CAP Close trading / back to an old level trading

Cap Close Strategie

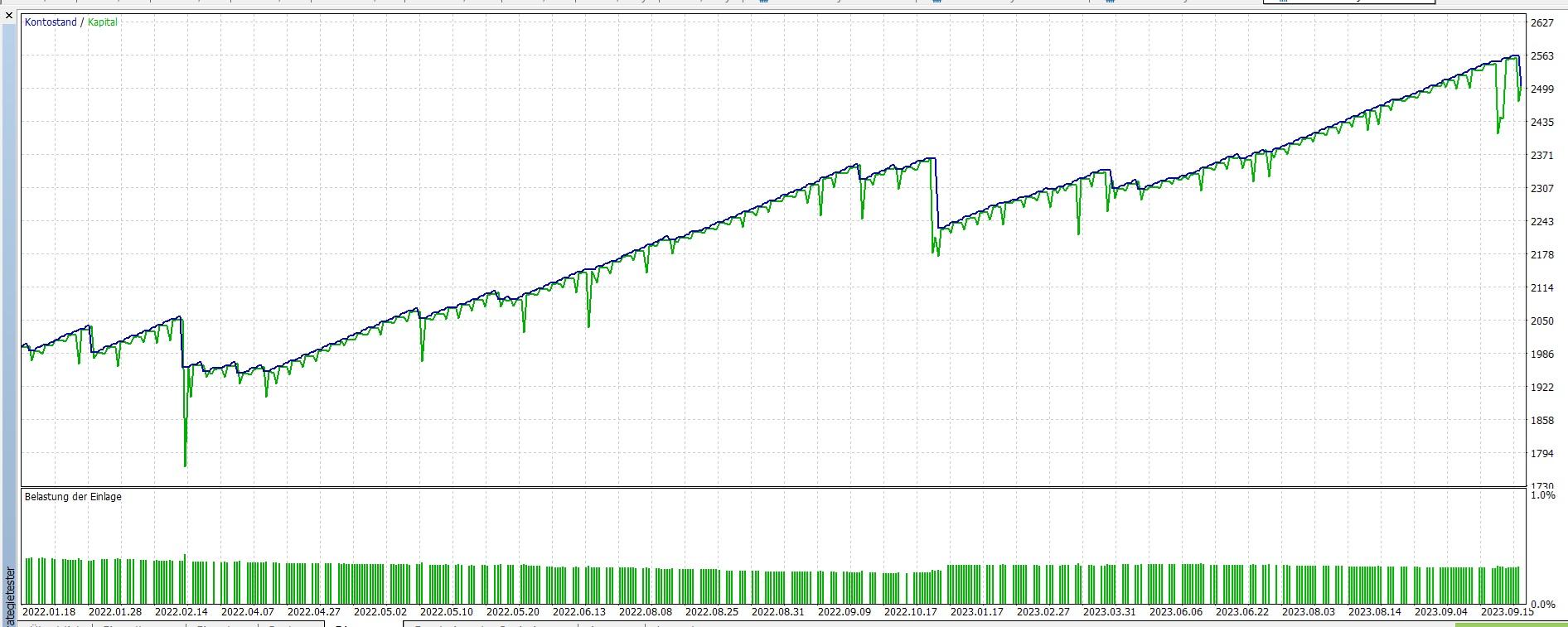

