Dtrend + Fibonacci

Hello Community,

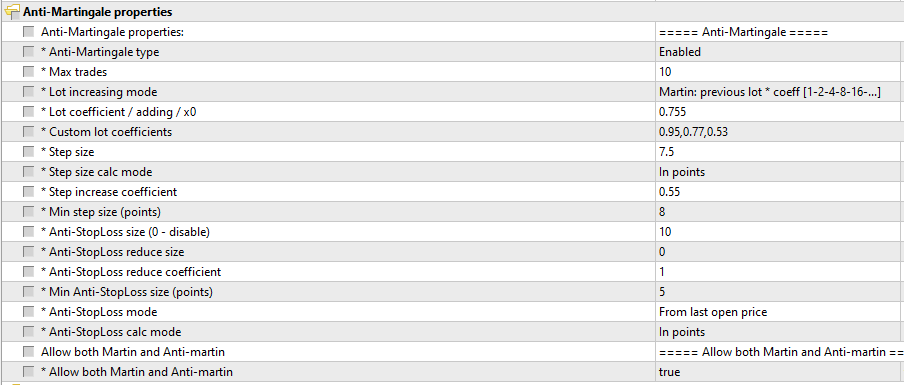

This is a strategy that uses the new indicator from version 2.35 called "DTrend". Open and close orders according to this indicator.

It also uses Fibonacci + IdentifyTrend to open the orders.

