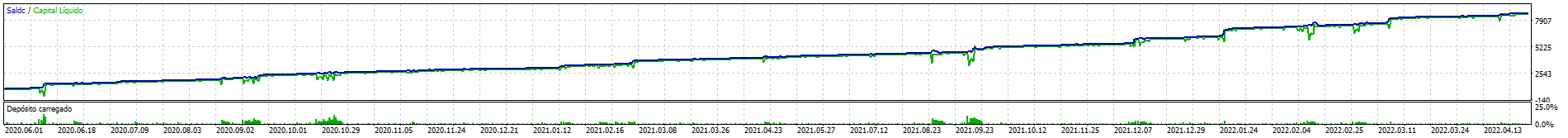

This is continuation of my previous post where I posted a US500 M5 strategy. I was able to work on different instruments and believe best way to share results and my studies are now on this Global Indexes post.

I was able to consolidate the following basic strategy:

- Buy only, no indicator (can use a MA as optional)

- H1, if you would like more emotion you can go to other timeframes

- TP between 0.50% - 0.80% of instrument value

- In my view the current TPs will work as the instruments value are between pre pandemic crash and not much higher than historical high

- Martingale around same value of TP (lower values generates more aggressive strategies)

- Generally speaking, the more aggressive is the martingale (step and multiplier) the higher is the dd but floating isn’t keep for longer periods, the opposite if the martingale is less aggressive (lower dd but floating may take longer periods until take profit)

- Partial close (use all positive orders to close orders from top)

- Keep open martingale to closing orders from top

- Use of a moving average to filter martingale and partial close

- Variations are applied to diversify the strategy (conservative, moderate or aggressive)

- Diversification of capital is also provided by whether considering or not the dd from feb-mar 2020, related to covid-19, on the capital allocation.

Current running live with the following instruments on Exness broker, in 4 different accounts:

- Fr40

- Us500

- UsTec

- Stoxx50

- Bra50 (ActivTrades)

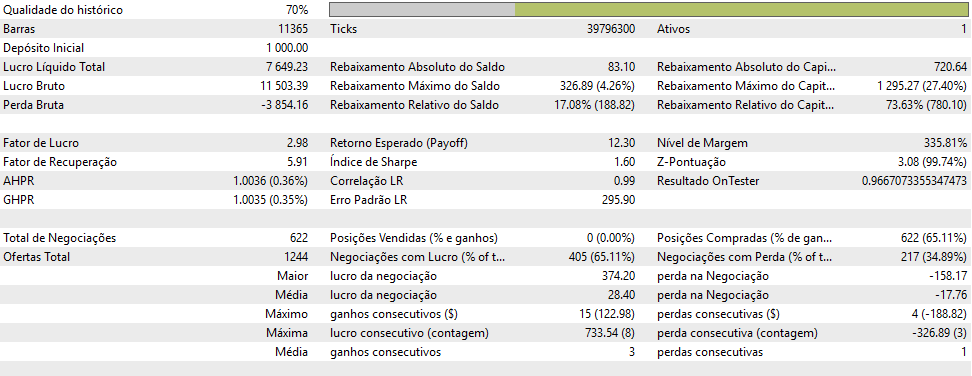

Set files side-by-side comparison and BT results (xls) are attached on the excel file, together with my current capital allocation for each of the strategies.

Tarso Mastella - Global Indexes.xlsx

Following individual posts contain the set files, balance/equity graph and bt results for the different versions.

Thanks Andrey for this amazing EA, I will keep studying it and sharing results, hope and can start contributing as a patron soon.

My signals running the strategies:

https://www.mql5.com/pt/signals/1375023

https://www.mql5.com/pt/signals/1389908

https://www.mql5.com/pt/signals/1433631

How would you rate the customer service you received?