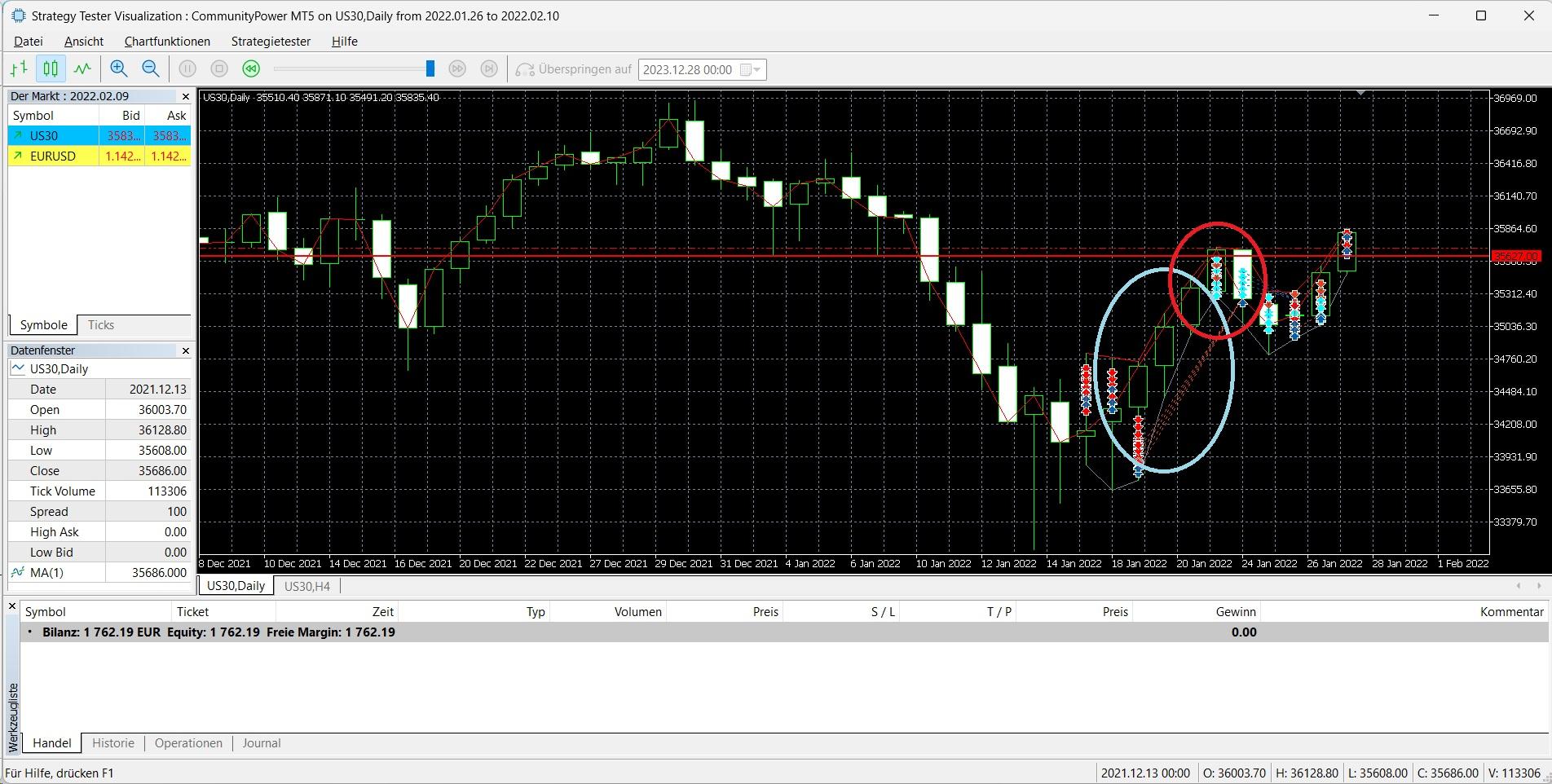

I checked manual EURUSD, DAX and DOW JONES with data from investing.com for 2022-2023

