Gold Strategy - No Indicator

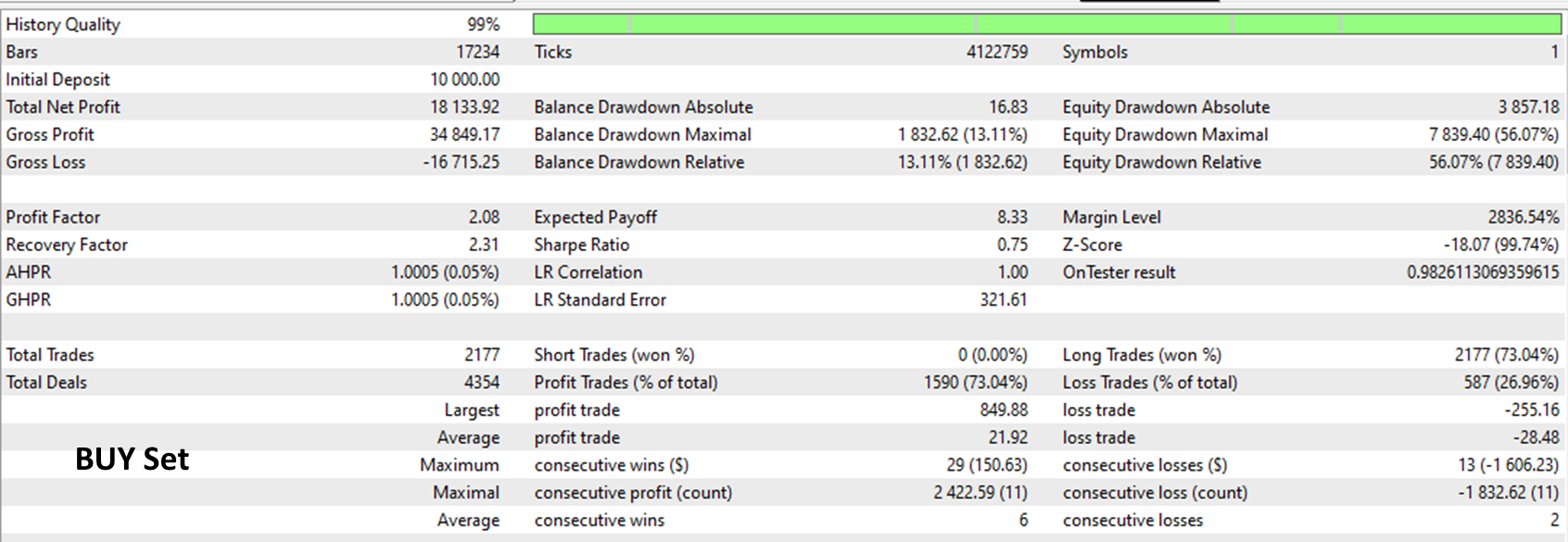

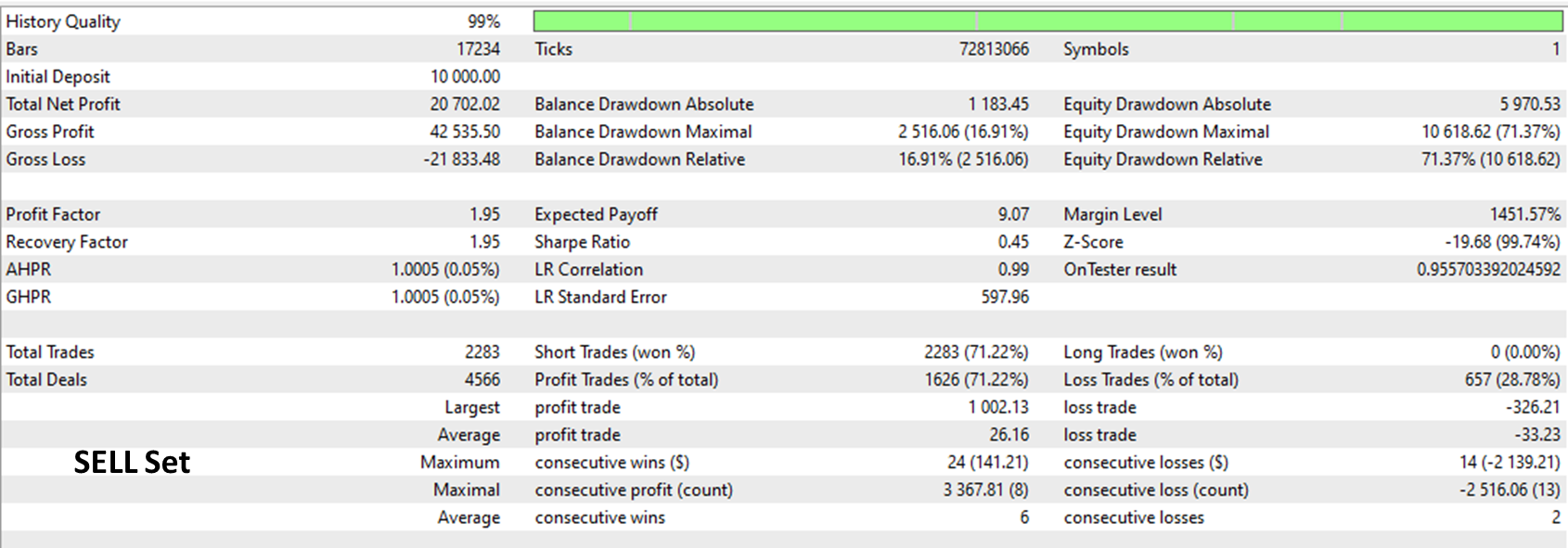

Strategy uses the new martingale feature using multiple by the distance.

Pure average/martingale price management, not using any indicator.

Backtested on FBS and Exness cents account. Running live since November/2022.

Money Management is:

$ 100 ($10,000 cents) for every Buy set added to chart

$ 150 ($15,000 cents) for every Sell set added to chart

To start I would suggest $ 300 ($ 30,000 cents) with 3 Buy and 2 Sell sets added to a total of 5 charts.

I am currently running live with 10 Buy and 6 Sell charts

https://www.mql5.com/pt/signals/1776732

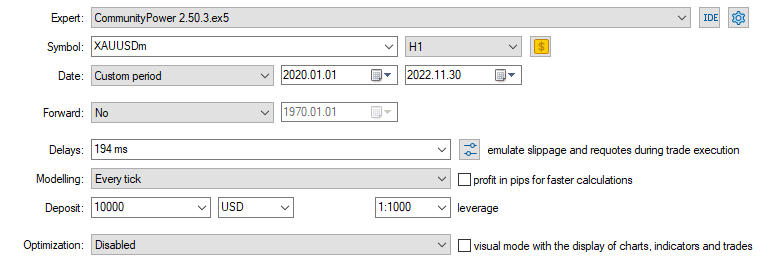

communitypower v2.50.3 xauusd h1 buy.set

communitypower v2.50.3 xauusd h1 sell MT4.set

communitypower v2.50.3 xauusd h1 sell.set

communitypower v2.50.3 xauusd h1 buy MT4.set

Please let me know your thoughts.

Is it not possible to have this setup in single chart with martingale and antimartingale features?

Just curious to know ur difficulties with such setup.

That would have helped in knowing the backtest report but with this we will not be able to do so except running live.