GBPUSD Nemeths Multi Trend Conditions

So after watching the first half of this video

I decided to give it a chance to design the idea in CP.

It is a combination of CCI + MACD + IdentifyTrend + Above/Below MA + Martingale + narrow TP

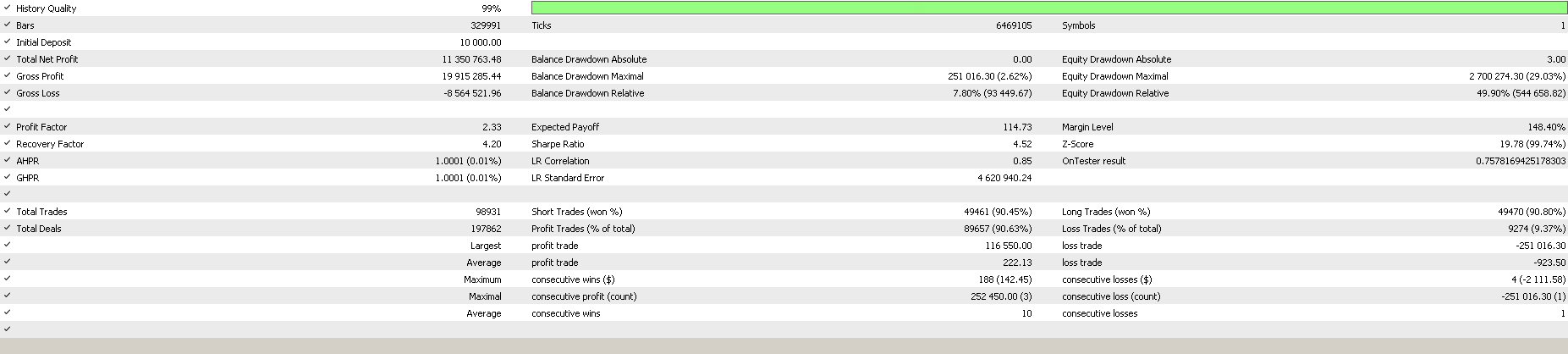

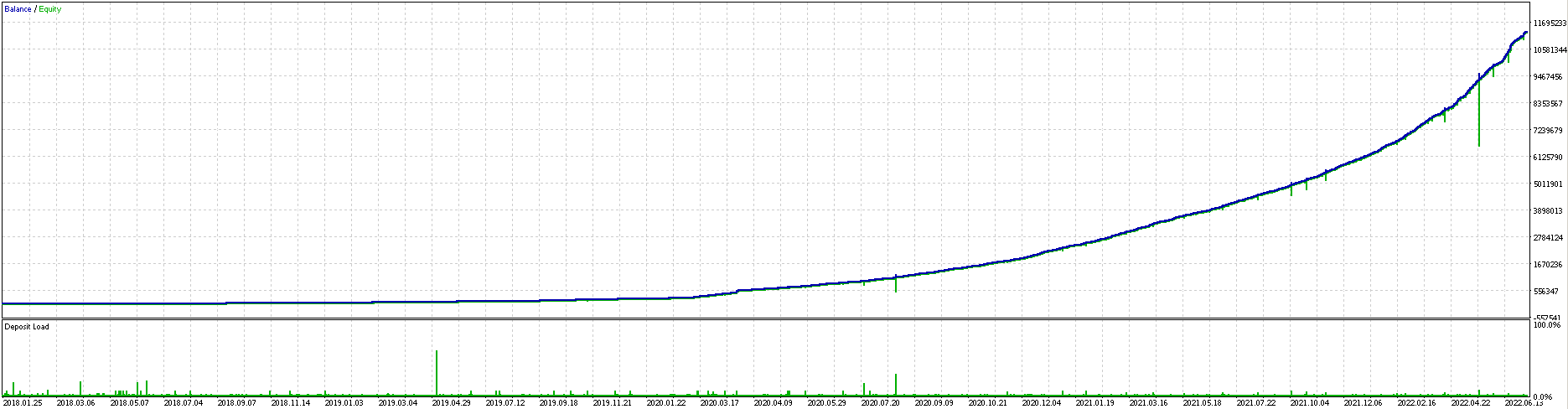

After running the optimization on 2021 and 2022 (using OHCL) the results seemed too good to be true.

After checking it in more detail they still are but its not the holy grail after all :)

It generalizes well on other years (note: the training range was 2022 January until June) and opens like 20-40 positions per day.

By sharing this set file here, I hope someone can come up with a hedge idea like explained in Nemeths Video at 38:09

https://youtu.be/DJz4E7VyeSw?t=2289

If the trend on a higher time frame reverts, open a hedge (factor 1.4) and keep it open until everything is in break even or close it when the trend reverts again.If the hedge did not clean up everything in BE, then continue martingale of the original process.