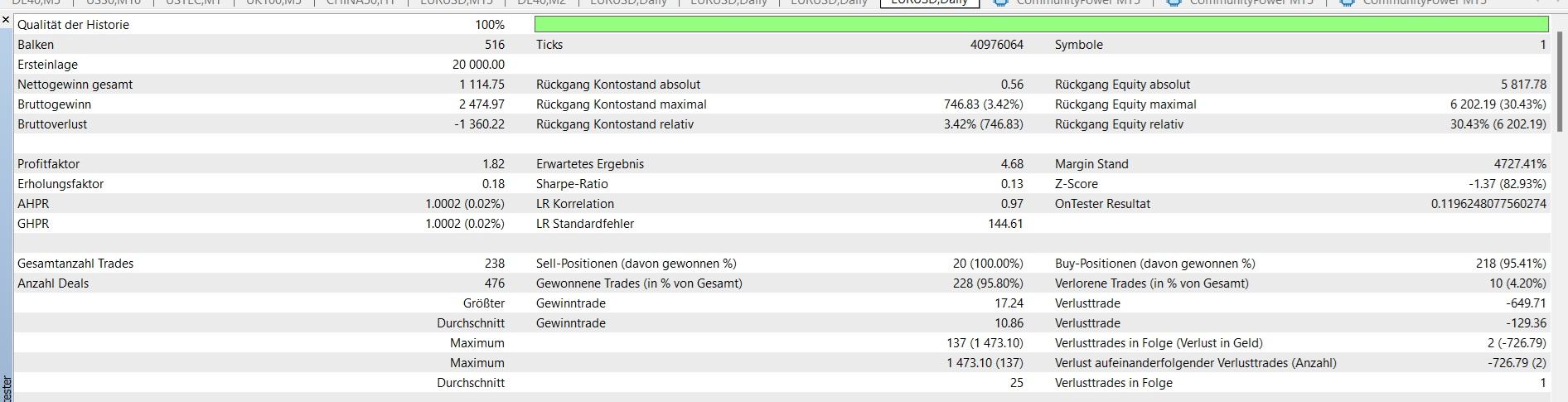

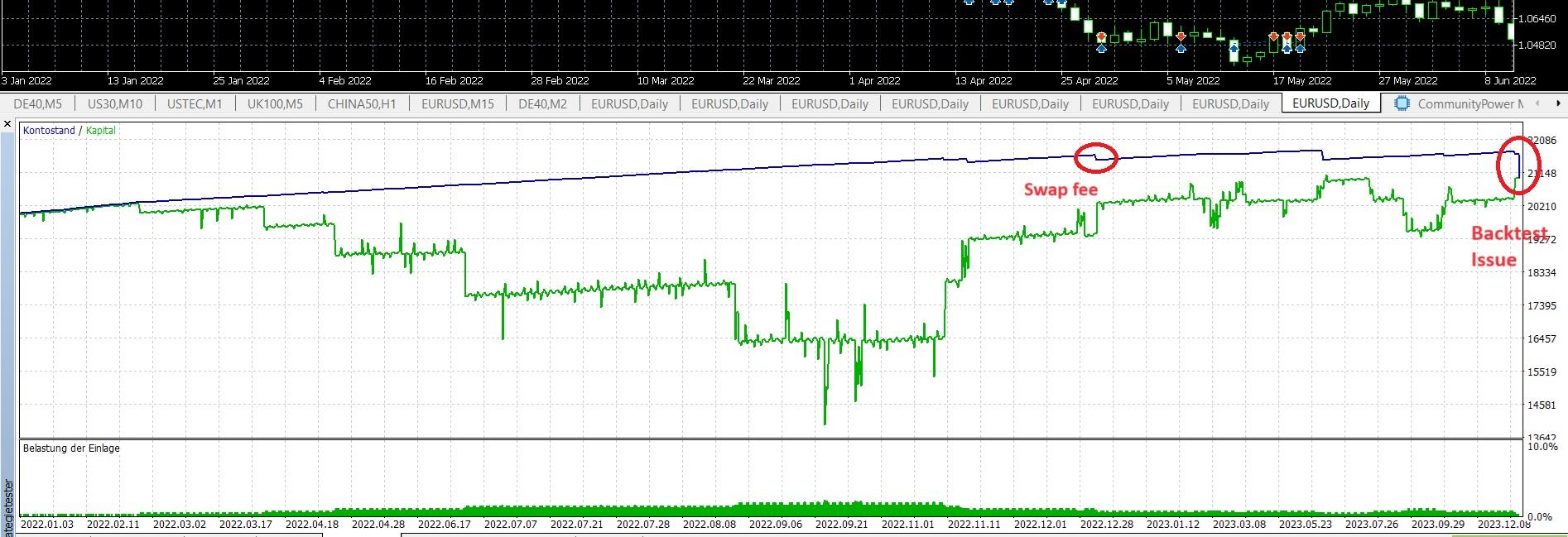

EURUSD

Days times % close

1st day 481 93.22

2nd day 6 1.16

3rd day 2 0.39

4th day 3 0.58

95.35 % after 4 days

DOW Jones

times % closed

1st day 325 63.85

2nd day 43 8.45

3rd day 21 4.13

4th day 15 2.95

5th day 9 1.77

81.14 % after 5 days

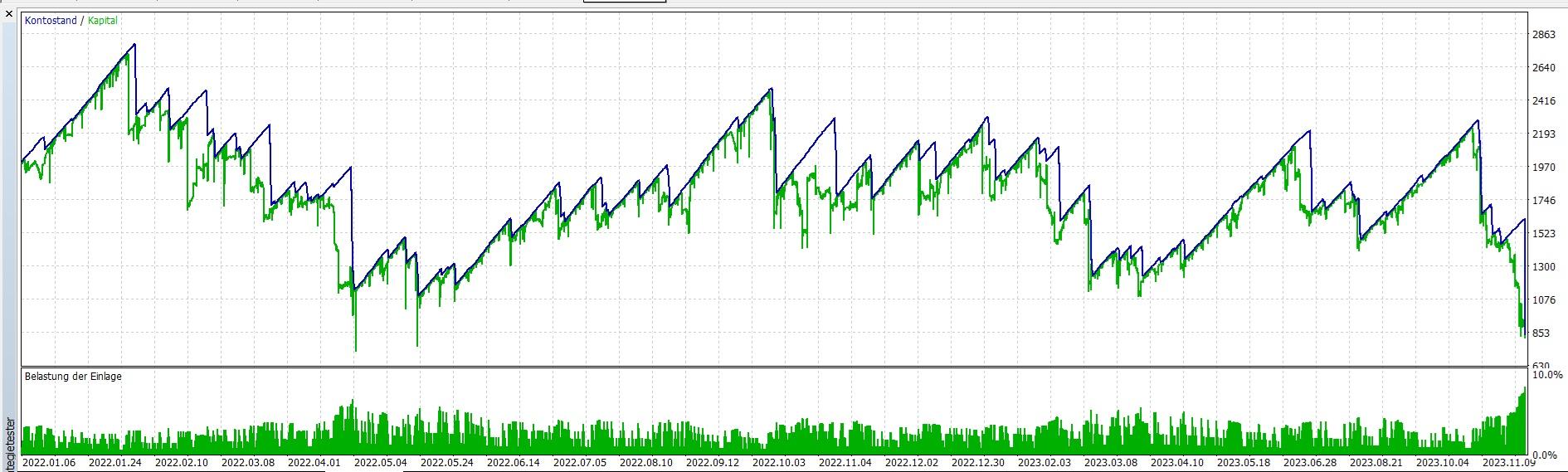

DAX

times % closed

1st day 289 56.78

2nd day 54 10.61

3rd day 29 5.70

4th day 18 3.54

5th day 17 3.34

79.96 % after 5 days

new parameters:

- Target (Take Profit): candle close on a specific time. eg. 17:30, 1 min, 5 Min, 30 Min.

- Distance from Target: in Points or % ATR to open a trade towards Target Price.

