7pairs dynamic grid

Hi guys,

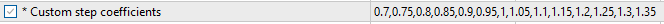

So I was just playing around with various grid step-ups based on volatility. And ended up with an idea to basically go smaller then bigger when calculating the step distance. the only way to do that was to go with custom step coefficients.

As you can se we first start decreasing the step sizes then when we are in a situation where market is still moving against us we start expanding the grid.

We also use the 5min ATR, but with a look back of a whole day, 288. This gives us the average 5min movement of the day to base your grid spacing.

The last part of the grid was the lot sizes. Usual calculation types often blow the account, so I ended up taking the Fibonacci sequence and stretched it to 15 orders with custom lot sizes just to maintain control on risk. The best custom lot sizes I came up with is the following:

This keeps the lot sizes in check, but makes it bottom heavy to be able to average out the trade a bit easier.

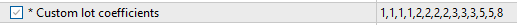

So then I had to work on entry signals, this part I find doesn't matter as much to this idea, but I decided to use Stochastic K and default TDI. (Feel free to choose any signal you want). I ran this for all 28 pairs filtering out any set with greater than 30% relative drawdown. Then looking at open trade correlation, I went with the least correlating pairs to lessen the chance of drawdowns lining up, these are the best picks from the results.

I decided to exclude TP and SL for the time being and go purely with signals. Once I'm confident enough, ill aiming for a global TP and SL, which would have all the different grids interacting together.

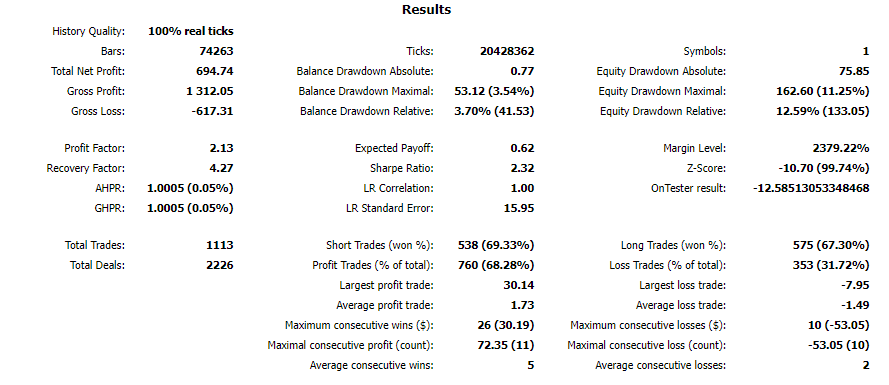

Here are the results so far:

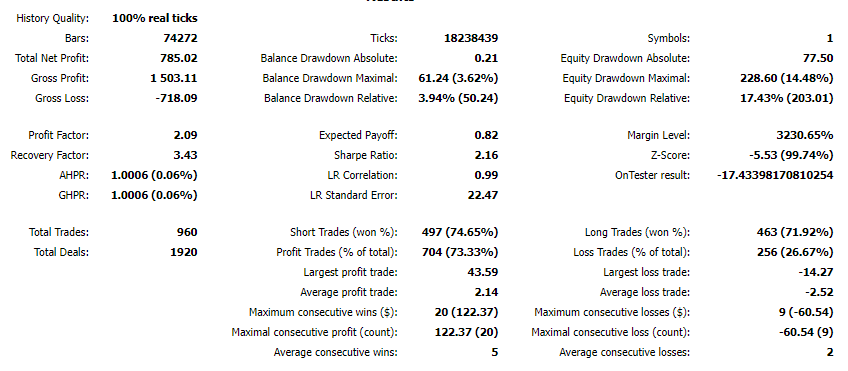

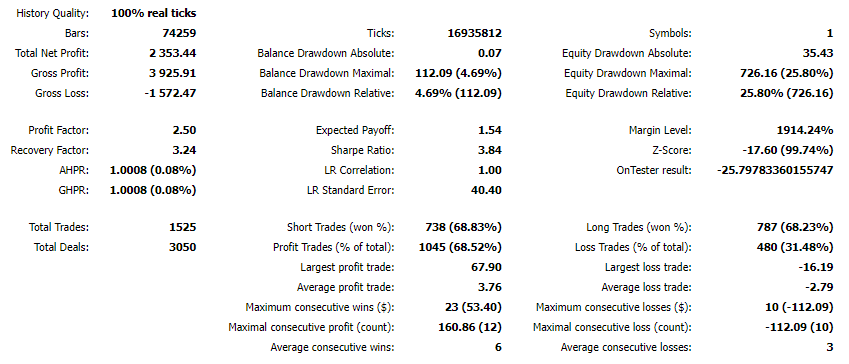

AUDCAD:

