Ultra Hedge *Beta* - JPow

Hi Guys,

I´ve been working a new system lately. An ultra hedge system. What does that mean I will explain soon:

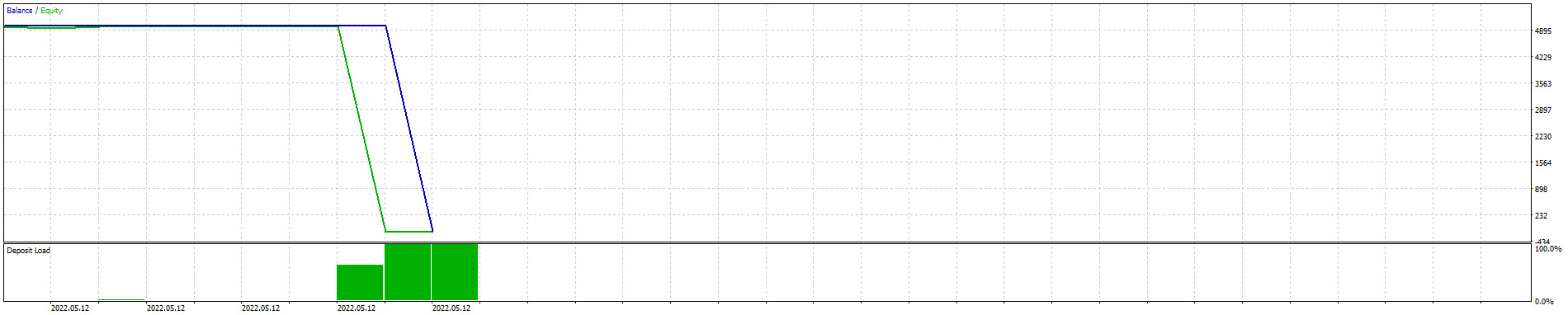

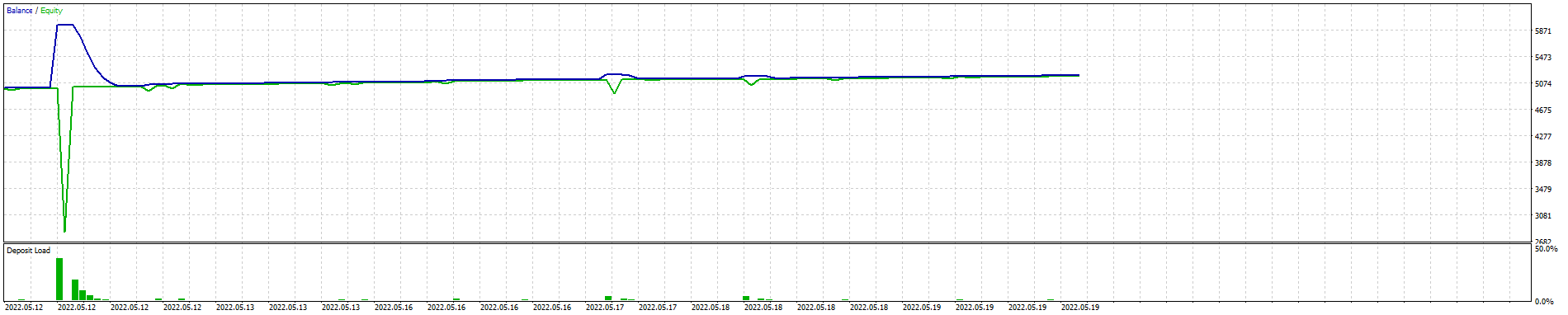

Well, rates are rising globally. This will lead to alot more volatility for forex because it´s getting more interesting to park money in cash. Our martingale system needs to become more well-conceived.So I developed this setup.

We working with different Phases and the same pairs. What I got so far;

Pairs are marked as: N = neutral / S = Sell / B = Buy

Phase 1: CHFJPY (N) / EURCHF (S) / EURJPY (B)

Phase 2: GBPCHF (N) / CHFJPY (S) / GBPJPY (B)

Phase 3: USDCHF ( N) / EURCHF (S) / EURUSD (B)

Phase 4: EURUSD (N) / USDJPY (S) / EURJPY (B)

All simple, its just Stochastic who either buys or sells. The (S) part is just reversing the signal. The "N" is the decision maker. So it´s supposed

to 2 vs 1 (the hedge).

