VWAP purchase with institutional

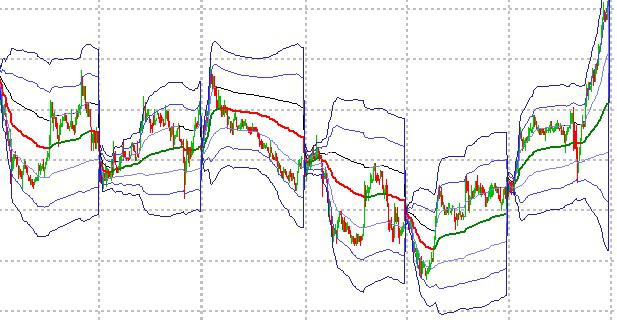

Volume Weighted Average Price (VWAP) is a measure that represents the weighted average price at which you trade of a given time span on a given title have taken place. The measure is used in particular by institutional investors as a reference for the execution of a sale and purchase operation articulated on several exchanges. The vwap and its upper and lower standard deviations represent supports and resistances (with particular emphasis on the second band). On a day in range, strong hands like to buy on weakness (second band) and sell on strength (vwap), the price will bounce between vwap and bands. On a trending day the price will break out of the bands. The same concept can be applied on longer time frames hence the need to have an indicator on a weekly / monthly / composite basis.

I would like to see the VWAP in CP as well *thumbsup*.

VWAP is a powerfull indicator, because the "big guys" are measured on their performance with this indicator.

"How to avoid this?"

Maybe add a day/period waiting timer for like 5 hours for this signal to be valid. One can also use the general time settings if using the vwap indicator.

So, you suggest just to ignore signals first hours of day?

It is the solution, but I don't like it.

Why not to start calculation of VWAP from other hour (05:00, 17:00, any other)?

Let's wait for other opinions.