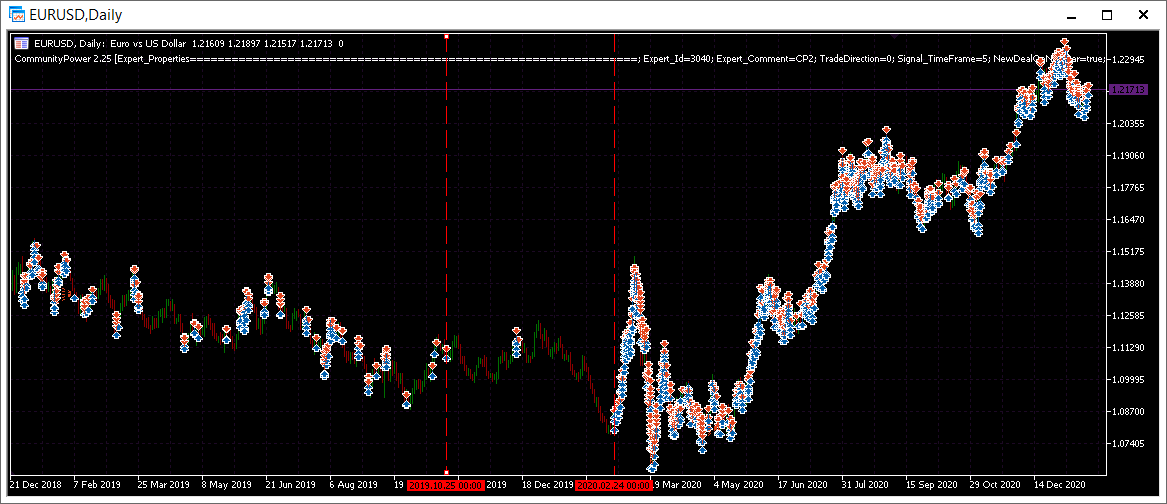

Adjustment to Martingale settings on EUR-USD Default setting Set file

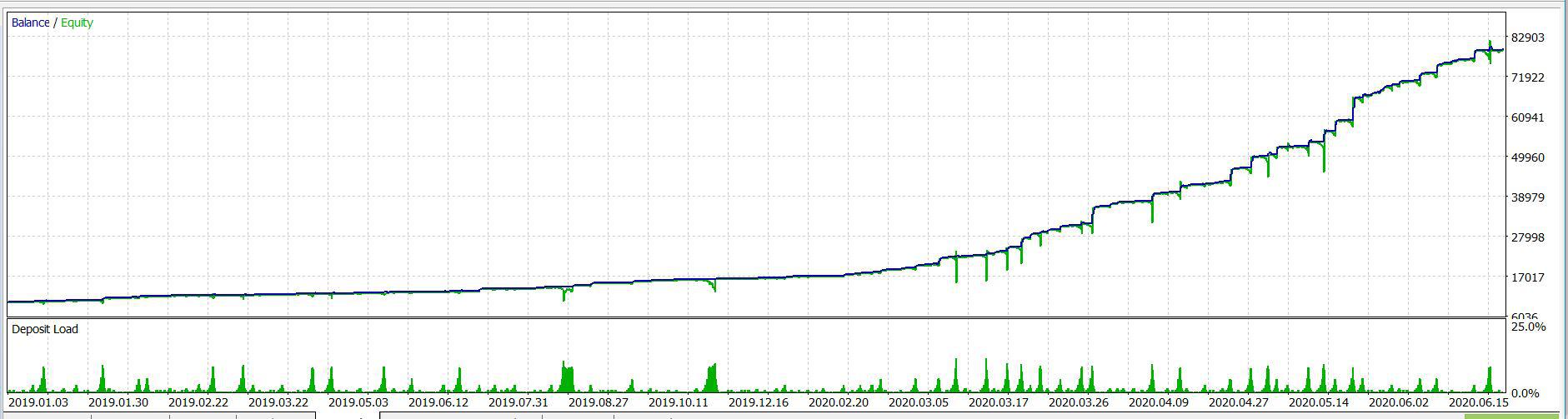

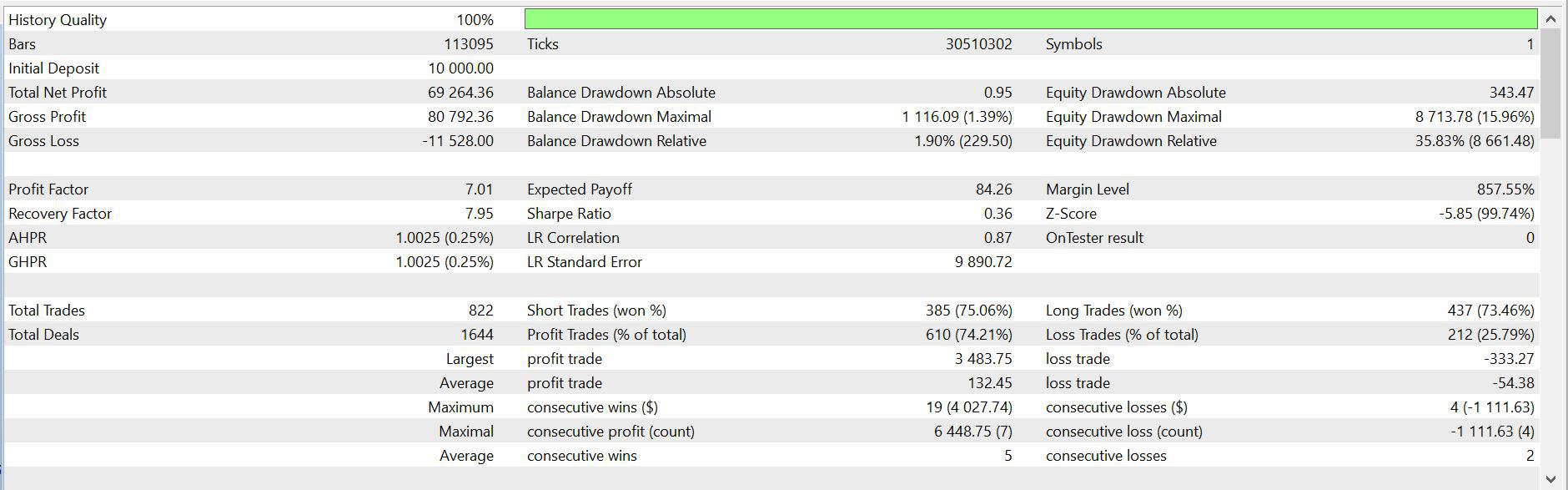

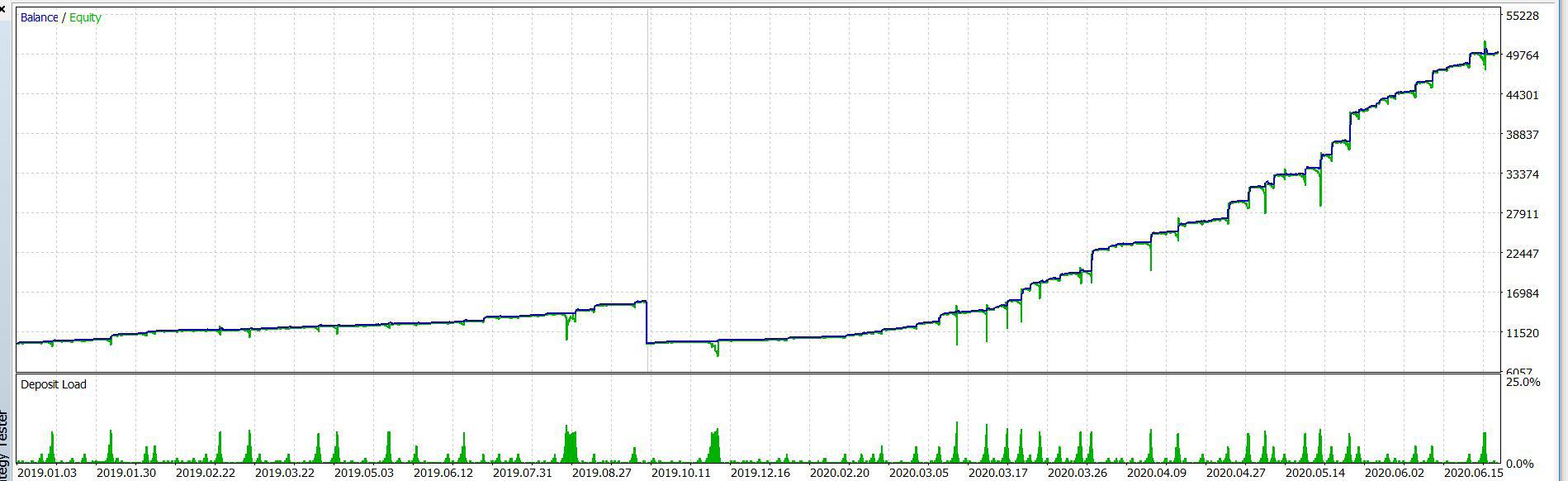