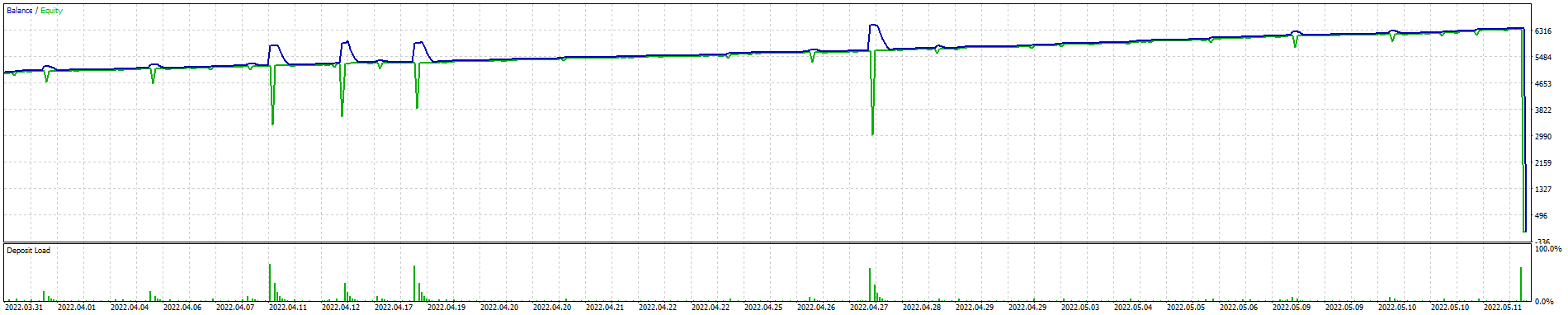

This backtesting is hard and not really possible so I set up a live signal: https://www.mql5.com/en/signals/1745827?source=Site+Signals+My

Any suggestions for improvements? Is it possible to connect the the pairs for each phase? ( maybe via the magic number?) So it closes every phase individually. Of course the "Phases" can be expanded to more pairs.

Anyway here are the sets.

Ultra Hedge.zip ( the magic number need to changed for every pair)

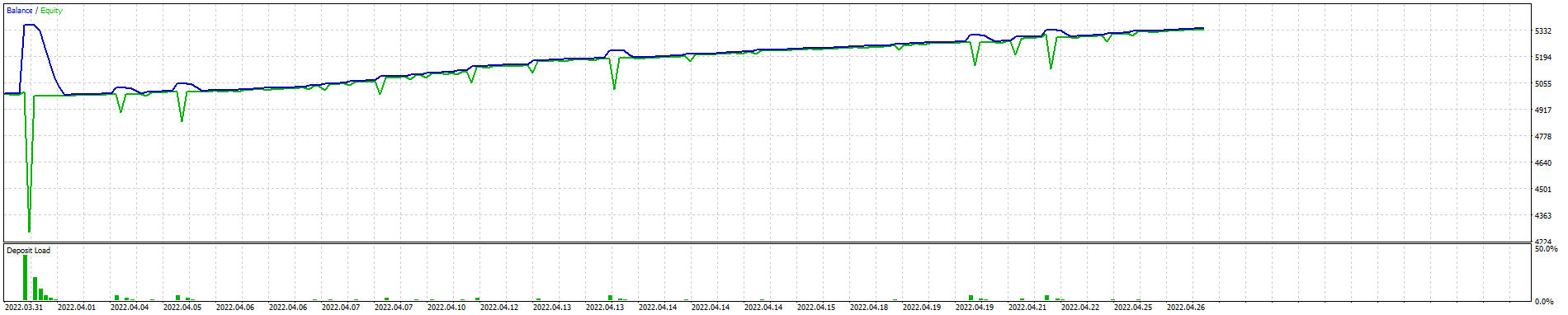

Overview:

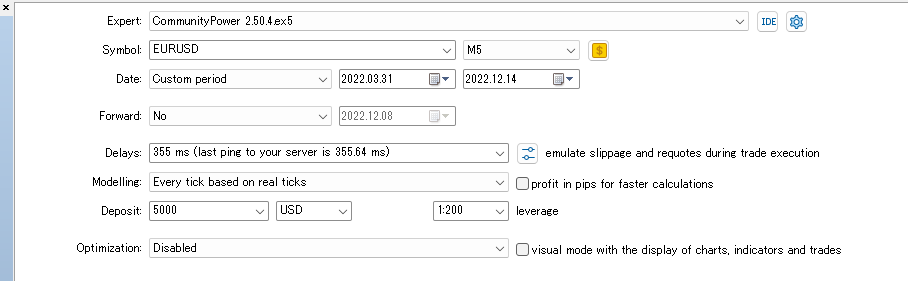

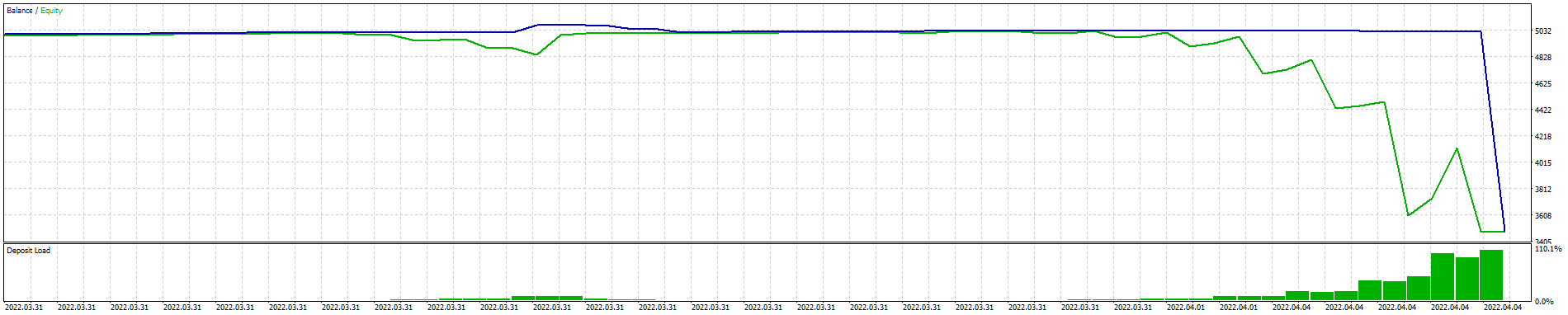

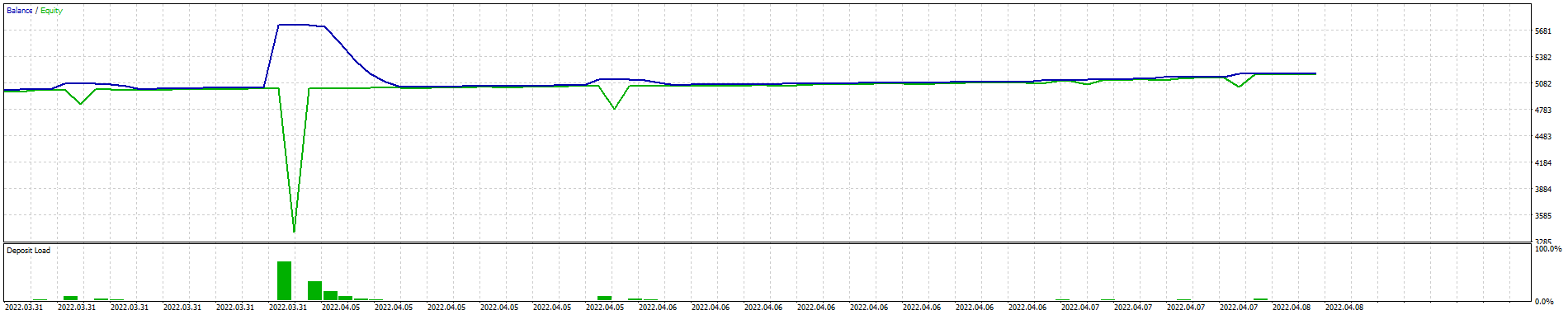

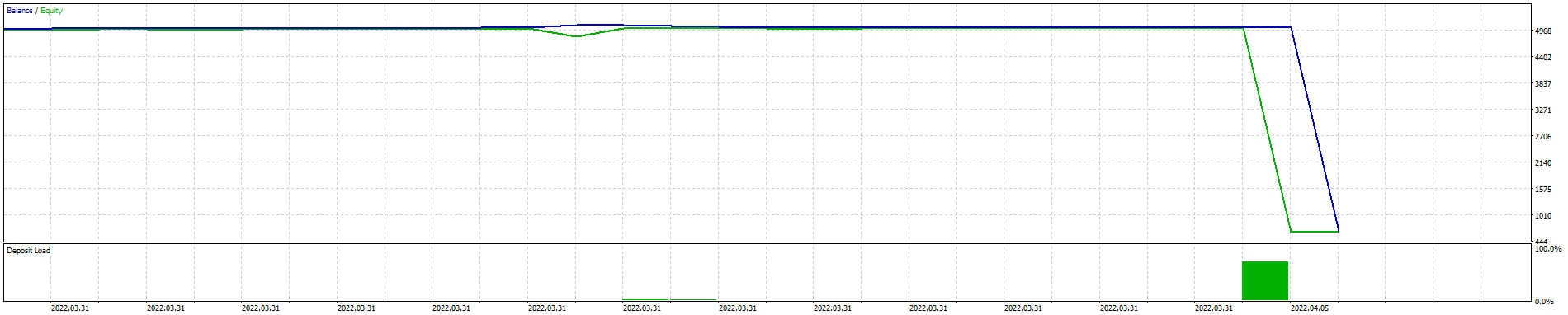

Version 1:

