Ultra Hedge *Beta* - JPow

Hi Guys,

I´ve been working a new system lately. An ultra hedge system. What does that mean I will explain soon:

Well, rates are rising globally. This will lead to alot more volatility for forex because it´s getting more interesting to park money in cash. Our martingale system needs to become more well-conceived.So I developed this setup.

We working with different Phases and the same pairs. What I got so far;

Pairs are marked as: N = neutral / S = Sell / B = Buy

Phase 1: CHFJPY (N) / EURCHF (S) / EURJPY (B)

Phase 2: GBPCHF (N) / CHFJPY (S) / GBPJPY (B)

Phase 3: USDCHF ( N) / EURCHF (S) / EURUSD (B)

Phase 4: EURUSD (N) / USDJPY (S) / EURJPY (B)

All simple, its just Stochastic who either buys or sells. The (S) part is just reversing the signal. The "N" is the decision maker. So it´s supposed

to 2 vs 1 (the hedge).

This backtesting is hard and not really possible so I set up a live signal: https://www.mql5.com/en/signals/1745827?source=Site+Signals+My

Any suggestions for improvements? Is it possible to connect the the pairs for each phase? ( maybe via the magic number?) So it closes every phase individually. Of course the "Phases" can be expanded to more pairs.

Anyway here are the sets.

Ultra Hedge.zip ( the magic number need to changed for every pair)

Seems like the integration/usage of a News Filter has some positiv impact...

Lets see how they deal with the upcoming correction of EURUSD... :-)

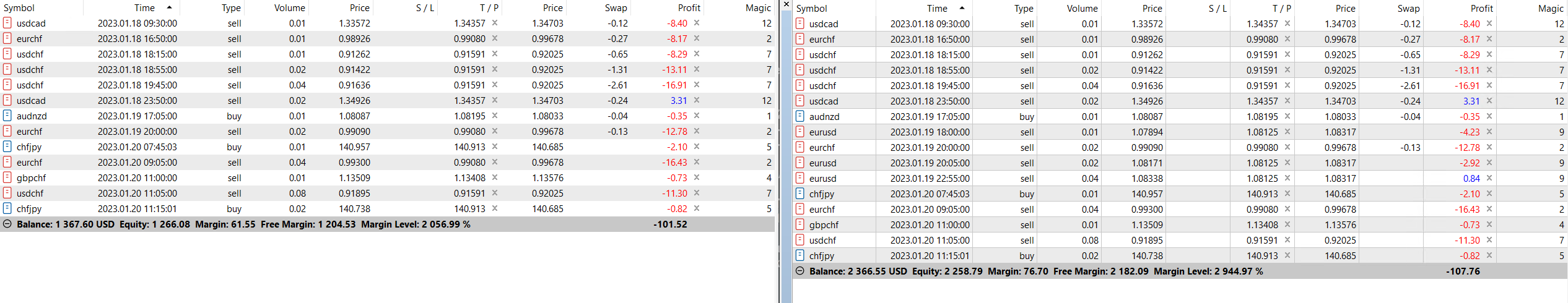

updated overview:

(NEWS -> news as filter, nNEWS -> no news as filter)

V1:

Pepperstone Ultra Hedge (started 28.10.22)

IC Markets Ultra Hedge (started 28.10.22)

Roboforex ECM Ultra Hedge V1 (started 06.01.23) [DEAD]

Roboforex ECM Ultra Hedge nNEWS (started 06.01.23)

Robo ECN Hedge Ultra V1 NEWS filter (started 13.01.23)

Robo ECN Hedge Ultra V1 nNEWS filter (started 13.01.23)

Roboforex ECN Hedge Ultra V1 Magic (started 13.01.23)[DEAD]

Roboforex ECN Hedge Ultra V1 (started 20.01.23)

V1.3:

IC Markets Ultra Hedge V1 3 (started 06.01.23)

Roboforex ECN Ultra Hedge V1 3 nNEWS (started 05.01.23)

Robo ECN Hedge Ultra V1 3 NEWS (started 18.01.23)

V2:

Pepperstone Ultra Hedge V2 (startet 11.11.22)

IC Markets Ultra Hedge V2 (started 11.11.22)

Admiral Markets Ultra Hedge V2 (started 11.11.22)

V2.1;

Pepperstone Ultra Hedge V2 1 (started 28.11.22)

IC Markets Ultra Hedge V2 1 (started 28.11.22)

Thanks to the set file author for this great piece of work, the system looks great. Also thanks to you for your perseverance with the different brokers and versions.

I ahve only set up today so forgive any lack of understanding, I am trying to learn more about this.

I may be missing something but is this really a hedging system or 12 pairs operating independently? It seems that, at different times, some pairs are profitable while others get into drawdown, then things either sort themselves out or the account goes pop. An integrated hedging system would take profit from one pair while simultaneously closing a pair in drawdown, hopefully with an overall gain.

Has anyone tried the suggestion in a previous post about setting an 8-10% SL on individual pairs to further automate the system?