2% Risk per Trade

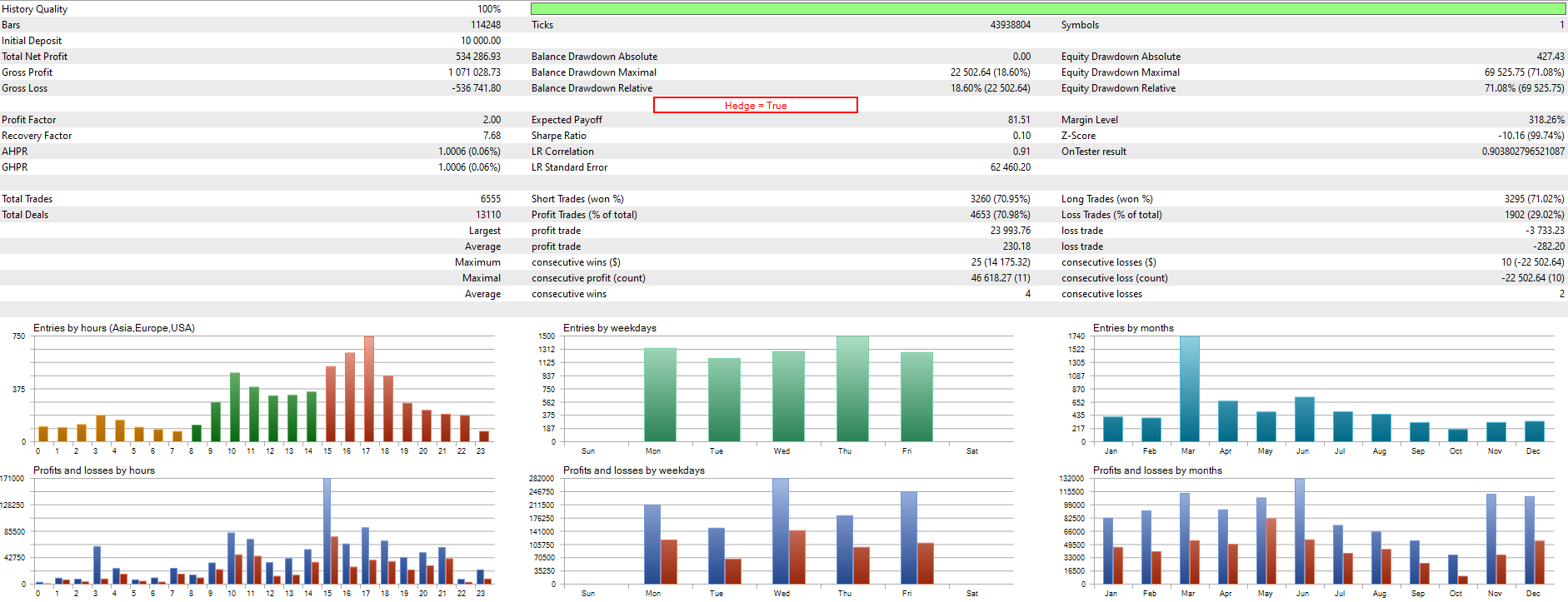

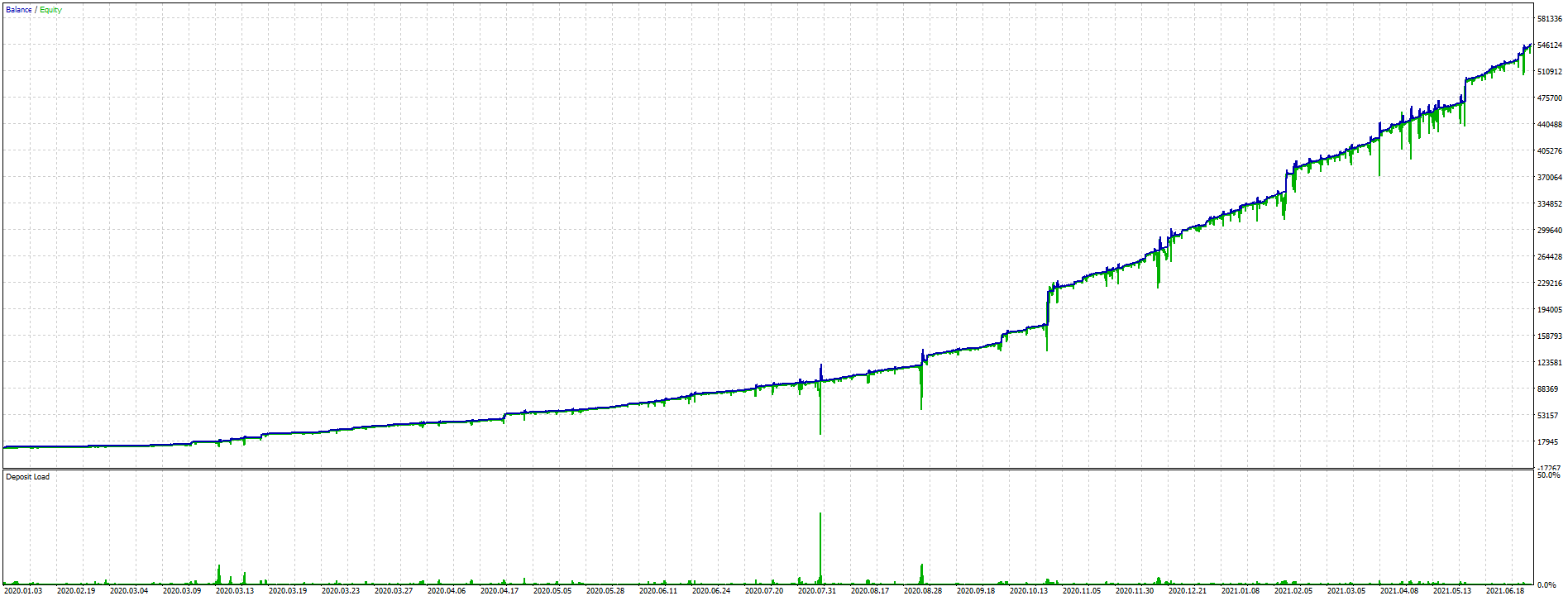

