VWAP purchase with institutional

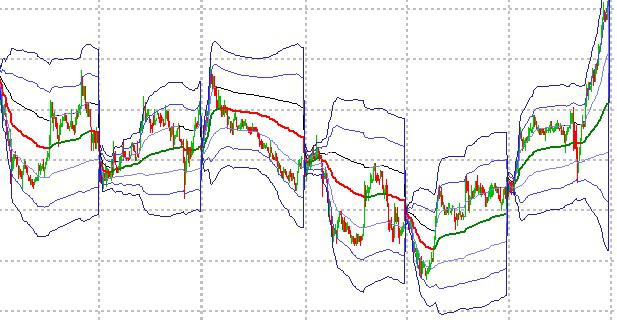

Volume Weighted Average Price (VWAP) is a measure that represents the weighted average price at which you trade of a given time span on a given title have taken place. The measure is used in particular by institutional investors as a reference for the execution of a sale and purchase operation articulated on several exchanges. The vwap and its upper and lower standard deviations represent supports and resistances (with particular emphasis on the second band). On a day in range, strong hands like to buy on weakness (second band) and sell on strength (vwap), the price will bounce between vwap and bands. On a trending day the price will break out of the bands. The same concept can be applied on longer time frames hence the need to have an indicator on a weekly / monthly / composite basis.

I like to try trading new signals with the simulator. The daily test was productive. It could be even better with CP managed revenue. This is much easier (for those who know how to program) to implement in the EA. Buy in the lower deviations, sell in the upper ones. The yellow line is the VWAP magnet and the reference point for investors.