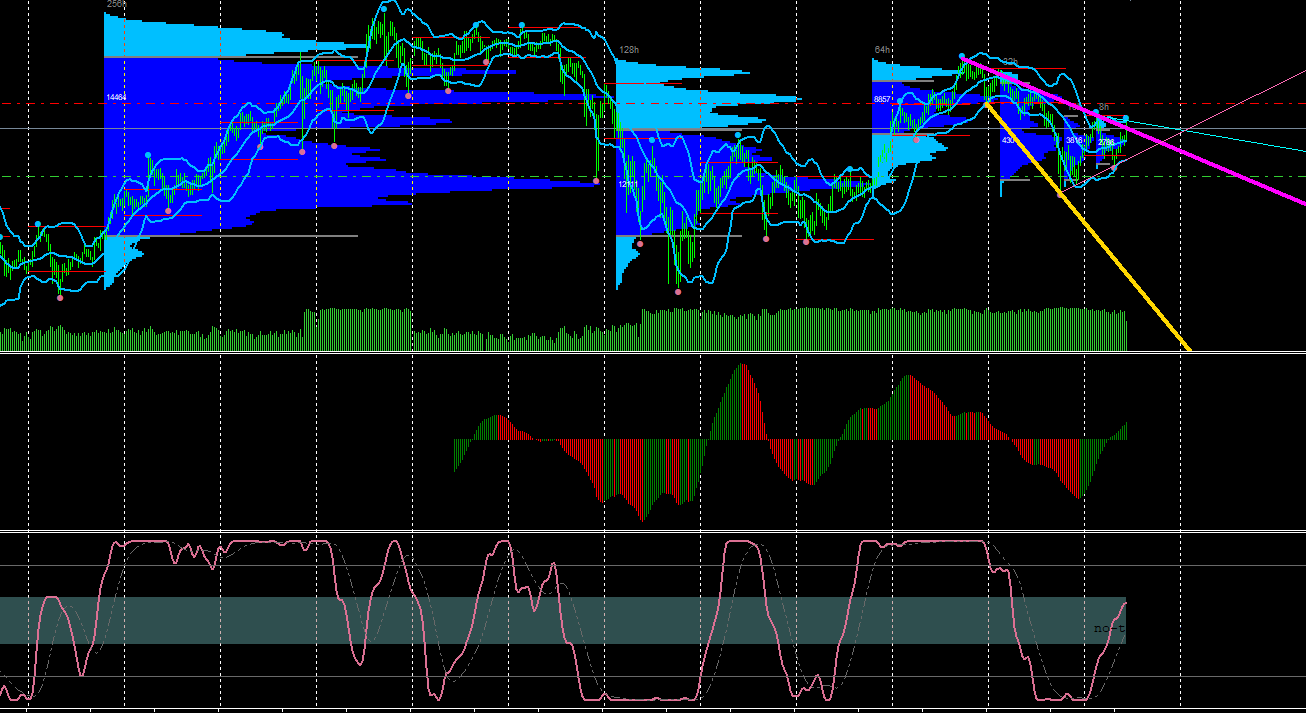

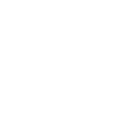

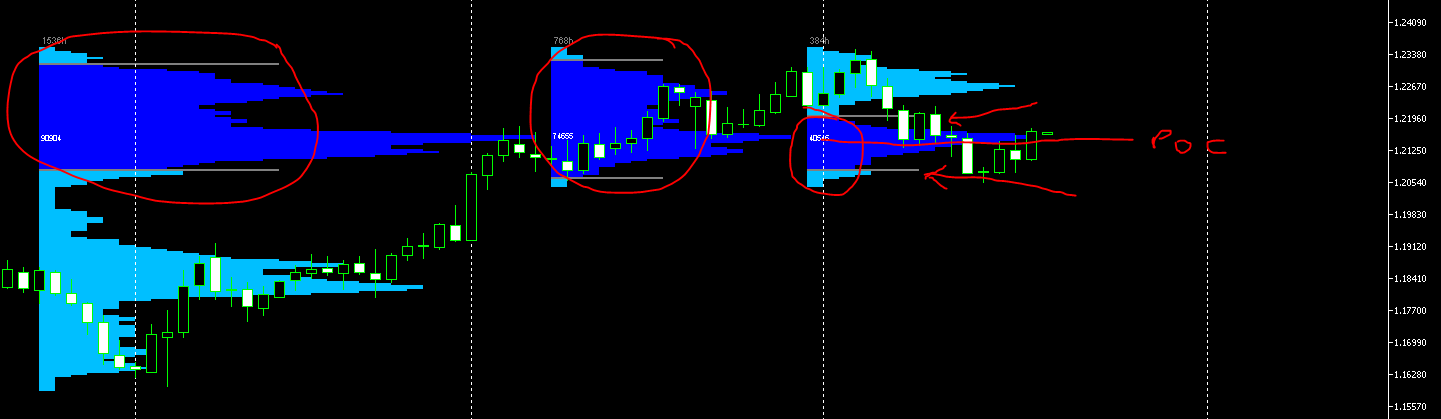

Market profile, volumes

There is no lack of ideas as well as the desire to refine the strategy. Lately I have been trading successfully using Boxprofile together with laguerre RSI, STLM and fractals trend line. The results are very good for the indications of the "Market profile" which makes it clear where the sales and purchases are positioned. It could be an interesting implementation for CP or even for a new project. I await subscriptions of interest

box profile dint appears as an attachment, im with Sai, wondering how to use these, seems interesting and i was seen it many times, but i cant catch up. Can you give more explanation?, please! thanks!!!