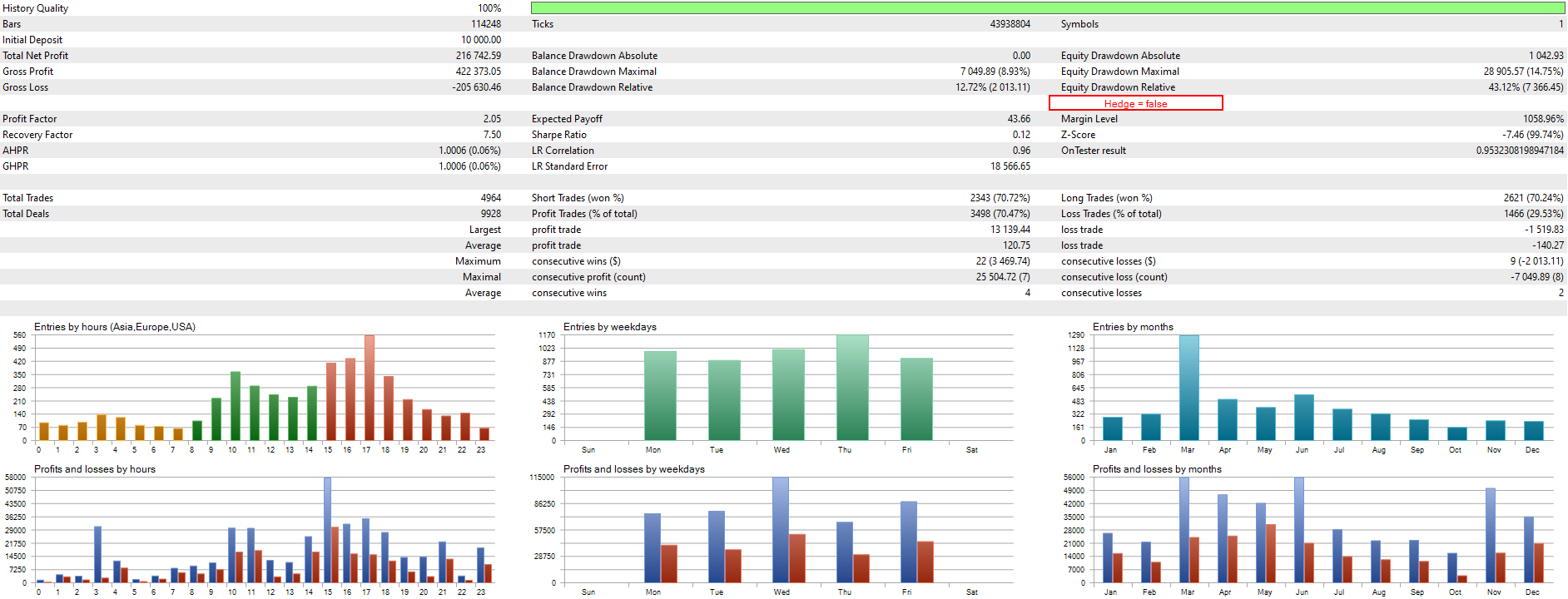

Hedge = True. If you want less DrawDown you can modify Hedge = False.