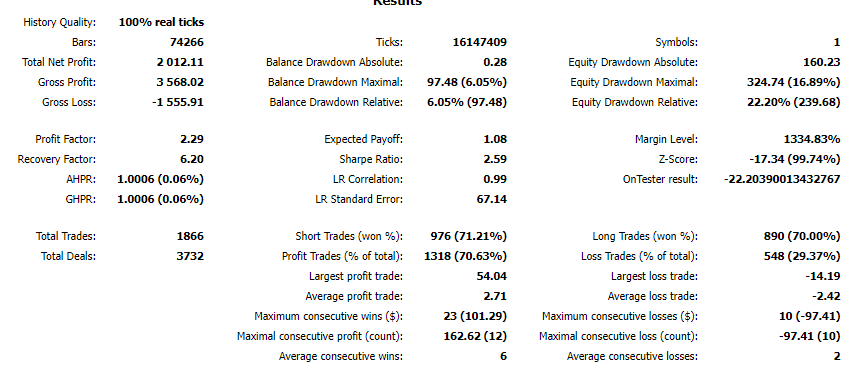

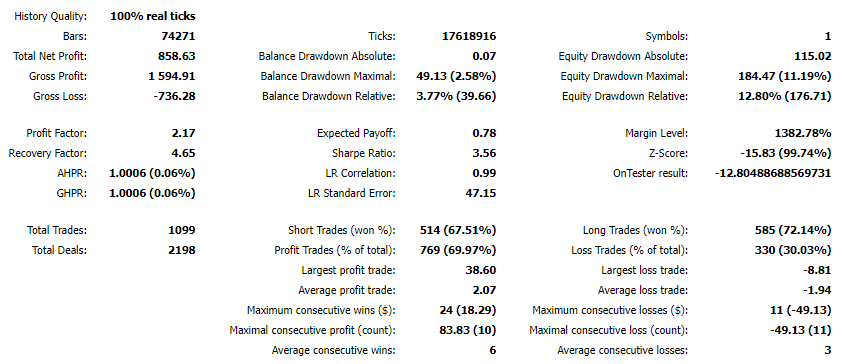

AUDUSD:

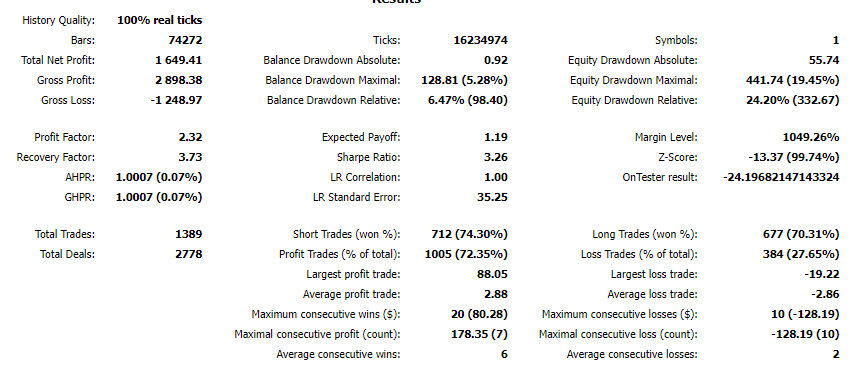

EURGBP:

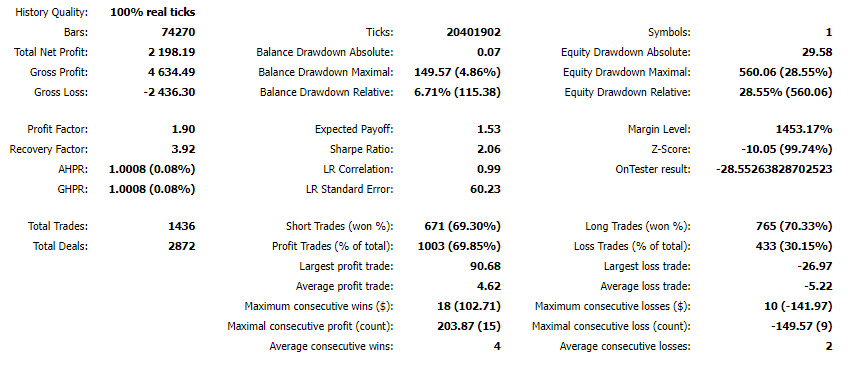

EURUSD:

GBPUSD:

NZDUSD:

USDCAD:

The above results are from 1-Sep-2022 to 31-Aug-2023, last year, using my broker, blueberry markets raw account.

SO... the idea here is to have these 7 pairs trade together... and since I don't really have a proper way to combine the results, and since the initial lot size is 0.01 per 1000USD, I think that having all 7 will compound each other to get bigger and bigger entries which should result in a higher return overall.

Here are the set files:

AUDCAD.set

AUDUSD.set

EURGBP.set

EURUSD.set

GBPUSD.set

NZDUSD.set

USDCAD.set

Use these for whichever pair you like, the main 3 parameters that you should optimize are:

- Pending order distance

- Martin Step Size

- Whatever entry signal you decide to go with.

The above sets are NOT a plug an play sets, just an idea I've been working on that thought I'd share and brain storm with you guys. And various brokers will sure have different setups and results.

Thank you!

Hey Lytnin, how are the set files going?