Satisfaction mark by Tarso Mastella 3 years ago

Add a comment about quality of support you received (optional):

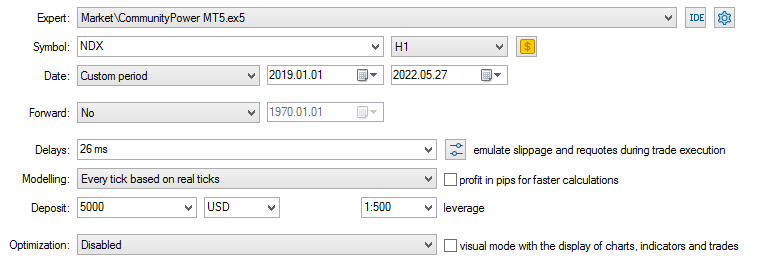

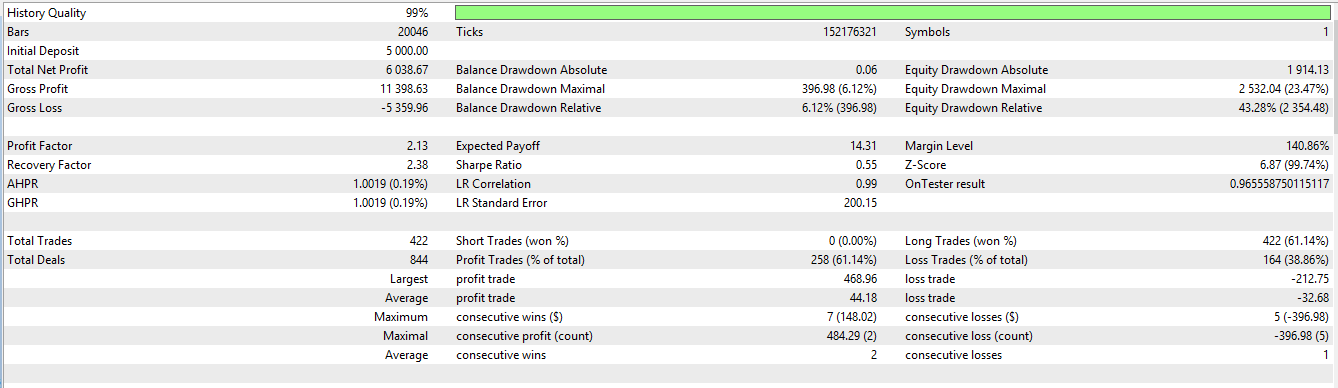

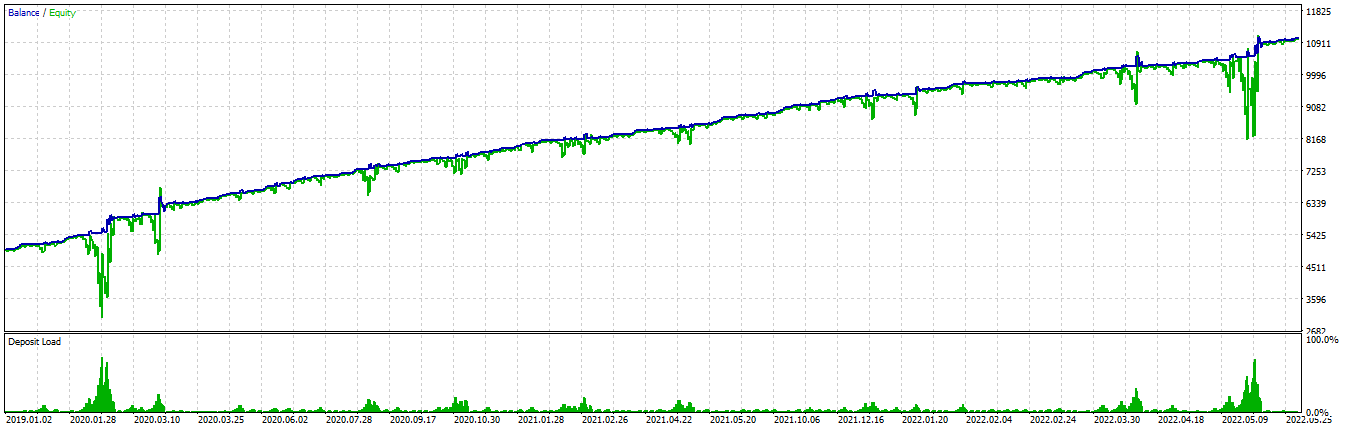