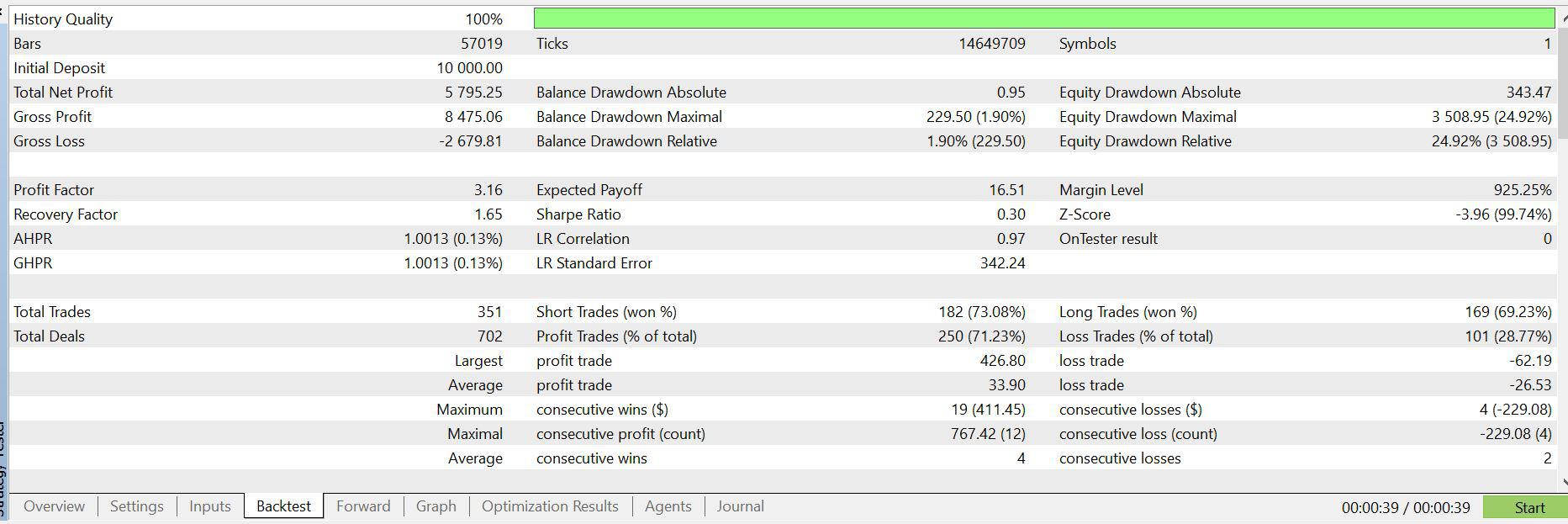

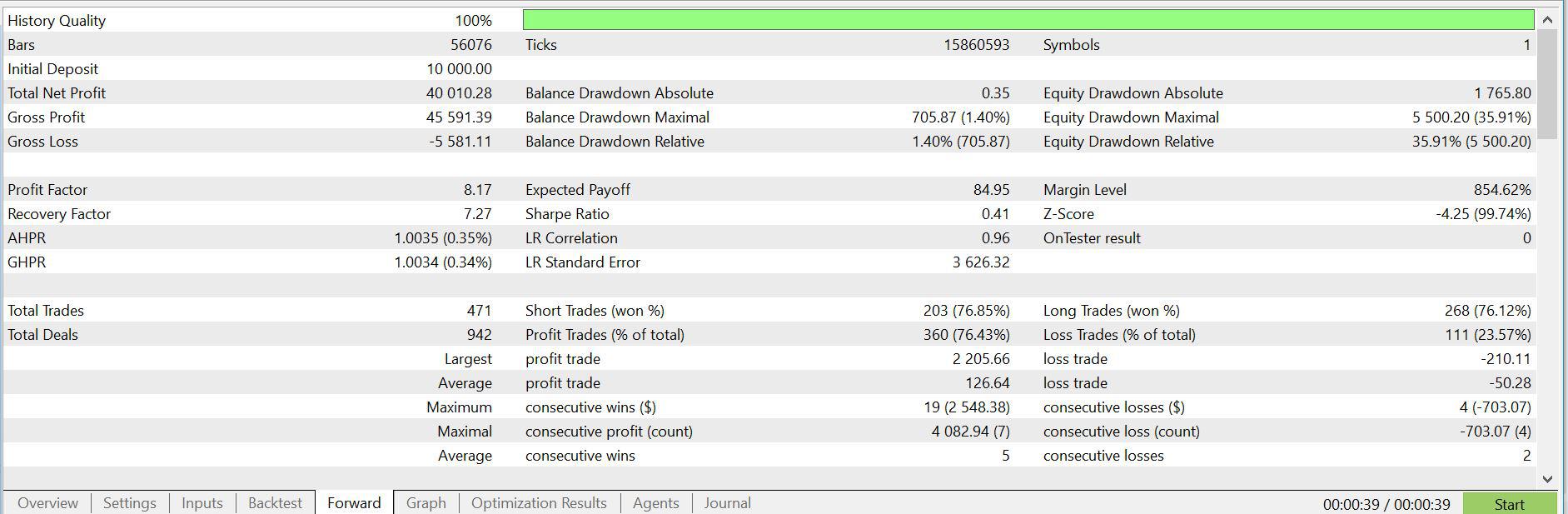

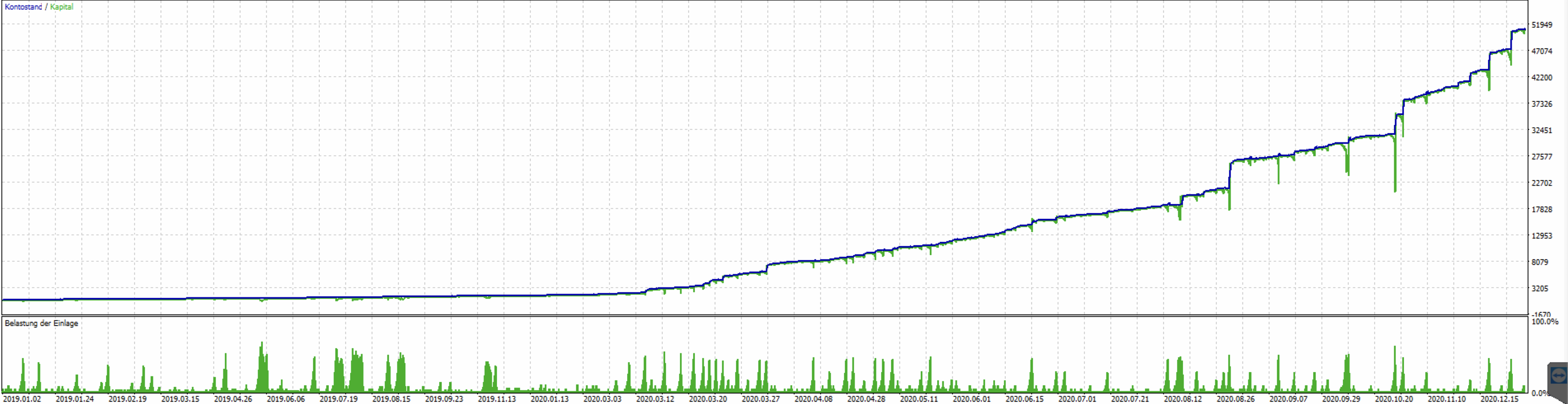

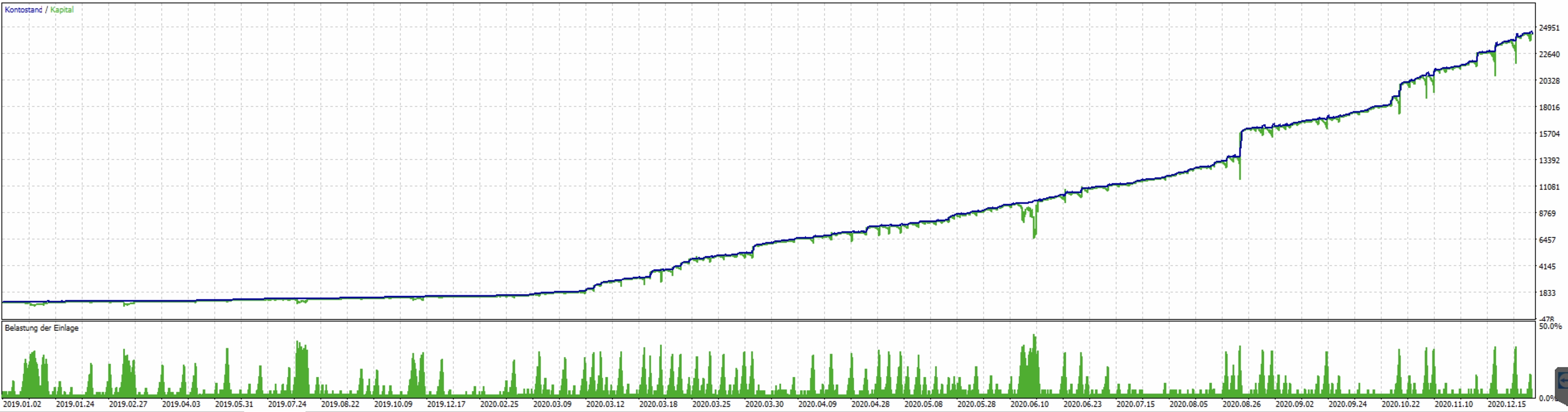

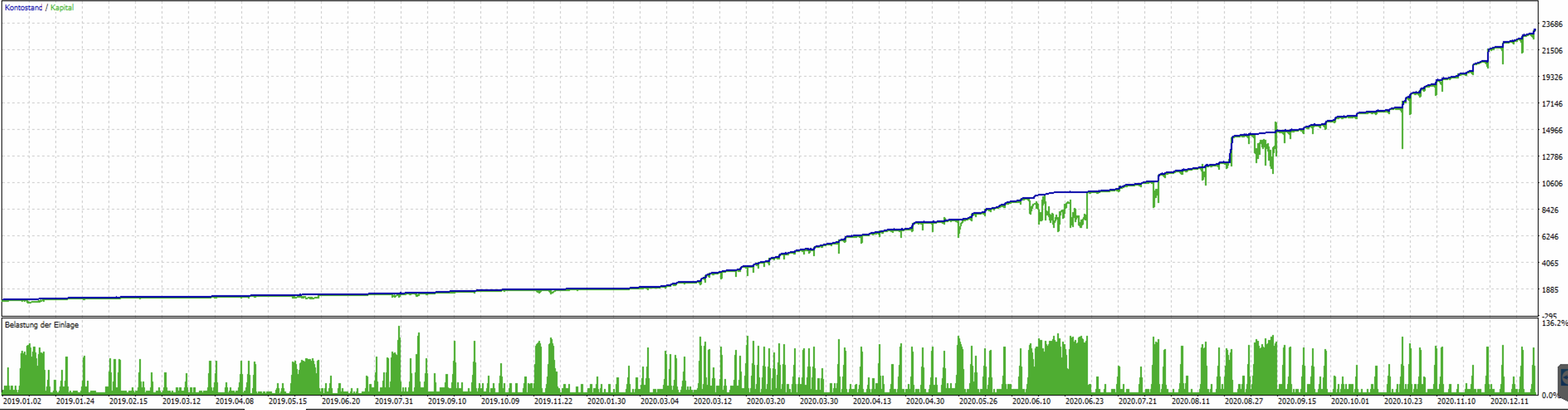

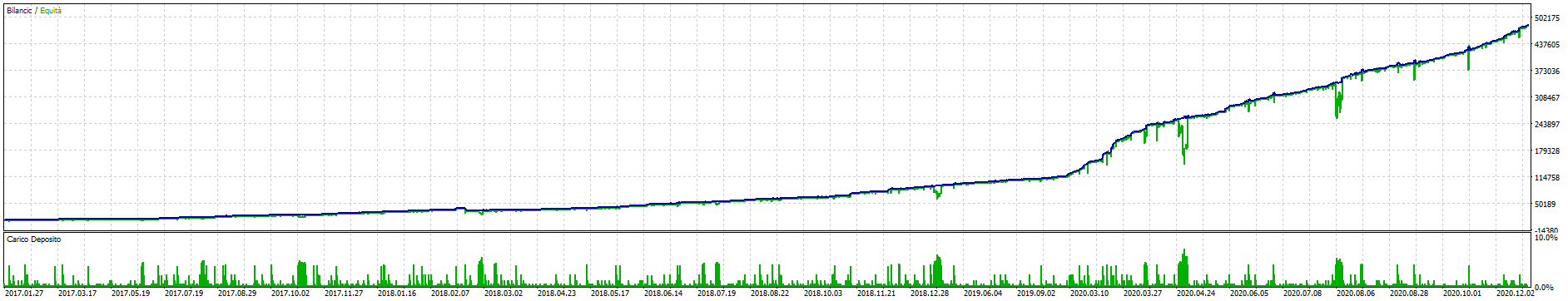