Roboforex ECN Ultra Hedge

Roboforex Pro Ultra Hedge

IC Markets RAW Ultra Hedge

IC Markets Ultra Hedge

Pepperstone Ultra Hedge

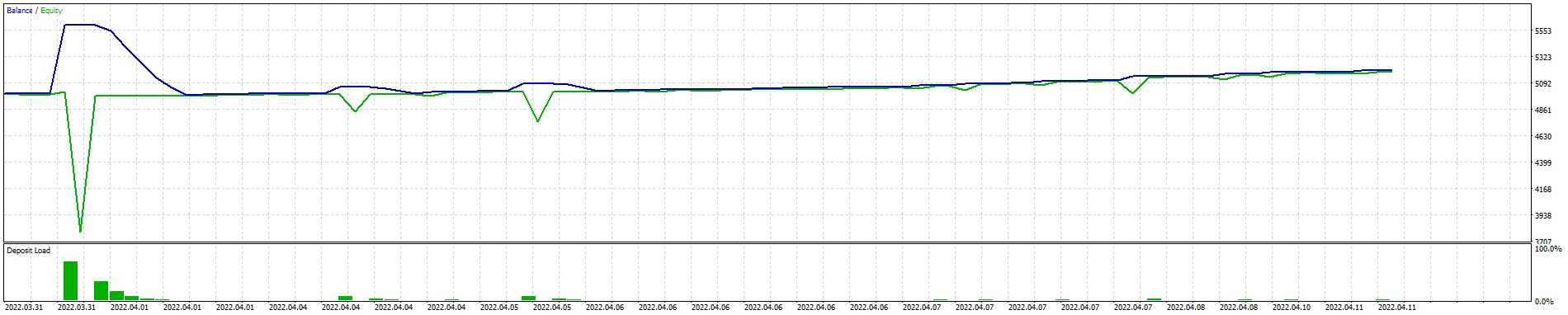

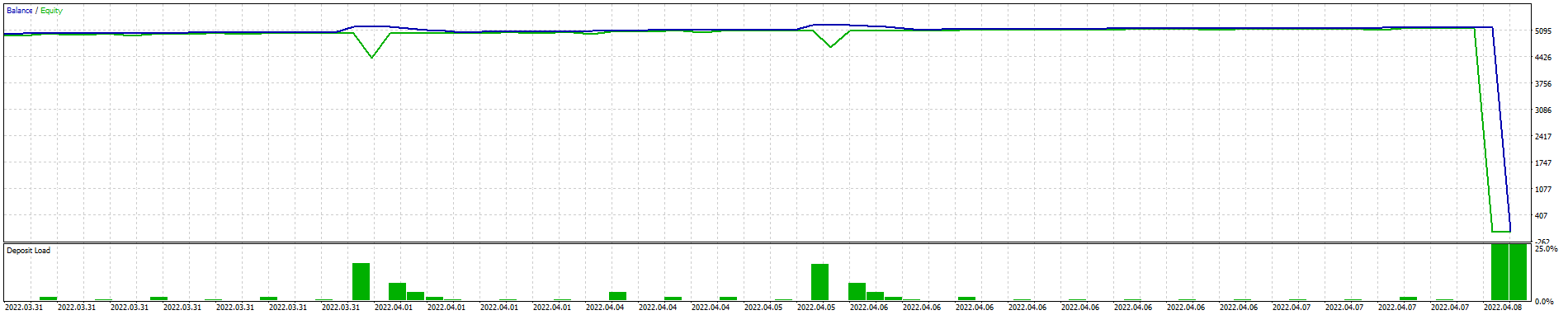

Version 2:

Roboforex Pro Ultra Hedge V2

Robo ECN Ultra Hedge V2

Admiral Markets Ultra Hedge V2

IC Markets Ultra Hedge V2

Pepperstone Ultra Hedge V2

@Chris Tom May I check if the magic number same for each set or phase for both of your v1, v2, v2.1? You keep the same setting from Jerome Powell without reduced the lot size to 0.005, aren't you?