limit DD protection

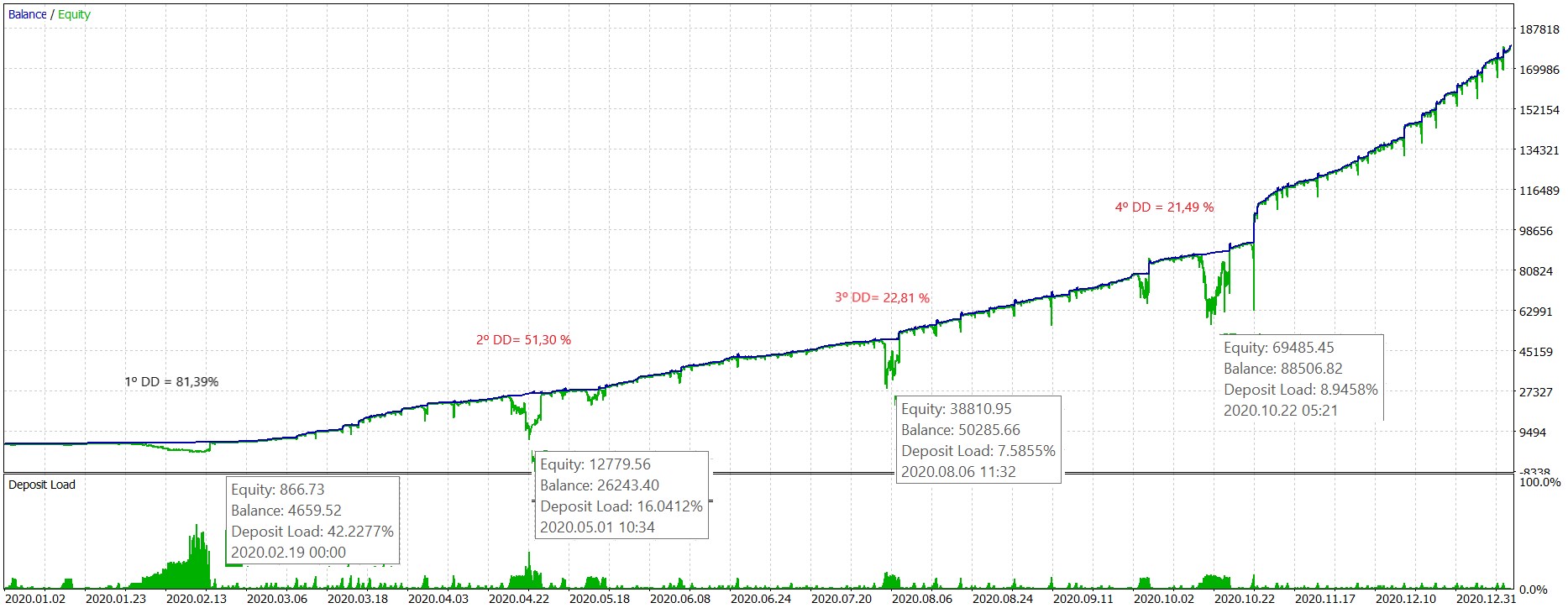

Backtest CP v. 2.25 ,default settings, Lot size (fixed/per 1000=0.02), on 5M chart of all 2020 wiht IC Markets Leverage 1:500, 4.000.-€ initial deposit. It took a few days to complete. Very good results but note 4 big decreasing DD in the chart . First one of 81,39%. The proposal is to implement a kind of security protection of maximum DD with an option to auto hedge 5 martingale current opened positions when Equity < 50%-60%. EA would check a trend filter like MA50 or smoothed Heiken Ashi filter of bigger TF (1H - 4 H) and when price bar crossover the trend filter close the hedged and restart nomal functionality. It is obvious that when big DD occours its becouse there is a long trend in place as seen in the chart below and somehow it could be put undercontrol using trend filter of bigger TF. It would be worhwhile despite of having worse overall results and even if it makes small losses sometimes, as a kind of account protetion insurance.

Yes, you are right. We should not open new deals while in "Lock DD" mode.

Let's see if we succeed in protecting the account under any market conditions with the less possible impact to the overall results of CP v2.25 default settings which are great.

Thank you.