Pivot Point for signal or confirmation

Pivot Point is one of the indicator i use the most for my strategies, either confirming trend, breakout retest or consolidation and combining with others indicators ... well used it's a good indicator that give confirmation and objectives.

We could either put support/resistance or only pivot point to see the trend in the timeframe of our choice

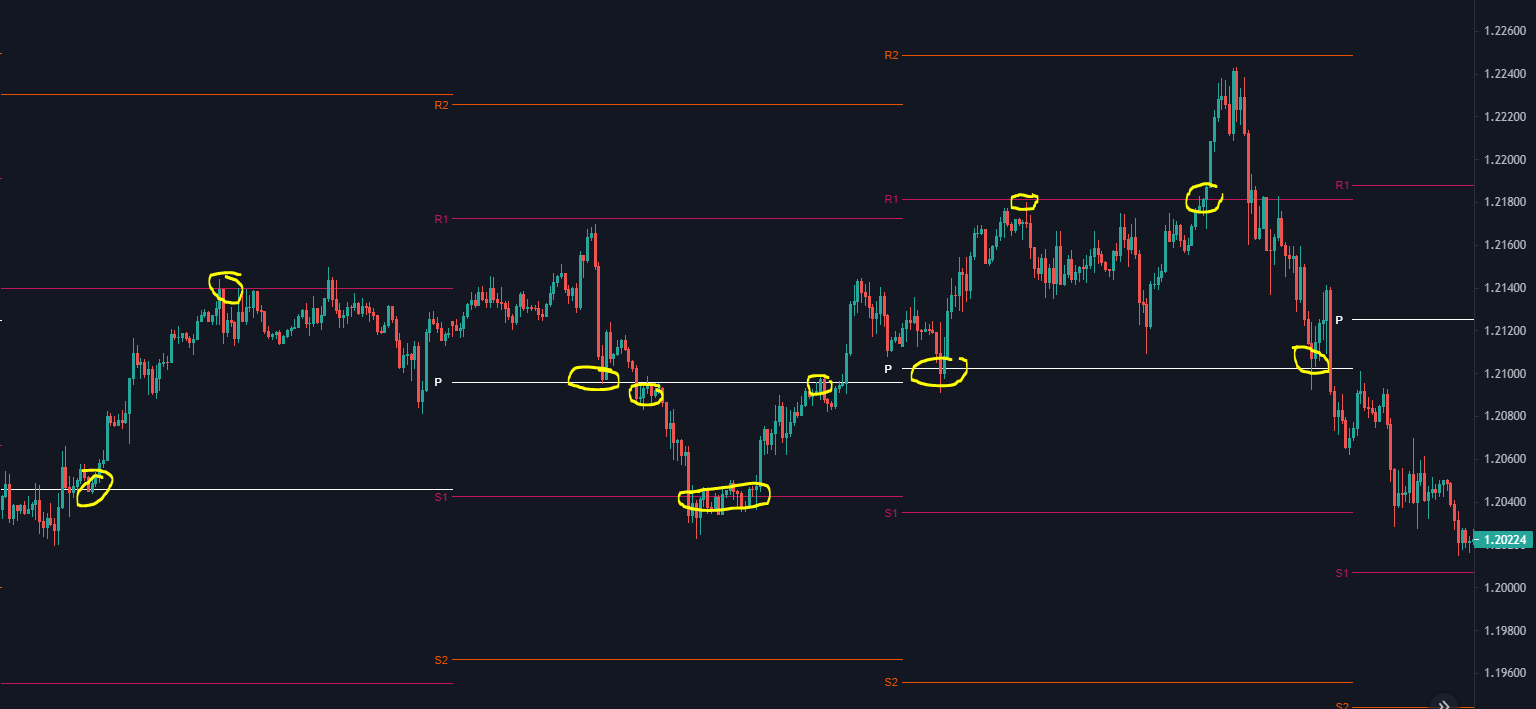

An example worth a thousand words

Below is a EURUSD M5 chart with daily Pivot (Short Term)

And here EURUSD H1 weekly Pivot

I took the best case scenario for illustrating my thoughts but sometime the market doesn't want to give us profit

For MetaTrader indicators i found for both 4/5

CAMRILLA POVIT POINT STRATEGY SHEET NO 2.txt