Trade with double bollinger band strategy

The Double Bollinger Band Strategy makes use of two Bollinger Bands in order to filter entries and exits in the forex market.

The strategy aims to enter Buy (Sell) trades when price crosses above (below) 3σ (2 standard deviation . The strategy also

considers the 2σ (2 standard deviations) standard deviation level of the Bollinger Bands for making trade decisions.

Please may reference the following web link for mql5.com to this related topic:

https://www.mql5.com/en/code/46630

Some work did to rewrite it in mql5 code as an indicator. Anyone familiar with this could help to improve and test it with custom Indy of CP? Thank you.

//+------------------------------------------------------------------+

//| BB_Signal.mq5|

//| Copyright 2023, MetaQuotes Software Corp. |

//| https://www.mql5.com |

//+------------------------------------------------------------------+

#property copyright "2023, MetaQuotes Software Corp."

#property link "https://www.mql5.com"

#property version "1.00"

#property indicator_chart_window

//--- input parameters

input int BB_KIKAN=20; // BB period

double waitBB = 0; // Initialize waitBB

datetime prevtime;

int orderPtn=0; // 0: Do nothing, 1: Buy, 2: Sell

// Create buffers to hold the upper and lower bands

double upperBuffer[];

double lowerBuffer[];

double BB3UP, BB3LO, BB2UP, BB2LO; // Define these variables here to make them global

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int OnInit()

{

//---

return(INIT_SUCCEEDED);

}

// Custom function to plot arrows

void PlotArrow(int direction, int shift, double price, color clr) {

string arrowName = direction > 0 ? "BuyArrow" : "SellArrow";

arrowName += "_" + IntegerToString(shift);

if (ObjectFind(0, arrowName) != -1) {

ObjectDelete(0, arrowName);

}

if (direction > 0)

ObjectCreate(0, arrowName, OBJ_ARROW_BUY, 0, iTime(_Symbol, _Period, shift), price);

else

ObjectCreate(0, arrowName, OBJ_ARROW_SELL, 0, iTime(_Symbol, _Period, shift), price);

ObjectSetInteger(0, arrowName, OBJPROP_COLOR, clr);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int OnCalculate(const int rates_total, const int prev_calculated, const datetime &time[], const double &open[], const double &high[], const double &low[], const double &close[], const long &tick_volume[], const long &volume[], const int &spread[])

{

// Get the handle of the Bollinger Bands indicator

int handle = iBands(_Symbol, _Period, BB_KIKAN, 3, 0, PRICE_CLOSE);

// Copy the upper band (index 0) and lower band (index 2) into the buffers

CopyBuffer(handle, 0, 0, rates_total, upperBuffer);

CopyBuffer(handle, 2, 0, rates_total, lowerBuffer);

// Now you can get the upper and lower bands using the buffers

BB3UP = upperBuffer[1]; // 3σ upper

BB3LO = lowerBuffer[1]; // 3σ lower

// Repeat the same for the 2σ Bollinger Bands

handle = iBands(_Symbol, _Period, BB_KIKAN, 2, 0, PRICE_CLOSE);

CopyBuffer(handle, 0, 0, rates_total, upperBuffer);

CopyBuffer(handle, 2, 0, rates_total, lowerBuffer);

BB2UP = upperBuffer[1]; // 2σ upper

BB2LO = lowerBuffer[1]; // 2σ lower

//*** Buy/Sell Conditions ***//

// Rest of your code...

// If in a Buy or Buy-wait state

if ((orderPtn == 1) || (waitBB > 0)) {

// Buy within BB2 range

if ((BB2UP > close[1]) && (BB2LO < close[1])) {

orderPtn = 1;

waitBB = 0;

PlotArrow(1, 1, close[1], clrGreen); // Plot Green Arrow for Buy Signal

} else {

orderPtn = 0;

waitBB = 1;

}

}

// If in a Sell or Sell-wait state

if ((orderPtn == 2) || (waitBB < 0)) {

// Sell within 2σ BB range

if ((BB2LO < close[1]) && (BB2UP > close[1])) {

orderPtn = 2;

waitBB = 0;

PlotArrow(-1, 1, close[1], clrRed); // Plot Red Arrow for Sell Signal

} else {

orderPtn = 0;

waitBB = -1;

}

}

return(rates_total);

}

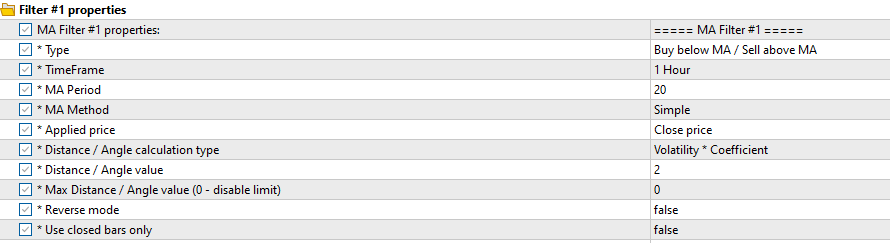

You can use the CP modules "MA Filter" to setup a BB like this:

Step 1

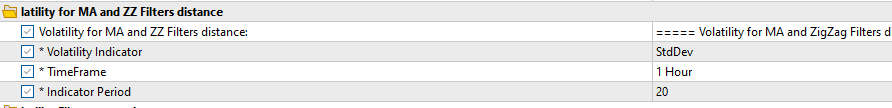

The Deviation is defined here:

Step 2

In MA Filter #2 you can setup other values for your 2nd BB. Deviation calculation can be definded only one time - this may or may not be a problem for your strategy.

Great to learn this. Thank you, Jan!