I know it won't be possible to model this 1:1 in CP, but maybe you can build something similar performing hedging after the hard and crazy in this set martingale opens 4 positions.

By the way, I tested it for a week now on real-time demo account.It didnt kill the account but without the hedging idea above, I would only use it on no-news days (and boring days like Mondays and Friday afternoon CET).

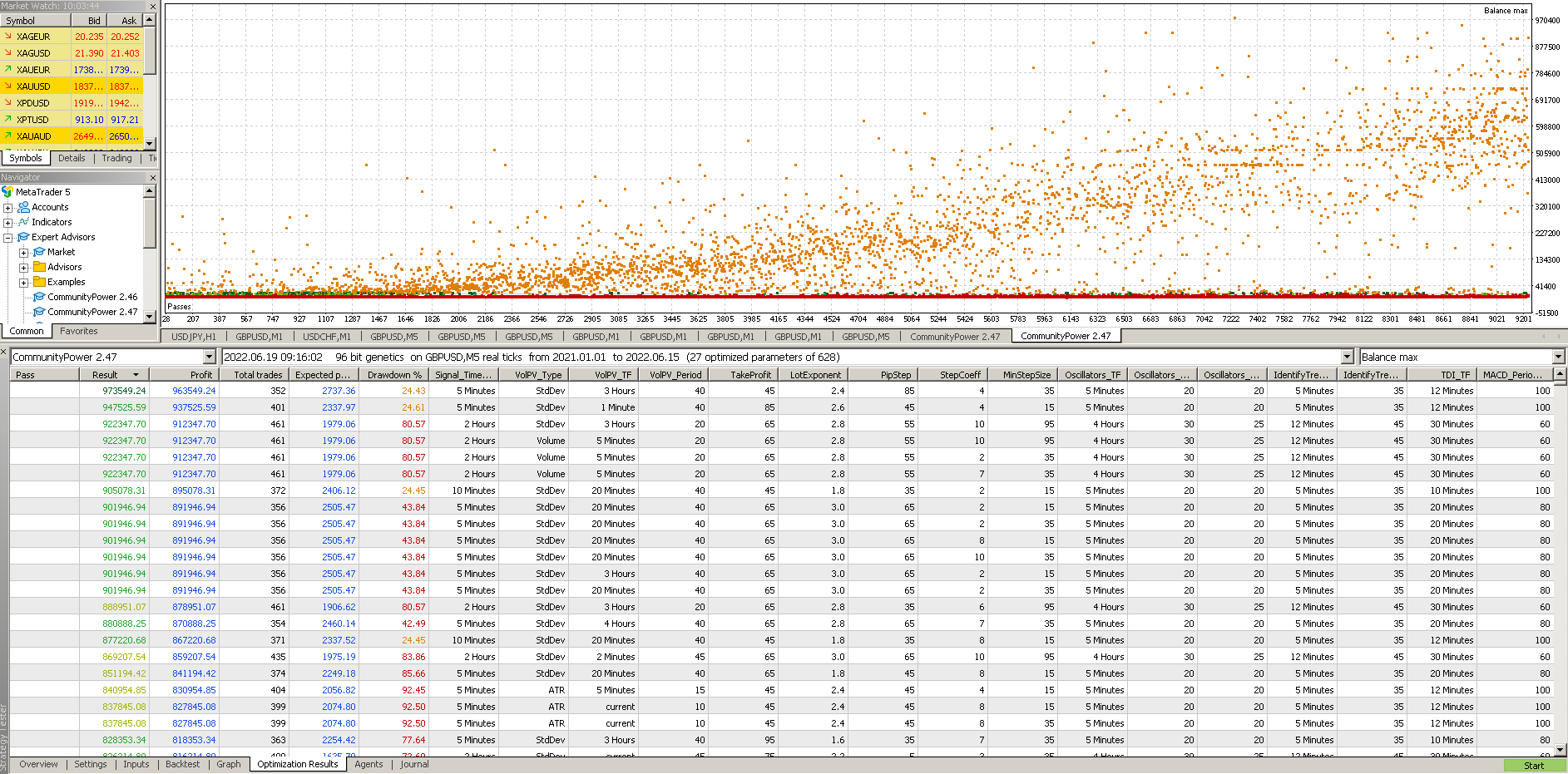

btw: the file also contains the optimization settings.

The optimization cache file.

May I ask why did u not check with real ticks and instead chosen OHLC? The result could have been different. I suggest you to check it.

The result you posted is too good to believe.

I will come up with my backtest result in some time.