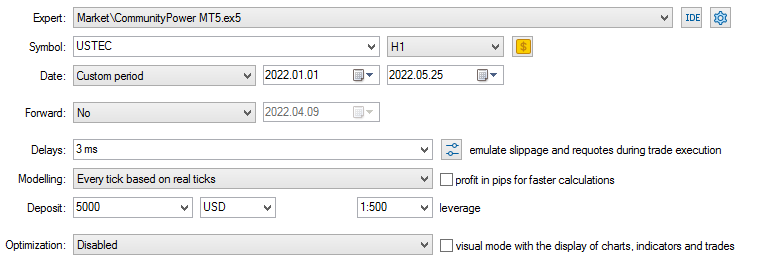

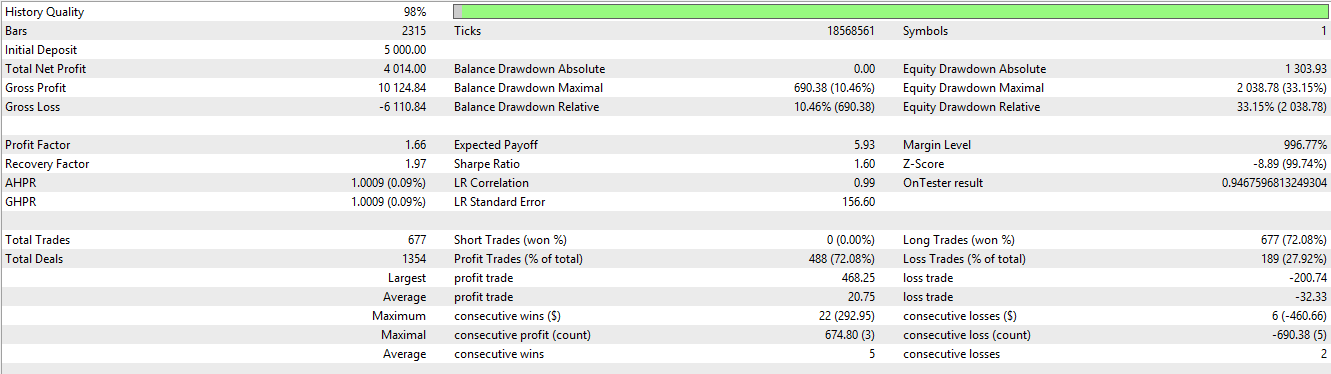

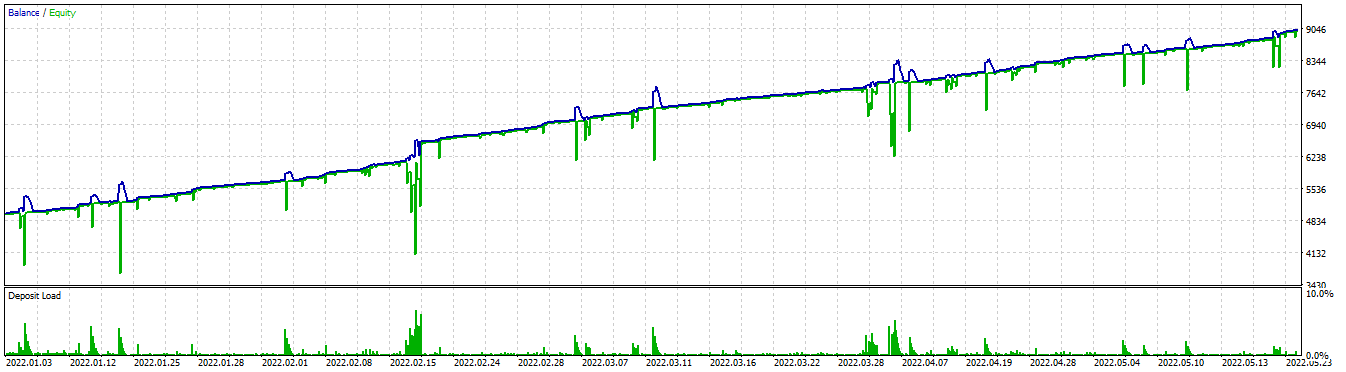

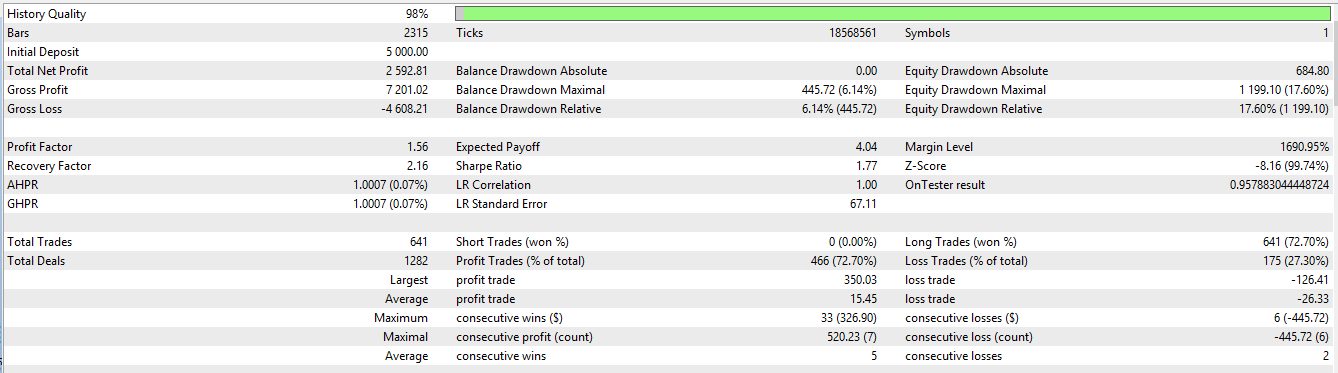

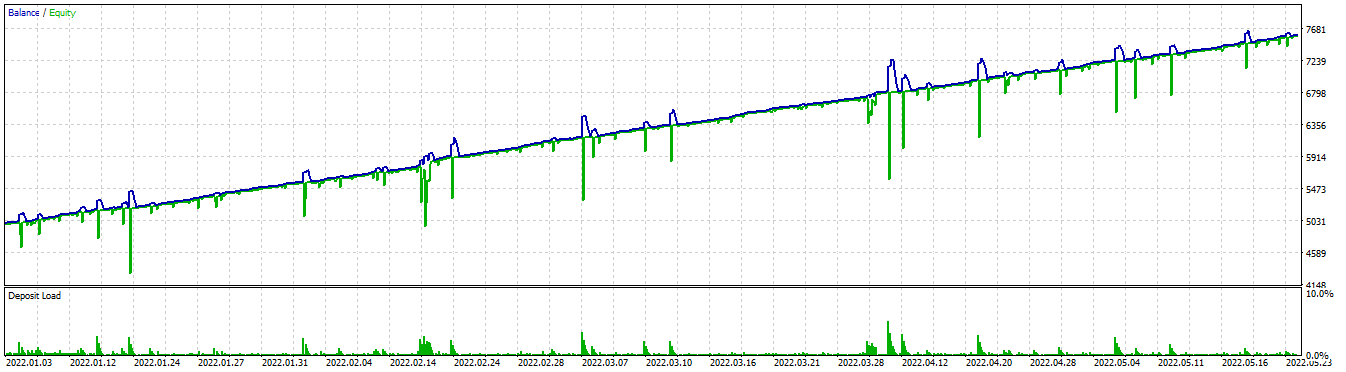

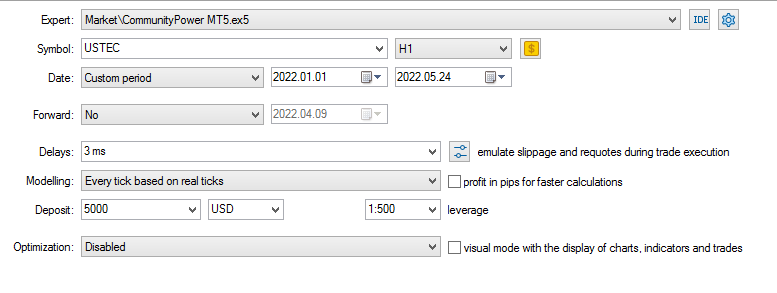

