Volatility based default set

Hi guys,

Rather than having fixed step size, I've been tinkering with the idea of having the steps based on volatility. Specially with the ability to fix the volatility based on the first order, we can have a somewhat flexible, but still controlled grid spacing. The goal is to make the grid reflect somewhat recent price volatility. I've also done the same for the pending order distance.

Furthermore, once we have the max orders placed, i think its beneficial to have the "close any with any" option enabled along with "Allow hedge only on main drawdown %"

So I modified the default set to use a coefficient of the ATR indicator, along with the above mentioned.

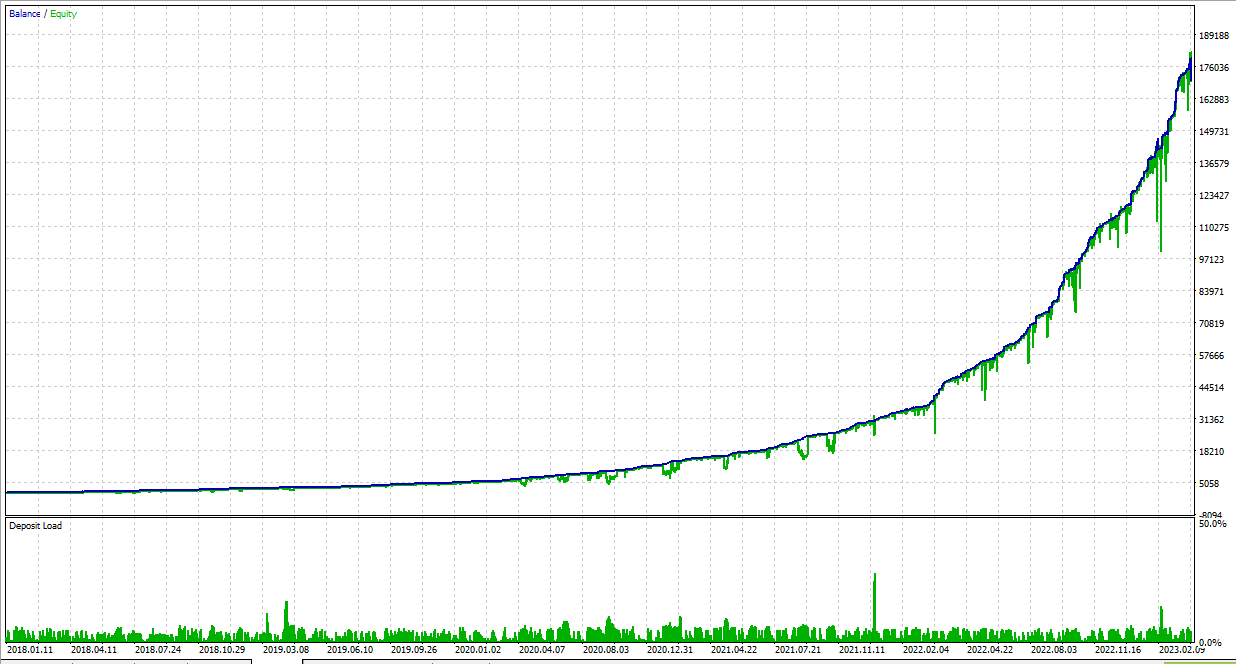

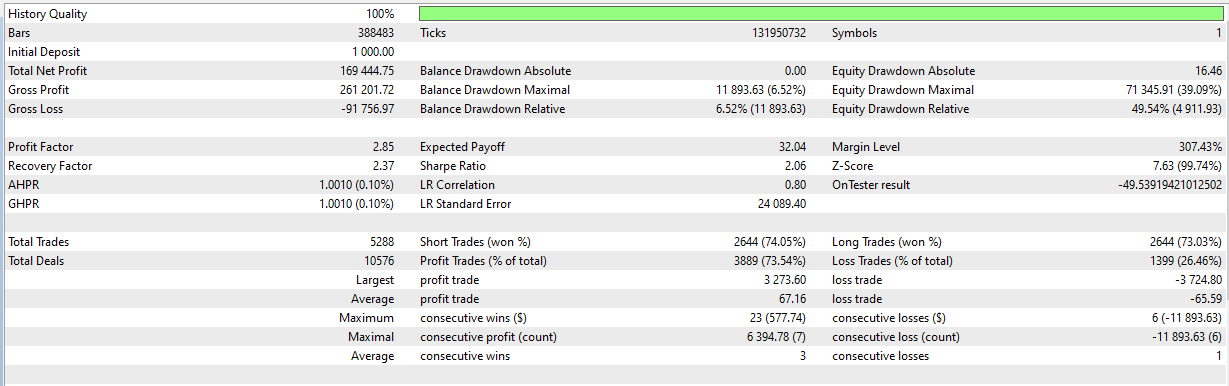

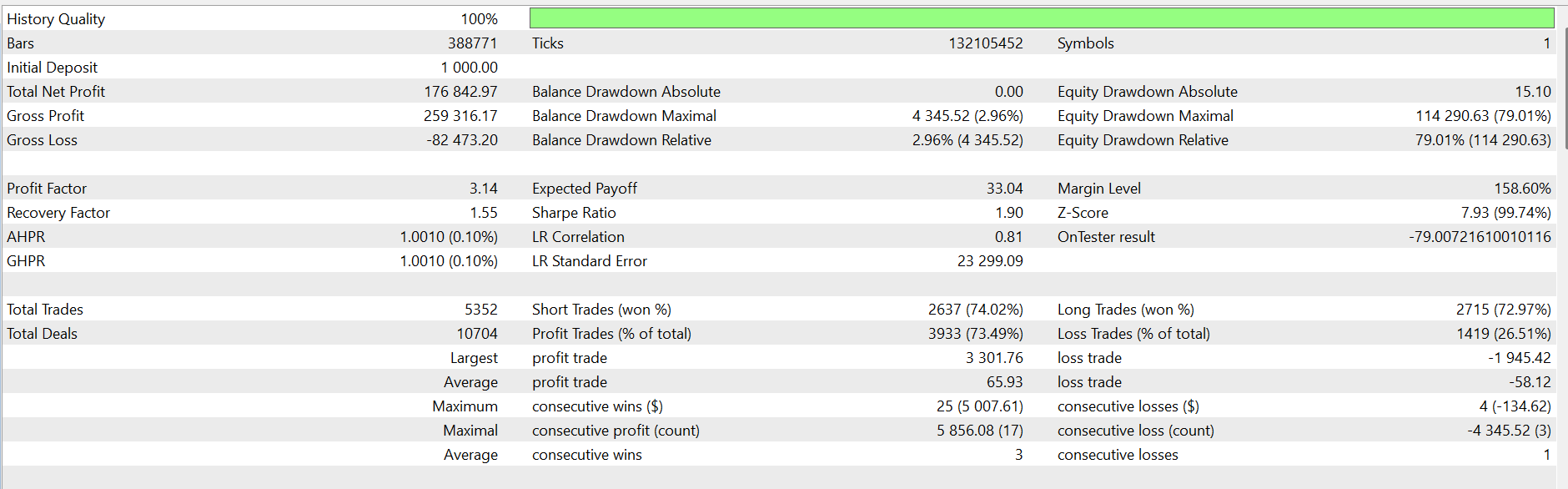

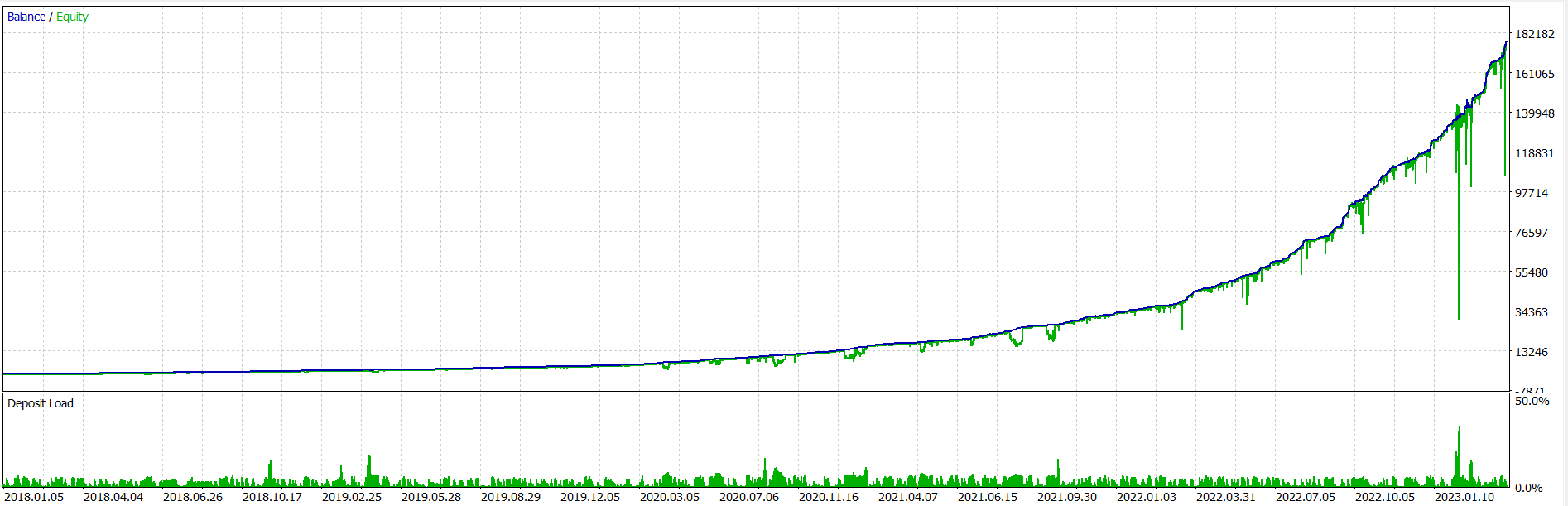

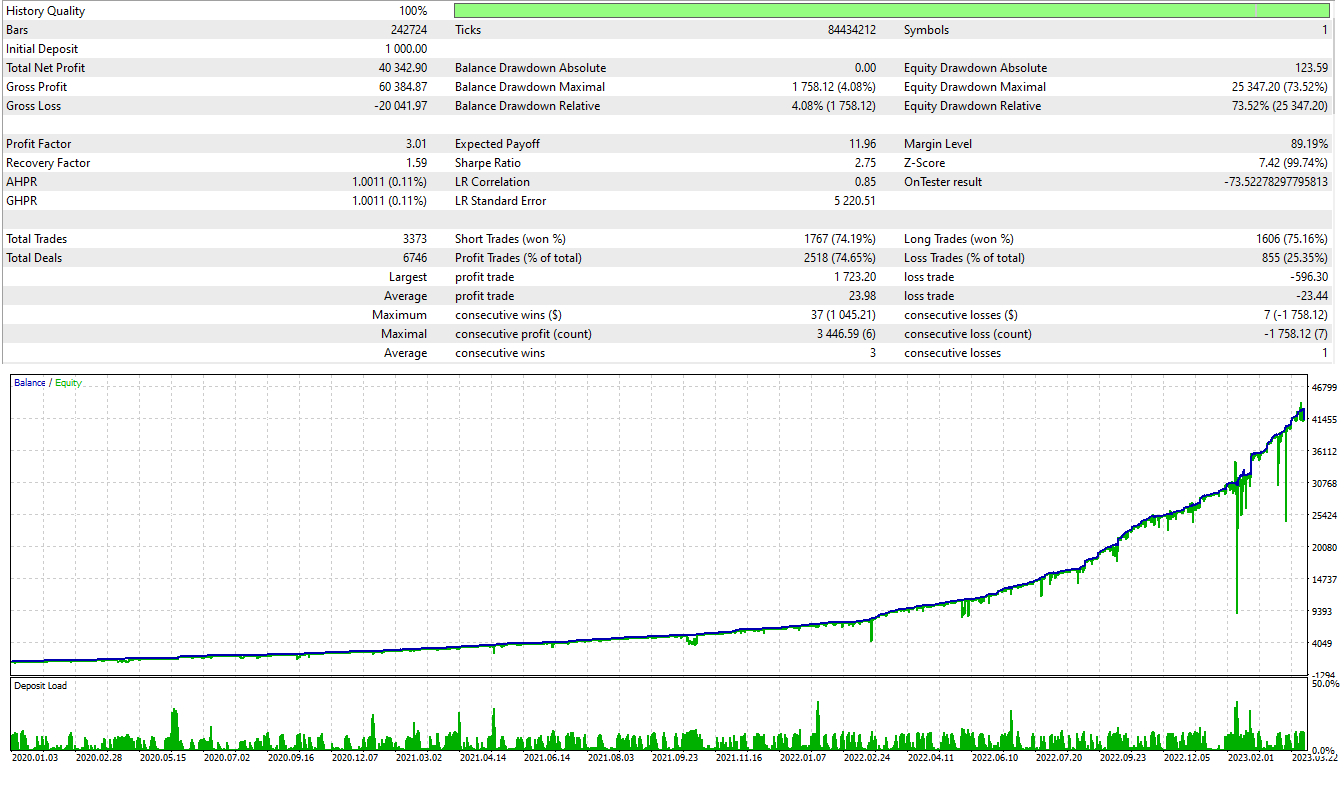

Here's the results of 01.01.2018 to 03.20.2023 on OctaFX with $1000 as initial deposit:

Would appreciate your inputs on how to further progress this idea.

ideal si 0.6-0.8

You are over complicating it.

Say ATR has a Value of 10points, and im using a 0.5 coefficient... That means it will use 5points...

If im using a coefficient of 2.75, then it would use 10x 2.75 = 27.5 points... Thats all...

in the default set, the step size is 15points, in my modified set it fluctuates depending on ATR x Coefficient.