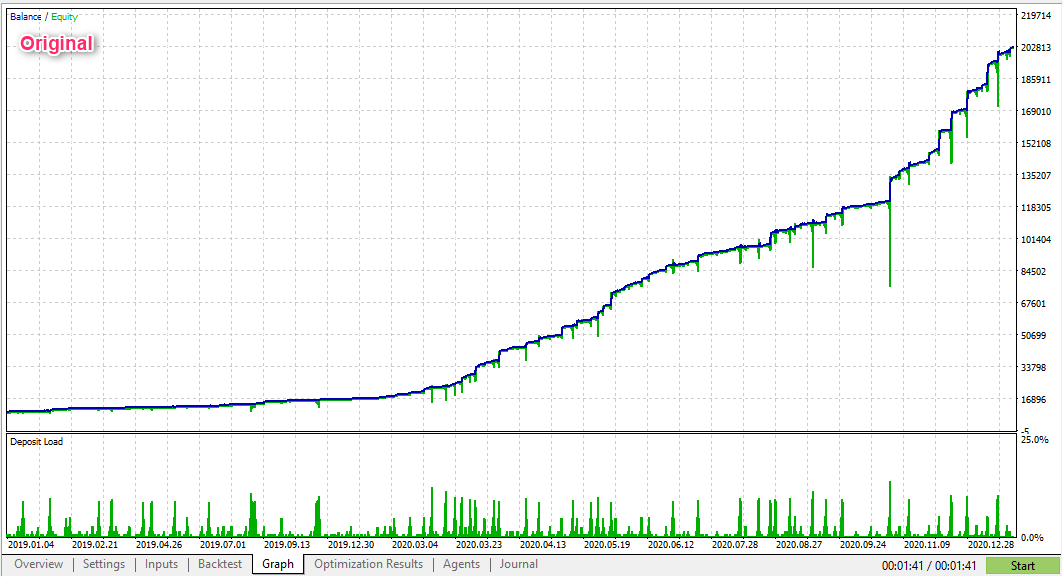

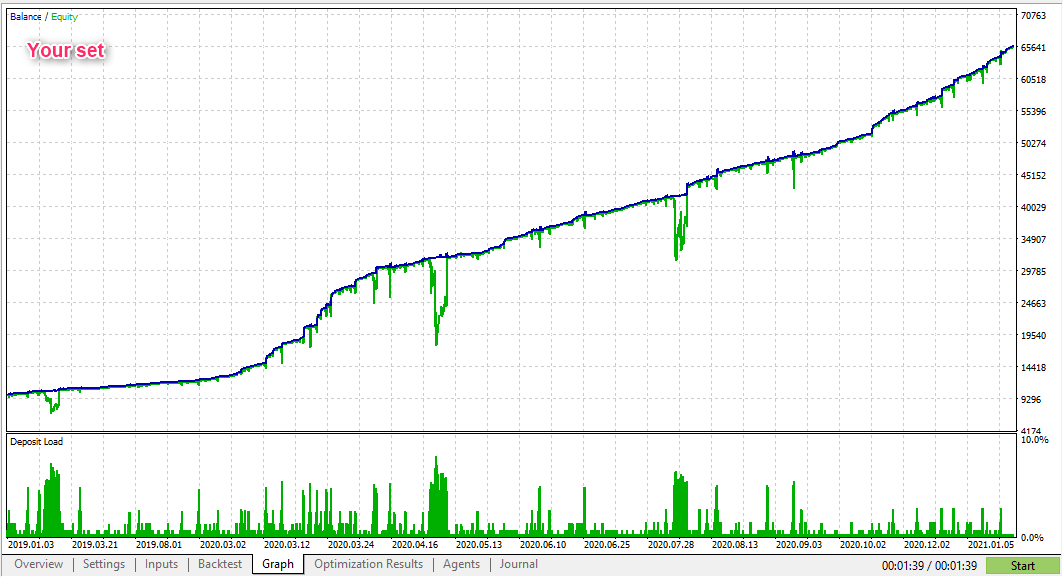

I have made a small adjustment to the martingale settings to try and smooth out, reduce the DD ,and increase profits.

I left the initial step size but reduced the step coefficient and have added another 1 trade

I have run various back test from 1.1.2019 and all looked good.

Obviously by doing this it can increase the sensitivity and make it riskier but currently it seems to have decreased the DD and increased profit.

Would be great to get some additional input if these changes are too risky or if there is a way to improve on this.

Thanks

Set-files updated for version 2.37 (by Andrey):

MT5_EURUSD_M5_DefaultPlusPending A_Martinga....set

MT4_EURUSD_M5_DefaultPlusPending A_Martinga....set

Set-files updated for version 2.30 (by Andrey):

MT5_EURUSD_M5_DefaultPlusPending A_Martinga....set

MT4_EURUSD_M5_DefaultPlusPending A_Martinga....set

Original set-files (by John):

MT5_EURUSD_M5_DefaultPlusPending A_Martinga....set

MT4_EURUSD_M5_DefaultPlusPending A_Martinga....set

Drago, just drop settings to defaults and load the attached set (for v2.18), it will work.

Andrey thanks!