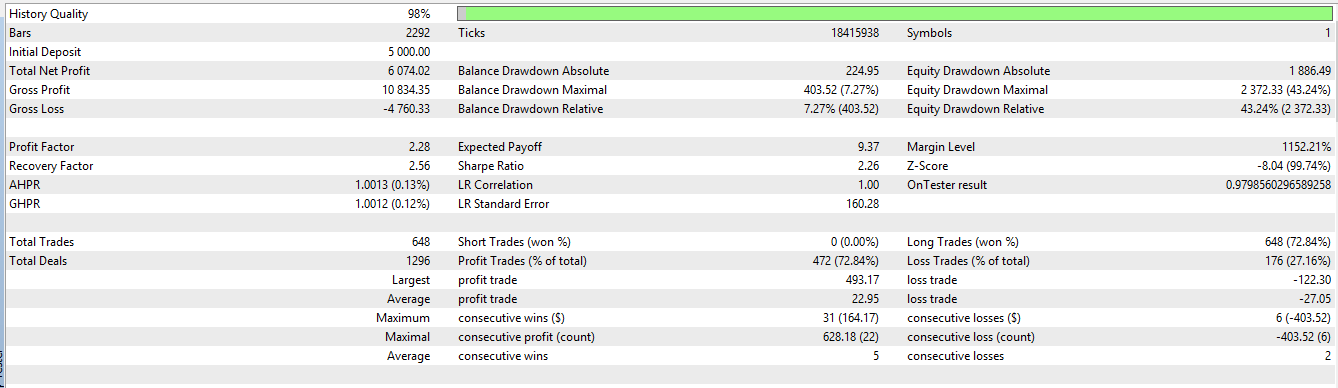

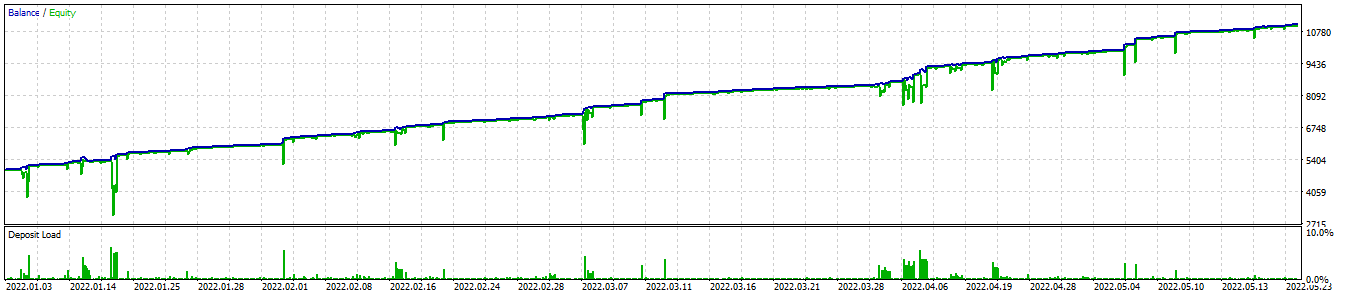

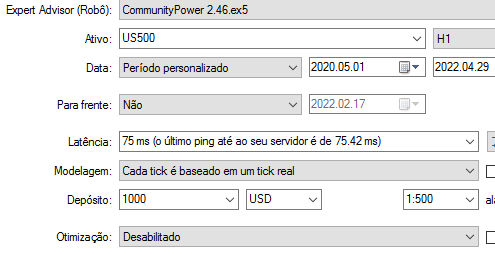

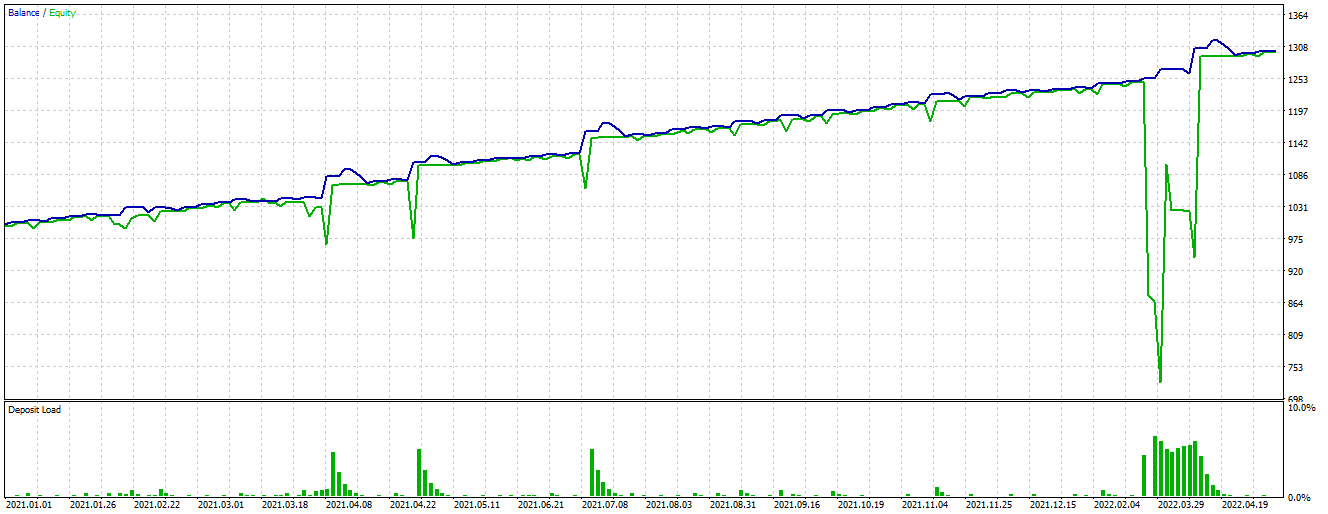

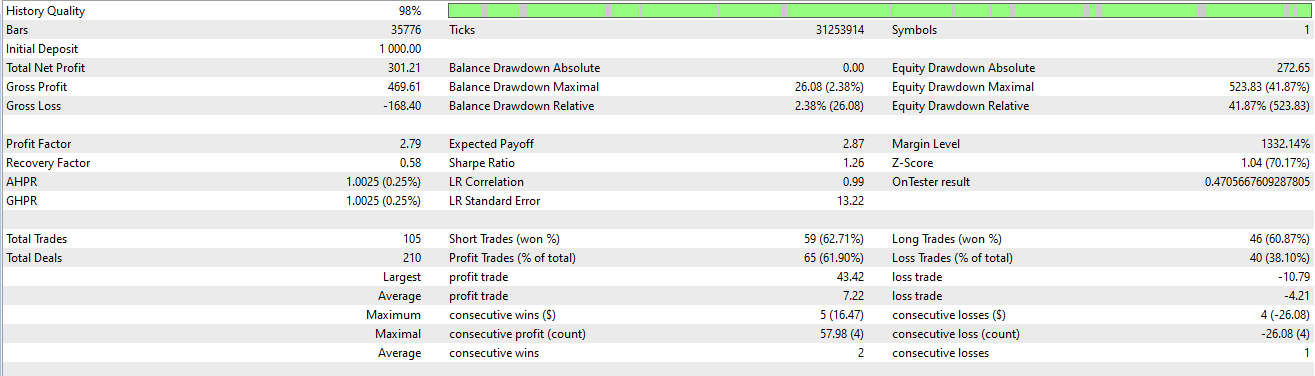

Ustec v6

Darwinex broker 2019 ---> 27-5-2022

Thanks for sharing. I got similar results on BT on FP Markets and Tickmill.

I am running live this v6 since 2022.03.23, max dd was around $ 1,200 and total profit to date is $1,117. I really believe if I have a risk free capital (from market gains) around $ 3,000 I will let this v6 run until it survives all dd or blow the account. By the way, I am calling this v6 the aggressive one. I already have a moderate and conservative versions of Nasdaq, hope I have time to prepare some summaries and share the setfles here for everyone.