- min distance in Points or % ATR to open a trade.

- Distance to Target in Points or % ATR for later or earlier trade close. (under- overshoot target price)

Signal should be valid for 24h. Can become multiple time filled/closed

If open trade is not closed on day one, have new deals should be possible daily (0-x time) and run them parallel

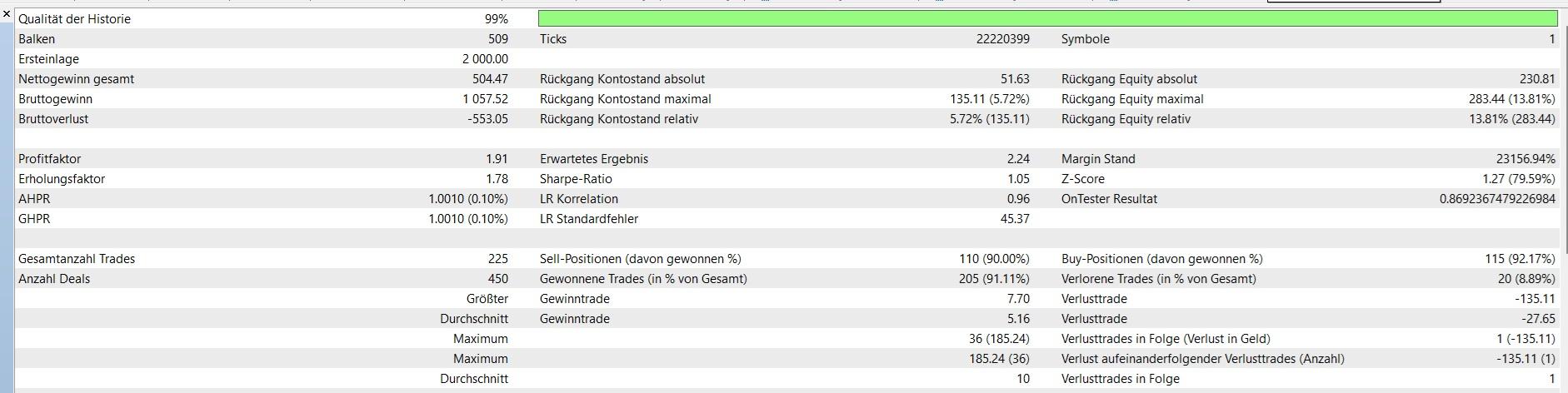

Example:

at 17:30 EURUSD is 1.100

active Periode 1: 09:00-10:00. we open trade at 1.112

close at 1.102

Not closed days are mostly when a strong trend begins, avoid with news filter

I don't understand the initial signal.

When should the EA open a trade?

Can you show the chart with an illustration?