VWAP purchase with institutional

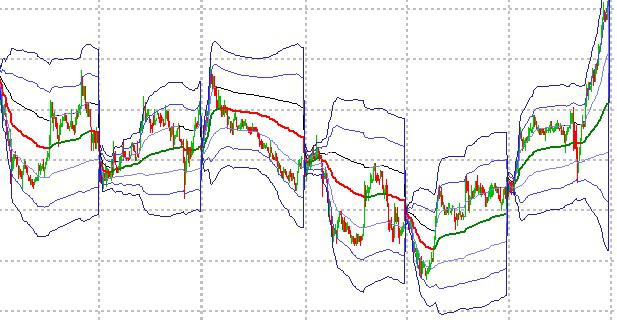

Volume Weighted Average Price (VWAP) is a measure that represents the weighted average price at which you trade of a given time span on a given title have taken place. The measure is used in particular by institutional investors as a reference for the execution of a sale and purchase operation articulated on several exchanges. The vwap and its upper and lower standard deviations represent supports and resistances (with particular emphasis on the second band). On a day in range, strong hands like to buy on weakness (second band) and sell on strength (vwap), the price will bounce between vwap and bands. On a trending day the price will break out of the bands. The same concept can be applied on longer time frames hence the need to have an indicator on a weekly / monthly / composite basis.

Could you propose a strategy with this indicator VWAP? I could put it together and share it.