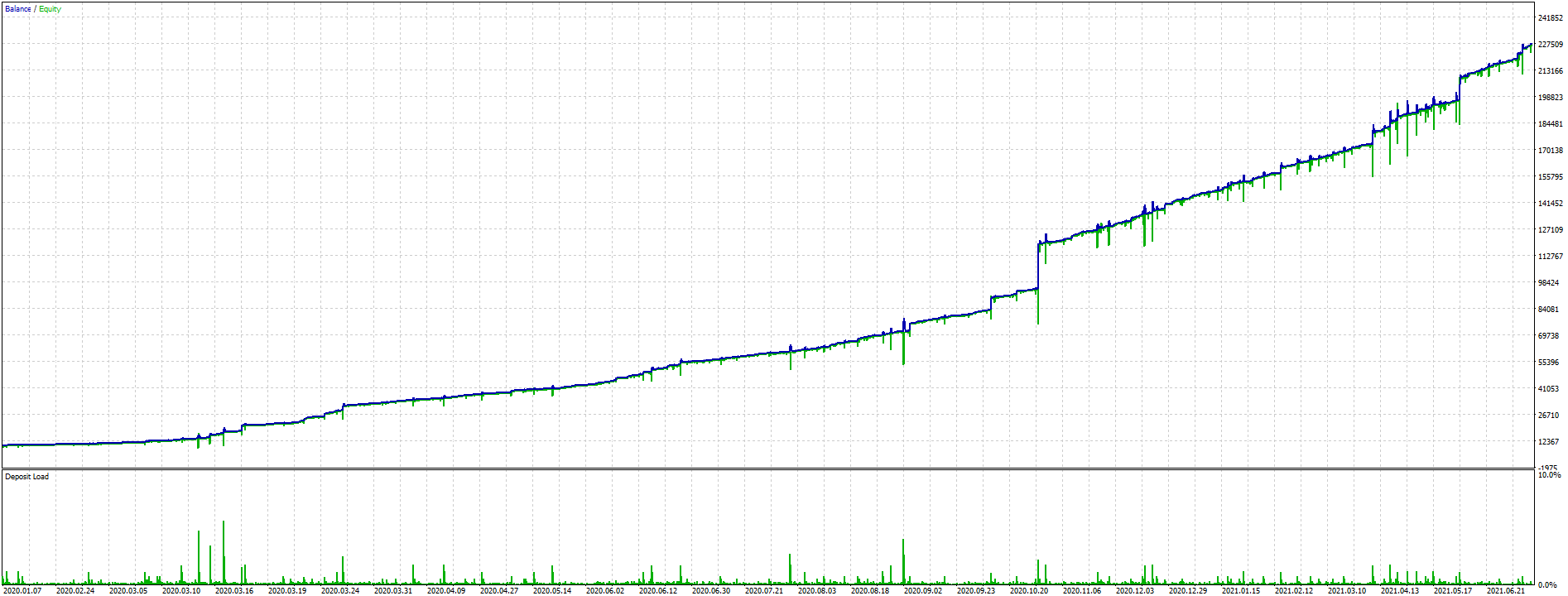

Hedge = True

Hedge = False

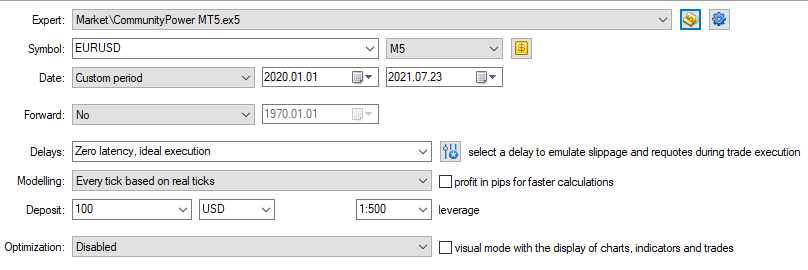

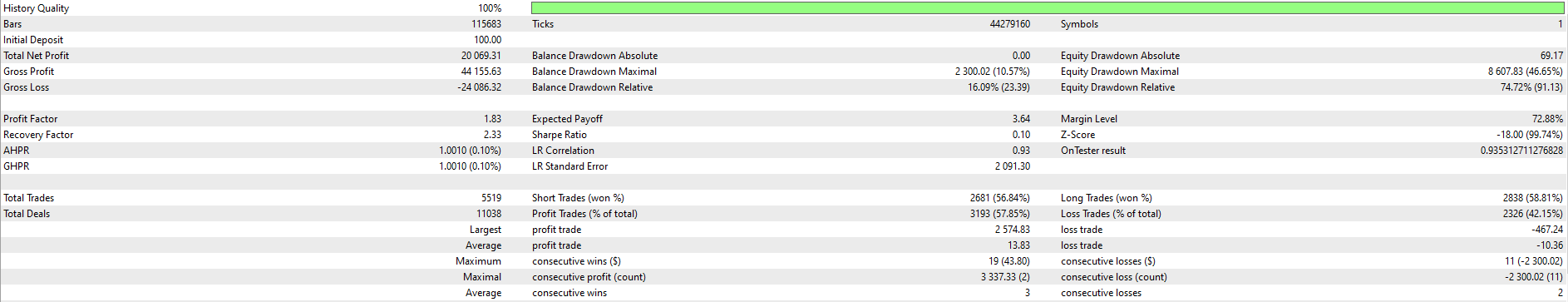

Deposit: 100 USD

Total NetProfit: 5.000 USD

Roboforex Cent Account

Hi Sir, my results for FBS with hedge = true, deposit 2500$ and i changed the risk to 2.1% because on my side it increases the profit without change drawdown. The set crash on February 2019 but if you start in March 2019 its ok.

It seems to be a good set i need to test in a demo account for see...