Hedge Series

I've been researching different trading methodologies, and one that had stood out to me is hedge trading series. The scenario goes as follows :

1. You enter a buy position.

2. if market keeps going in your favor, tp is hit as normal. If it doesn't, and price moves downwards, after a specified distance, you enter a sell position with an increased size (lot * coefficient).

3. if price keep moving down, the tp of the sell is hit and closes both orders. The sell position's profit would cover the loss of the buy since its a slightly bigger position.

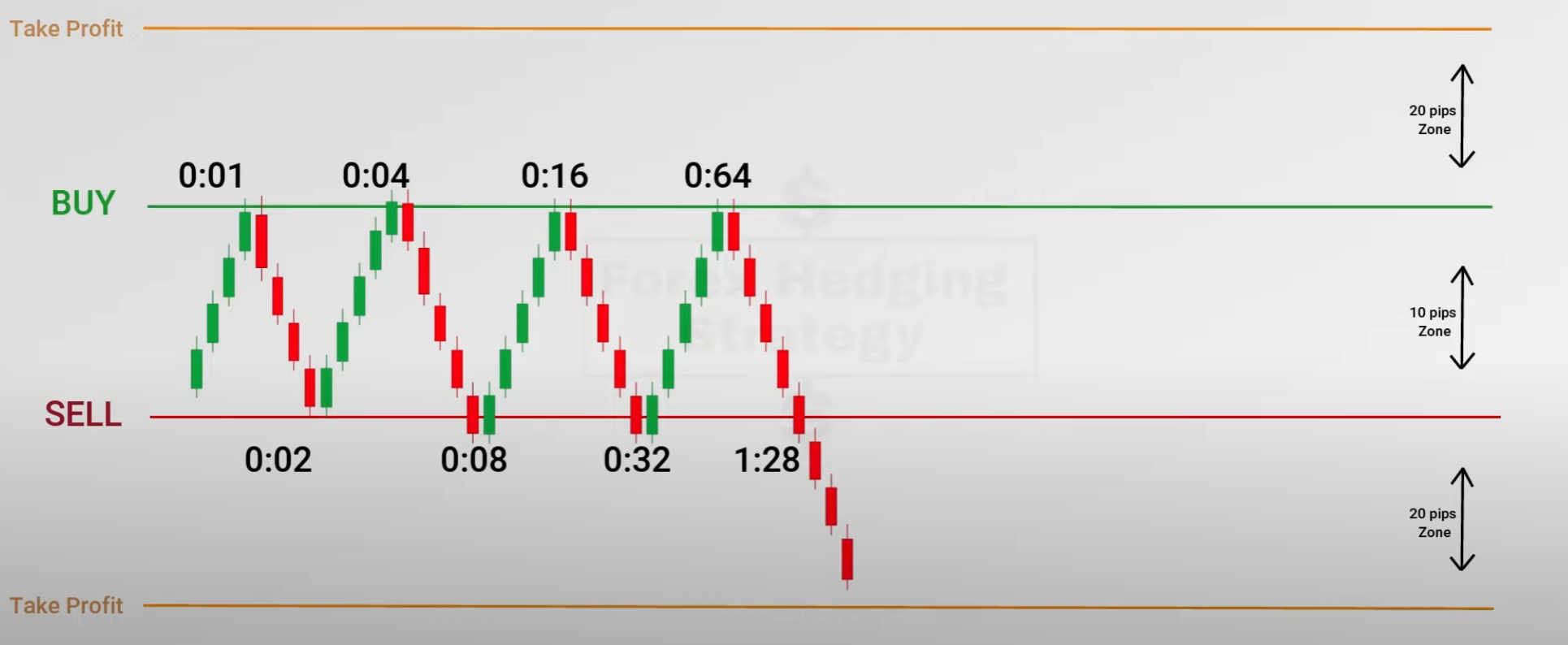

4. if price keeps moving side ways, then consecutive trades would open with bigger lot sizes as shown here:

5. If price touches the buy line, a new buy order is added to the series. If it touches the sell line, a new sell order is added to the series. These will of course need to be alternating and only open a new trade if the previous was the opposite direction.

6. Price will eventually spike in one direction and the bigger lot sizes will cover the the smaller opposite loses.

Think of it as a sideways martingale with the following properties:

1. Buffer zone in the middle - This can be set in pips or a volatility coefficient.

2. Lot increase mode - The usual modes Sum, Fibo, Martin, soft martin, etc.

3. Max number of trades in the series

4. Close on breakeven - to safe guard against prolonged market sideway movements.

5. and other usual options such as new deal at end of bar etc.

The TP and SL needs to be set from both the buy and sell lines. My guess the current available mode "from last open price" should accomplish this, however in practice maybe a new mode to calculate it from the edge of the buffer zone could be added.

As with martingale, this also has the risk of opening increasing lot size and blow the account, however it could be a great addition to our toolkit and opens the door for new strategies if used correctly.

I love this feature. it is called recovery zone :)